Sponsored Project Personnel Report of Direct Reimbursed Form

What is the Sponsored Project Personnel Report Of Direct Reimbursed

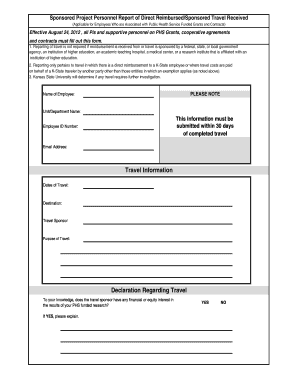

The Sponsored Project Personnel Report Of Direct Reimbursed is a crucial document used by organizations to report personnel costs associated with sponsored projects. This report provides detailed information on salaries and wages that are reimbursed directly from grant funds. It ensures transparency and accountability in the use of federal or state funds for research or other sponsored activities. The report typically includes data on employee names, positions, hours worked, and corresponding costs, aligning with the funding agency's requirements.

How to use the Sponsored Project Personnel Report Of Direct Reimbursed

Using the Sponsored Project Personnel Report Of Direct Reimbursed involves several steps to ensure compliance and accuracy. First, gather all necessary employee data, including names, job titles, and the number of hours worked on the project. Next, calculate the total costs associated with each employee's work on the sponsored project. Once the data is compiled, fill out the report accurately, ensuring that all figures align with the project budget. Finally, submit the report to the appropriate funding agency as per their guidelines.

Steps to complete the Sponsored Project Personnel Report Of Direct Reimbursed

Completing the Sponsored Project Personnel Report Of Direct Reimbursed requires careful attention to detail. Follow these steps:

- Collect employee information: Gather names, job titles, and hours worked for each individual involved in the project.

- Calculate personnel costs: Determine the total salary and wage expenses related to the project for each employee.

- Fill out the report: Input the collected data into the report format, ensuring accuracy in all entries.

- Review for compliance: Check the report against funding agency requirements to ensure all necessary information is included.

- Submit the report: Send the completed report to the designated funding agency by the required deadline.

Key elements of the Sponsored Project Personnel Report Of Direct Reimbursed

Several key elements are essential for the Sponsored Project Personnel Report Of Direct Reimbursed. These include:

- Employee Information: Names, job titles, and identification numbers of all personnel.

- Hours Worked: Total hours each employee dedicated to the sponsored project.

- Cost Breakdown: Detailed salary and wage information for each employee, including any benefits.

- Project Code: Identification of the specific project associated with the personnel costs.

- Certification: A statement confirming the accuracy of the reported information, often requiring a signature from a responsible official.

Legal use of the Sponsored Project Personnel Report Of Direct Reimbursed

The legal use of the Sponsored Project Personnel Report Of Direct Reimbursed is governed by federal and state regulations. Organizations must ensure that the report is completed accurately to comply with funding agency requirements. Misreporting can lead to audits, penalties, or loss of funding. It is essential to maintain records that support the reported data, as these may be requested during compliance reviews. Understanding the legal implications of this report helps organizations manage their sponsored projects effectively.

Filing Deadlines / Important Dates

Filing deadlines for the Sponsored Project Personnel Report Of Direct Reimbursed can vary based on the funding agency and the specific project. It is important to be aware of these deadlines to avoid penalties. Generally, reports must be submitted at regular intervals, such as quarterly or annually, depending on the terms of the grant. Keeping a calendar of important dates related to the project can help ensure timely submissions and compliance with all reporting requirements.

Quick guide on how to complete sponsored project personnel report of direct reimbursed

Finish [SKS] effortlessly on any gadget

Digital document administration has become popular among companies and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the correct form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without interruptions. Manage [SKS] on any device with airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

How to modify and eSign [SKS] effortlessly

- Locate [SKS] and click on Obtain Form to begin.

- Use the tools we offer to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Finish button to save your modifications.

- Select how you want to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced files, cumbersome form searching, or mistakes that necessitate printing new document versions. airSlate SignNow meets all your document management requirements in just a few clicks from a device of your choice. Modify and eSign [SKS] and facilitate outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sponsored project personnel report of direct reimbursed

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

Can I use award funds from one sponsored project to cost share on another sponsored project?

Federal sponsors also do not allow the funds supporting one federal project to be used as cost sharing for another federal project. Consult your SPO Contract and Grant Officer if you have questions about cost sharing of federal funds. The costs must be allocable to the project.

-

What are the sources of cost share?

Examples of cost-share are: Salaries and appropriate por on of fringe benefits - depending on the source of the funds paying the salary. Travel funds for an approved project trip • Local travel • Supplies or Equipment needed for project implementa on – leased or purchased.

-

What is cost share in kind?

In-kind cost sharing are those contributions wherein the value can be readily determined, verified, documented, and justified but where no actual cash is transacted in securing the good or service comprising the contribution.

-

What is sponsored research at a University?

Research activities are properly classified as Sponsored Research if the research activity is sponsored (funded) by an external organization, i.e. a federal, state, or private organization or agency.

-

What is an example of a cost share?

Examples. A faculty member proposes to spend 30 % of her total time worked for UC Davis as effort on a project sponsored by NSF. She plans to charge 10 % of her salary to the project. The remaining 20% of her effort is cost share because she is committing the effort, but is not charging the entire 30% to the sponsor.

-

What is the difference between a grant and sponsored research?

Grants have fewer conditions than other sponsored projects. Sponsors award grants to support research which has been described by PIs in proposals submitted often, but not always, in response to solicitations.

-

What does the cost share consist of?

Cost Sharing or matching is the funding or costs contributed or allocated to a sponsored project or program not borne by the sponsor. Cost sharing can be required by law, regulation or administrative decision of a Federal agency or other sponsor.

-

How to calculate cost share?

Cost Share Total amount should be calculated as follows. Institutional Base Salary – Salary Cap = Cost Share Base Salary. Cost Share Base Salary x Percent Effort = Cost Share Salary. Cost Share Salary x Fringe Percent Rate = Cost Share Fringe Amount. Cost Share Salary + Cost Share Fringe Amount = Cost Share Total.

Get more for Sponsored Project Personnel Report Of Direct Reimbursed

Find out other Sponsored Project Personnel Report Of Direct Reimbursed

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors