Form IL 1040 Illinois Department of Revenue

What is the Form IL 1040 Illinois Department Of Revenue

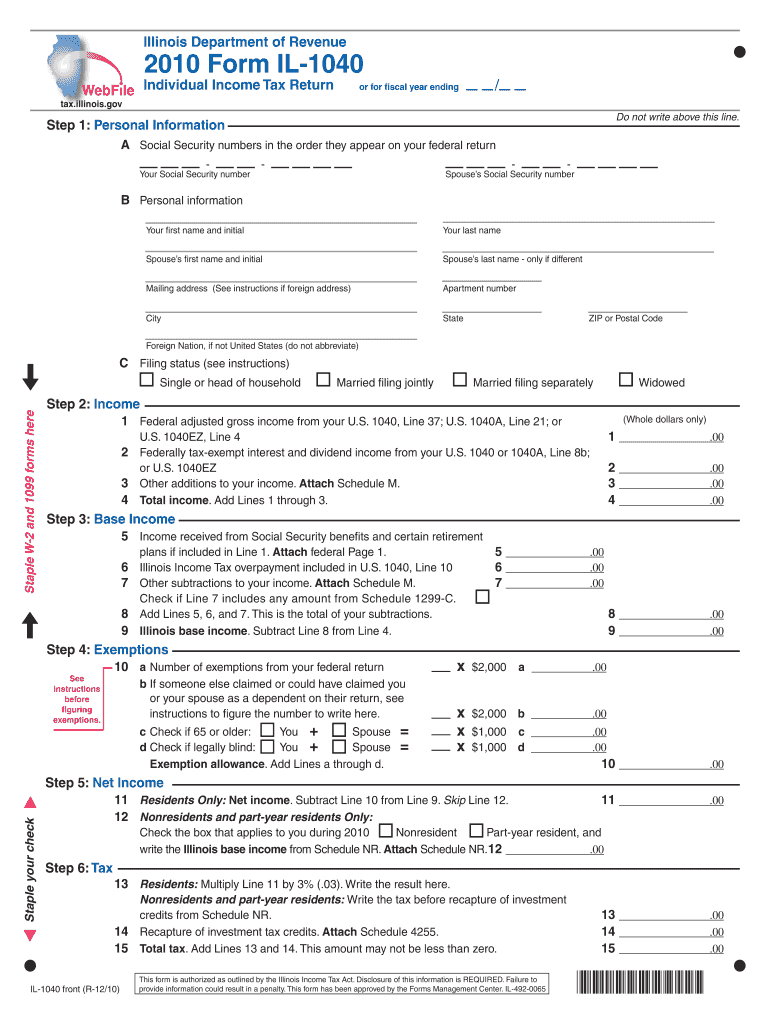

The Form IL 1040 is the individual income tax return used by residents of Illinois to report their income and calculate their state tax liability. This form is essential for individuals who earn income within the state, including wages, salaries, and other forms of compensation. The Illinois Department of Revenue requires this form to assess the amount of tax owed or the refund due to the taxpayer. Understanding the purpose of the Form IL 1040 is crucial for compliance with state tax laws and ensuring accurate reporting of income.

How to obtain the Form IL 1040 Illinois Department Of Revenue

The Form IL 1040 can be obtained through several methods. Taxpayers can download the form directly from the Illinois Department of Revenue's official website. Additionally, physical copies of the form may be available at local government offices, public libraries, or tax preparation offices. It is advisable to ensure that you are using the most current version of the form to avoid any issues during the filing process.

Steps to complete the Form IL 1040 Illinois Department Of Revenue

Completing the Form IL 1040 involves several key steps:

- Gather necessary documents: Collect all relevant financial documents, including W-2 forms, 1099s, and records of other income.

- Fill out personal information: Enter your name, address, and Social Security number at the top of the form.

- Report income: Include all sources of income on the form, ensuring that you accurately report wages, interest, and dividends.

- Calculate deductions: Identify any eligible deductions that may reduce your taxable income, such as standard deductions or itemized deductions.

- Determine tax liability: Use the tax tables provided by the Illinois Department of Revenue to calculate the amount of tax owed based on your taxable income.

- Sign and date the form: Ensure that you sign and date the form before submission, as an unsigned form may be considered invalid.

Filing Deadlines / Important Dates

Filing deadlines for the Form IL 1040 are typically aligned with federal tax deadlines. Generally, individual income tax returns are due on April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to be aware of any specific changes or extensions announced by the Illinois Department of Revenue, especially during unusual circumstances such as natural disasters or public health emergencies.

Form Submission Methods

Taxpayers have various options for submitting the Form IL 1040. The form can be filed electronically through approved e-filing software, which often provides a streamlined process for tax preparation. Alternatively, individuals may choose to print the completed form and mail it to the designated address provided by the Illinois Department of Revenue. In-person submissions are also possible at local tax offices, although this method may require an appointment and adherence to specific guidelines.

Key elements of the Form IL 1040 Illinois Department Of Revenue

The Form IL 1040 consists of several key elements that taxpayers must complete:

- Personal Information: This section requires basic details such as name, address, and Social Security number.

- Income Section: Here, taxpayers report various sources of income, including wages, dividends, and interest.

- Deductions: Taxpayers can claim standard or itemized deductions to lower their taxable income.

- Tax Calculation: This section helps determine the total tax liability based on reported income and applicable tax rates.

- Signature: The form must be signed and dated by the taxpayer to validate the submission.

Quick guide on how to complete form il 1040 illinois department of revenue 14949783

Complete [SKS] effortlessly on any device

Digital document management has gained popularity among companies and individuals. It offers an ideal environmentally-friendly alternative to traditional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents quickly without hassles. Manage [SKS] on any device with the airSlate SignNow mobile apps for Android or iOS, and streamline any document-related task today.

The easiest way to edit and electronically sign [SKS] without difficulty

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and electronically sign [SKS] and ensure effective communication at every stage of your form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form IL 1040 Illinois Department Of Revenue

Create this form in 5 minutes!

How to create an eSignature for the form il 1040 illinois department of revenue 14949783

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form IL 1040 from the Illinois Department of Revenue?

Form IL 1040 is the individual income tax return form used by residents of Illinois to report their income and calculate their state tax obligations. It is essential for ensuring compliance with state tax laws and is submitted to the Illinois Department of Revenue.

-

How can airSlate SignNow help with Form IL 1040 submissions?

airSlate SignNow streamlines the process of completing and submitting Form IL 1040 to the Illinois Department of Revenue. With our eSigning capabilities, you can easily fill out, sign, and send your tax documents securely and efficiently.

-

Is there a cost associated with using airSlate SignNow for Form IL 1040?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our cost-effective solutions ensure that you can manage your Form IL 1040 submissions without breaking the bank, providing excellent value for your investment.

-

What features does airSlate SignNow offer for managing Form IL 1040?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking, all of which enhance the management of Form IL 1040. These tools simplify the process and ensure that your submissions to the Illinois Department of Revenue are accurate and timely.

-

Can I integrate airSlate SignNow with other software for Form IL 1040?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to connect your workflow for Form IL 1040 submissions. This integration capability enhances productivity and ensures that all your documents are easily accessible.

-

What are the benefits of using airSlate SignNow for Form IL 1040?

Using airSlate SignNow for Form IL 1040 offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your tax documents are handled with care, making the filing process with the Illinois Department of Revenue hassle-free.

-

How secure is airSlate SignNow when handling Form IL 1040?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure storage solutions to protect your Form IL 1040 and other sensitive documents, ensuring that your information remains confidential and secure throughout the submission process.

Get more for Form IL 1040 Illinois Department Of Revenue

Find out other Form IL 1040 Illinois Department Of Revenue

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document