A4 Form Alabama

What is the A4 Form Alabama

The A4 Form Alabama is a state tax withholding form used by employers in Alabama to report and withhold state income tax from employees' wages. This form is essential for ensuring compliance with Alabama's tax laws, as it helps determine the correct amount of state tax to be withheld based on the employee's earnings and filing status. The A4 Form is typically filled out by employees when they start a new job or when they wish to update their withholding information.

How to use the A4 Form Alabama

Using the A4 Form Alabama involves several steps. First, employees must complete the form with accurate personal information, including their name, address, and Social Security number. Next, they need to indicate their filing status and the number of allowances they are claiming. This information will help the employer calculate the appropriate amount of state income tax to withhold from each paycheck. Once completed, the form should be submitted to the employer's payroll department.

Steps to complete the A4 Form Alabama

Completing the A4 Form Alabama requires careful attention to detail. Here are the steps to follow:

- Provide your personal information, including your full name, address, and Social Security number.

- Select your filing status, which can be single, married, or head of household.

- Claim the number of allowances you wish to take, which will affect your withholding amount.

- Sign and date the form to certify that the information provided is true and accurate.

- Submit the completed form to your employer's payroll department.

Legal use of the A4 Form Alabama

The A4 Form Alabama is legally binding and must be filled out accurately to comply with state tax regulations. Employers are required to withhold state income tax based on the information provided on this form. Failure to submit a completed A4 Form may result in incorrect withholding, leading to potential penalties for both the employer and employee. It is important to keep the form updated, especially if there are changes in personal circumstances, such as marital status or the number of dependents.

Filing Deadlines / Important Dates

Filing deadlines for the A4 Form Alabama coincide with the start of employment or any changes in withholding status. Employees should submit the form to their employer as soon as they start a new job or when they wish to update their withholding information. Employers are required to process these forms promptly to ensure accurate tax withholding in accordance with state regulations.

Form Submission Methods (Online / Mail / In-Person)

The A4 Form Alabama is typically submitted in person to the employer's payroll department. However, some employers may offer online submission options through their payroll systems. It is advisable to check with your employer regarding their preferred submission method. In general, mailing the form directly to the employer is not common practice, as it may delay the processing of your withholding information.

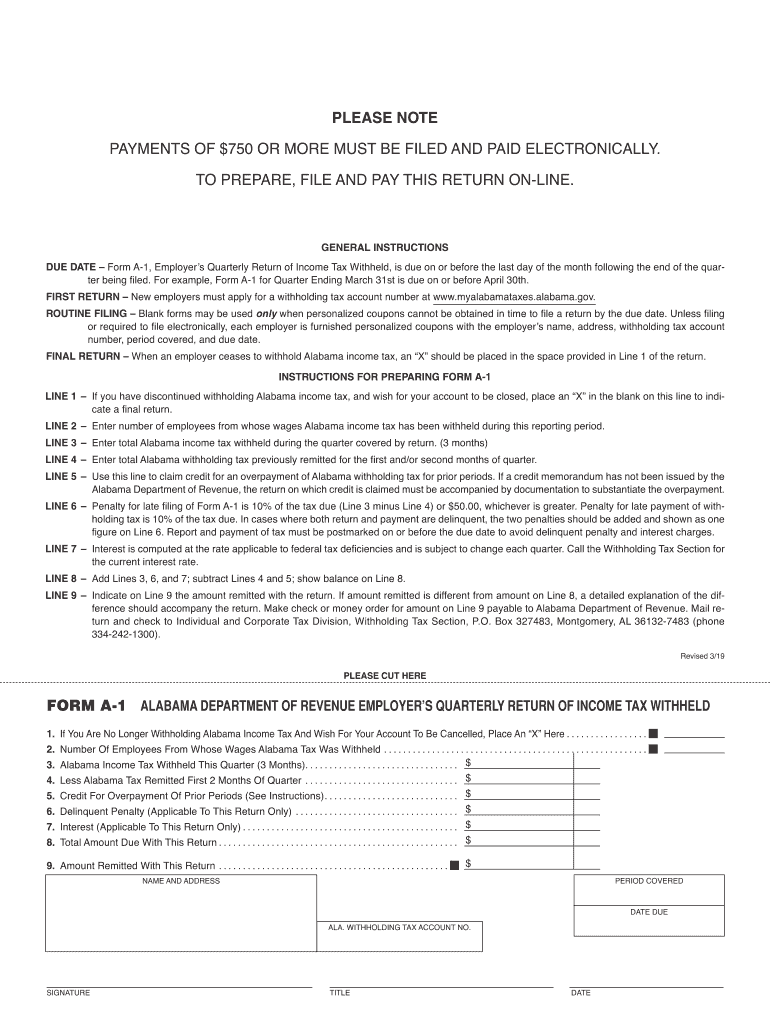

Quick guide on how to complete to prepare file and pay this return on line

Complete A4 Form Alabama effortlessly on any device

Online document management has surged in popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage A4 Form Alabama on any device using airSlate SignNow's Android or iOS applications and streamline any document-centric process today.

How to modify and eSign A4 Form Alabama with ease

- Obtain A4 Form Alabama and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to share your form, via email, SMS, invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choosing. Modify and eSign A4 Form Alabama to ensure excellent communication at any step of your form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the to prepare file and pay this return on line

How to make an electronic signature for your To Prepare File And Pay This Return On Line online

How to create an eSignature for your To Prepare File And Pay This Return On Line in Google Chrome

How to create an electronic signature for putting it on the To Prepare File And Pay This Return On Line in Gmail

How to generate an eSignature for the To Prepare File And Pay This Return On Line from your smart phone

How to create an electronic signature for the To Prepare File And Pay This Return On Line on iOS devices

How to create an electronic signature for the To Prepare File And Pay This Return On Line on Android OS

People also ask

-

What is the process to form a 1 state of Alabama using airSlate SignNow?

To form a 1 state of Alabama, simply download the required documents from the airSlate SignNow platform. Then, fill out the necessary information and electronically sign the documents. Our solution ensures compliance with Alabama regulations, so you can confidently complete the formation process.

-

How much does it cost to form a 1 state of Alabama with airSlate SignNow?

airSlate SignNow offers competitive pricing for businesses looking to form a 1 state of Alabama. Our plans start at an affordable monthly rate, allowing you to choose a package that best fits your needs. Additionally, we provide a free trial option for new users to explore our features before committing.

-

What features does airSlate SignNow offer for forming a 1 state of Alabama?

With airSlate SignNow, you gain access to a range of features designed to streamline your experience when you form a 1 state of Alabama. These include customizable templates, secure storage, and mobile access, ensuring that you can manage your documents efficiently from anywhere at any time.

-

What are the benefits of using airSlate SignNow for document signing?

Using airSlate SignNow to form a 1 state of Alabama presents several benefits, including time savings and enhanced security. Our platform simplifies the document signing process, allowing you to expedite important transactions while keeping your information safe. Plus, the user-friendly interface helps you navigate without hassle.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow is designed to easily integrate with numerous applications, enhancing your experience when you form a 1 state of Alabama. From CRM systems to cloud storage providers, our integrations allow for seamless workflows, enabling you to handle your documents more efficiently.

-

Is electronic signing legally recognized in Alabama?

Absolutely! Electronic signatures made through airSlate SignNow when you form a 1 state of Alabama are legally recognized in Alabama. Our platform complies with e-signature laws, ensuring that your electronically signed documents hold the same validity as traditional signed documents.

-

What type of support does airSlate SignNow provide to users?

airSlate SignNow offers comprehensive support to users who want to form a 1 state of Alabama. Our dedicated customer support team is available via chat, email, and phone to assist you with any inquiries or technical issues. We also provide a resource center with tutorials and FAQs for self-help.

Get more for A4 Form Alabama

- Real estate withholding return for form

- Truncated taxpayer identification numbers on forms w 2 and

- Form rew 3 residency affidavit of entity transferor

- I 010 form 1 wisconsin income tax wisconsin income tax form 1

- Estate tax forms 2022maine revenue services

- 99 2206600 reconciliation of maine income tax form

- I 015i schedule h ez wisconsin homestead credit short form schedule h ez wisconsin homestead credit

- Wisconsin state fair official quilt entry form

Find out other A4 Form Alabama

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors