50 771 Form

What is the Texas 50-771?

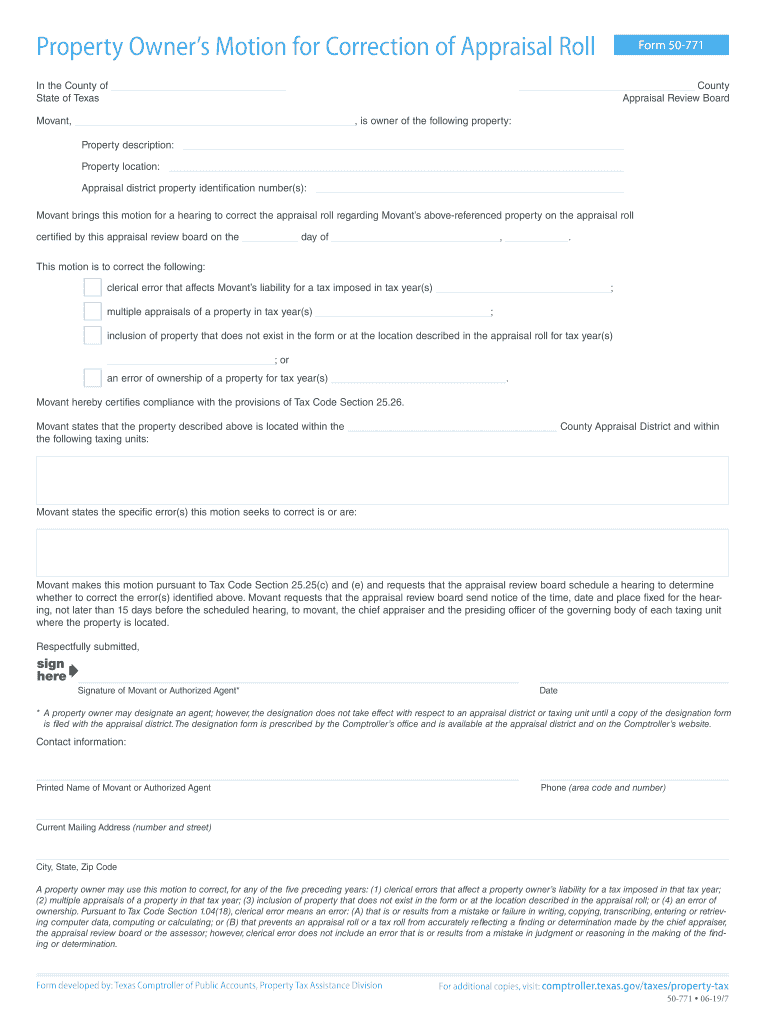

The Texas 50-771 form, also known as the property motion appraisal, is a document used to request a correction to a property appraisal. This form is essential for property owners in Texas who believe their property has been incorrectly assessed. The Texas Comptroller of Public Accounts oversees this process, ensuring that property values are accurately represented for tax purposes. The 50-771 form allows property owners to present their case for a reassessment, which can lead to adjustments in property taxes.

How to Use the Texas 50-771

Using the Texas 50-771 involves several steps to ensure that the form is completed correctly. First, gather all necessary documentation that supports your claim for a property appraisal correction. This may include previous appraisal notices, photographs of the property, or any relevant sales data. Next, fill out the form accurately, providing all requested information, such as your property details and the specific reasons for the motion. Finally, submit the completed form to the appropriate appraisal district office within the designated timeframe to ensure your request is considered.

Steps to Complete the Texas 50-771

Completing the Texas 50-771 form involves a systematic approach:

- Step One: Download the Texas 50-771 form from the Texas Comptroller's website or obtain a physical copy from your local appraisal district.

- Step Two: Fill in your personal information, including your name, address, and contact details.

- Step Three: Provide specific details about the property in question, including the property identification number and the reason for the correction request.

- Step Four: Attach any supporting documentation that validates your claim, such as photographs or comparable property sales.

- Step Five: Review the completed form for accuracy and completeness before submitting it.

- Step Six: Submit the form to your local appraisal district by mail, in person, or electronically, if available.

Legal Use of the Texas 50-771

The Texas 50-771 form is legally binding when submitted correctly and within the specified time limits. It is crucial for property owners to understand that this form must be filled out in accordance with Texas law to be considered valid. The form serves as a formal request for a review of the property appraisal, and failure to comply with legal requirements may result in the denial of the motion. Ensuring that all information is accurate and that supporting documents are included can significantly impact the outcome of your request.

Key Elements of the Texas 50-771

Several key elements are vital for the successful completion of the Texas 50-771 form:

- Property Identification: Accurate identification of the property is essential, including the property ID number.

- Reason for Correction: Clearly stating the reason for the appraisal correction helps the appraisal district understand your request.

- Supporting Documentation: Providing relevant documents strengthens your case and supports your claims.

- Signature: The form must be signed by the property owner or an authorized representative to be considered valid.

Who Issues the Texas 50-771?

The Texas 50-771 form is issued and managed by the Texas Comptroller of Public Accounts. This office oversees property tax assessments and ensures compliance with state regulations regarding property appraisals. Property owners must submit their completed forms to their local appraisal district, which is responsible for reviewing the requests and making any necessary adjustments to property values. Understanding the role of the Texas Comptroller and local appraisal districts is crucial for effectively navigating the property appraisal correction process.

Quick guide on how to complete movant brings this motion for a hearing to correct the appraisal roll regarding movants above referenced property on the

Complete 50 771 effortlessly on any device

Digital document management has surged in popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without any delays. Manage 50 771 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related processes today.

How to modify and eSign 50 771 with ease

- Obtain 50 771 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or conceal sensitive details with the tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your updates.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs with just a few clicks from any device of your choice. Modify and eSign 50 771 and ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the movant brings this motion for a hearing to correct the appraisal roll regarding movants above referenced property on the

How to generate an electronic signature for your Movant Brings This Motion For A Hearing To Correct The Appraisal Roll Regarding Movants Above Referenced Property On The online

How to make an electronic signature for the Movant Brings This Motion For A Hearing To Correct The Appraisal Roll Regarding Movants Above Referenced Property On The in Google Chrome

How to create an eSignature for putting it on the Movant Brings This Motion For A Hearing To Correct The Appraisal Roll Regarding Movants Above Referenced Property On The in Gmail

How to create an eSignature for the Movant Brings This Motion For A Hearing To Correct The Appraisal Roll Regarding Movants Above Referenced Property On The right from your mobile device

How to create an electronic signature for the Movant Brings This Motion For A Hearing To Correct The Appraisal Roll Regarding Movants Above Referenced Property On The on iOS devices

How to create an eSignature for the Movant Brings This Motion For A Hearing To Correct The Appraisal Roll Regarding Movants Above Referenced Property On The on Android

People also ask

-

What is a Texas motion appraisal?

A Texas motion appraisal is a process that allows property owners to challenge their property tax appraisals. This legal motion must follow specific procedures set forth by Texas law, ensuring that property valuations are fair and accurate. By utilizing a motion appraisal, property owners can potentially reduce their tax liabilities.

-

How does airSlate SignNow facilitate the Texas motion appraisal process?

airSlate SignNow streamlines the Texas motion appraisal process by allowing users to eSign documents quickly and securely. This eliminates the need for printing, signing, and scanning, making the entire process more efficient. With airSlate SignNow, you can manage your appraisal documents seamlessly.

-

What are the costs associated with filing a Texas motion appraisal?

Costs for filing a Texas motion appraisal can vary based on several factors, such as filing fees, legal assistance, and any associated appraisal costs. While airSlate SignNow offers a cost-effective solution for managing documents, be sure to factor in any potential fees that may apply when engaging in the motion appraisal process.

-

Can airSlate SignNow integrate with other tools for Texas motion appraisal?

Yes, airSlate SignNow can integrate with various tools to enhance the Texas motion appraisal process. By integrating with cloud storage services, document management systems, and other applications, users can streamline their workflows and ensure that all important documents are easily accessible. This can save time and improve communication during the appraisal challenge.

-

What features does airSlate SignNow offer for Texas motion appraisal?

airSlate SignNow provides several features that are beneficial for handling Texas motion appraisals, including customizable templates, secure eSignatures, and real-time document tracking. These tools allow users to manage their appraisal documents efficiently while ensuring compliance with Texas regulations. The platform is designed to simplify the process from start to finish.

-

What are the benefits of using airSlate SignNow for Texas motion appraisal?

The primary benefits of using airSlate SignNow for Texas motion appraisal include increased efficiency, enhanced security, and reduced turnaround times. Users can easily create, send, and eSign documents without the hassles of traditional paperwork. This results in a smoother process for property owners contesting their appraisals.

-

Is airSlate SignNow suitable for businesses filing Texas motion appraisals?

Absolutely, airSlate SignNow is well-suited for businesses filing Texas motion appraisals. The platform offers solutions that cater to the needs of both individuals and businesses, ensuring that all documentation is handled effectively. Businesses can streamline their appraisal challenges while maintaining a professional image through the use of eSignatures.

Get more for 50 771

- Marketplace facilitator certificate of collection form

- Perrysburg tax department find the business information

- Ohio it re explanation of corrections form

- Sales and use tax refund checklist form

- Corporation tax form

- Payment of estimated tax ky rev stat 141 207 form

- Recycl contract template form

- Ree professional organizer contract template form

Find out other 50 771

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself