St 3 Form

What is the ST-3?

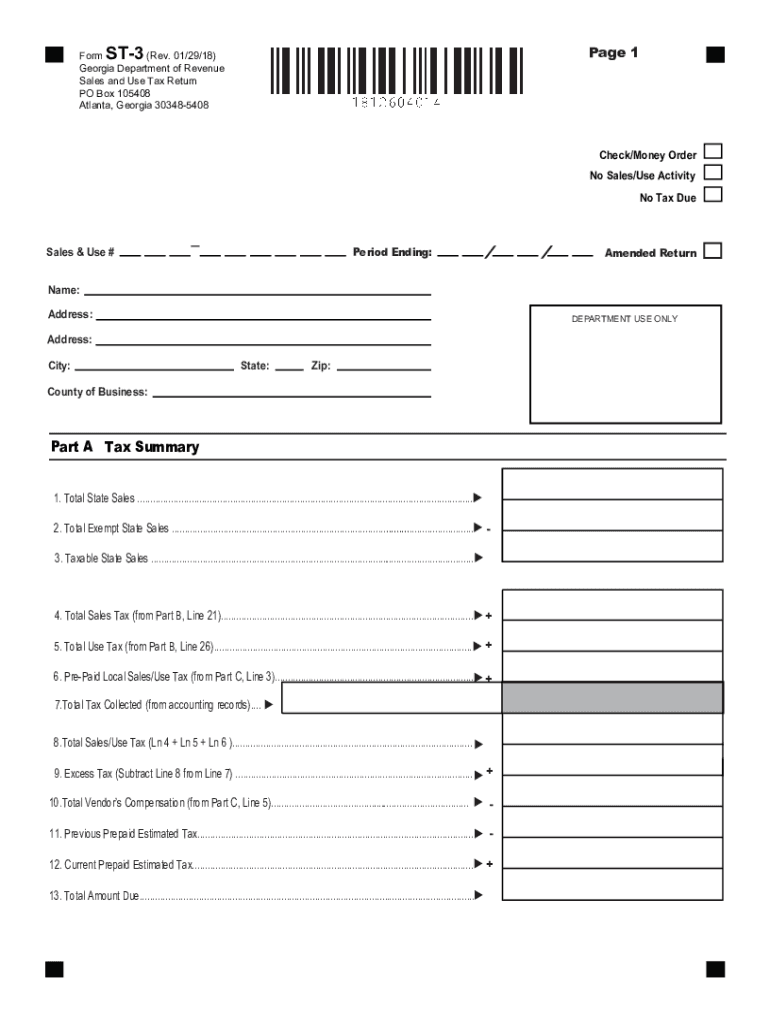

The ST-3 form is a sales and use tax certificate exemption used in Georgia. It allows eligible purchasers to buy certain items without paying sales tax. This form is crucial for businesses and individuals who qualify for tax exemptions under specific circumstances, such as reselling goods or purchasing items for manufacturing. Understanding the ST-3 form is essential for compliance with Georgia tax regulations.

How to Use the ST-3

To use the ST-3 form, the purchaser must complete it accurately, providing all necessary information, including the buyer's details and the reason for the exemption. After filling out the form, it should be presented to the seller at the time of purchase. The seller must retain a copy for their records to validate the tax-exempt sale. Proper use of the ST-3 ensures that both parties comply with Georgia tax laws.

Steps to Complete the ST-3

Completing the ST-3 form involves several key steps:

- Obtain the ST-3 form from the Georgia Department of Revenue or a trusted source.

- Fill in the purchaser's name, address, and tax identification number.

- Specify the reason for the exemption, such as resale or manufacturing.

- Sign and date the form to certify its accuracy.

- Provide the completed form to the seller at the time of purchase.

Legal Use of the ST-3

Using the ST-3 form legally requires adherence to Georgia's sales tax exemption laws. Only eligible purchasers can use this form to avoid sales tax. Misuse or fraudulent claims can result in penalties, including fines or back taxes owed. It is vital for both buyers and sellers to understand the legal implications of using the ST-3 to ensure compliance with state regulations.

Eligibility Criteria

To be eligible for using the ST-3 form, purchasers must meet specific criteria set by the Georgia Department of Revenue. Common eligibility includes being a registered reseller or a manufacturer purchasing items for production. Additionally, the items purchased must qualify for exemption under Georgia law. Understanding these criteria helps ensure that the form is used correctly and legally.

Required Documents

When completing the ST-3 form, certain documents may be required to support the exemption claim. These documents can include:

- Proof of business registration or tax identification number.

- Invoices or receipts for items purchased under the exemption.

- Any additional documentation that supports the reason for the exemption.

Having these documents ready can facilitate a smoother transaction and help avoid potential issues with tax compliance.

Penalties for Non-Compliance

Failure to comply with the regulations surrounding the ST-3 form can lead to significant penalties. If a business improperly accepts the ST-3 form, they may be liable for unpaid sales tax, interest, and penalties. Additionally, purchasers who misuse the form may face fines or legal action. Understanding these consequences emphasizes the importance of using the ST-3 form correctly and ensuring all claims are valid.

Quick guide on how to complete effective date this form st 3 is effective for sales beginning april 1 2018

Easily Prepare St 3 on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an excellent environmentally friendly alternative to conventional printed and signed paperwork, as you can access the necessary form and safely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents quickly without waiting. Handle St 3 on any device using airSlate SignNow’s Android or iOS applications and streamline any document-related task today.

Effortlessly Modify and eSign St 3

- Obtain St 3 and click on Get Form to begin.

- Utilize our tools to fill out your form.

- Highlight key parts of the documents or obscure sensitive details with the tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to finalize your changes.

- Select your delivery method for the form, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or mislaid files, tedious navigation through forms, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any preferred device. Modify and eSign St 3 to ensure smooth communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the effective date this form st 3 is effective for sales beginning april 1 2018

How to make an eSignature for your Effective Date This Form St 3 Is Effective For Sales Beginning April 1 2018 in the online mode

How to create an eSignature for the Effective Date This Form St 3 Is Effective For Sales Beginning April 1 2018 in Google Chrome

How to make an electronic signature for putting it on the Effective Date This Form St 3 Is Effective For Sales Beginning April 1 2018 in Gmail

How to generate an electronic signature for the Effective Date This Form St 3 Is Effective For Sales Beginning April 1 2018 from your smart phone

How to make an electronic signature for the Effective Date This Form St 3 Is Effective For Sales Beginning April 1 2018 on iOS

How to generate an eSignature for the Effective Date This Form St 3 Is Effective For Sales Beginning April 1 2018 on Android OS

People also ask

-

What is the GA sales use tax certificate exemption?

The GA sales use tax certificate exemption allows eligible businesses to purchase items without paying sales tax. This exemption is particularly beneficial for companies that are buying supplies or equipment needed for their operations. Understanding how to apply for this exemption can save your business signNow costs.

-

Who qualifies for the GA sales use tax certificate exemption?

Businesses that engage in manufacturing, certain types of services, or governmental entities can qualify for the GA sales use tax certificate exemption. It's essential to ensure that your business meets the necessary criteria outlined by the state regulations. To determine eligibility, consult the Georgia Department of Revenue guidelines.

-

How does airSlate SignNow aid in managing tax exemption certificates?

airSlate SignNow simplifies the process of managing tax exemption certificates, including those related to GA sales use tax certificate exemption. With our eSignature platform, businesses can easily collect, store, and manage exemption documents securely. This efficiency not only saves time but also ensures compliance with tax exemption regulations.

-

What features does airSlate SignNow offer for document signing?

airSlate SignNow offers features such as customizable templates, multi-party signing, and automated workflows designed to streamline the eSigning process. These features enhance efficiency while ensuring that all documents, including those pertaining to GA sales use tax certificate exemption, are handled with care and security. You can take control of your document management process effortlessly.

-

Is airSlate SignNow cost-effective for small businesses?

Yes, airSlate SignNow provides a cost-effective solution for small businesses looking to streamline their document signing processes, including handling GA sales use tax certificate exemption. Our pricing plans are designed to fit various business sizes and needs, ensuring access to essential eSigning features without breaking the bank. Consider the potential savings in time and resources.

-

What integrations does airSlate SignNow support?

airSlate SignNow seamlessly integrates with various business applications such as Google Drive, Salesforce, and Microsoft Teams. This integration enhances workflow efficiency and ensures you can manage documents relating to GA sales use tax certificate exemption alongside other business operations. These connections facilitate smoother collaboration and document management.

-

Can I track the status of my documents with airSlate SignNow?

Absolutely! airSlate SignNow provides tracking capabilities that allow you to monitor the status of all your documents throughout the signing process. This feature is particularly useful for managing important documents, including those associated with GA sales use tax certificate exemption. You’ll always know where your documents stand, enhancing transparency and accountability.

Get more for St 3

- Hotel tax certificate of registration form

- Employing children under age 14 f700 118 000 employing children under age 14 f700 118 000 form

- Business tax forms and publications for tax filing

- Tax year 2024 form

- Form u 6 rev public service company tax return forms fillable

- How to fill out and file a sched k 1 taxes s2e44 youtube form

- Important information on county of hawaii

- Form bb 1 rev 9 state of hawaii basic business application forms

Find out other St 3

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online