Form U 6, Rev , Public Service Company Tax Return Forms Fillable 2022

What is the Form U-6, Rev, Public Service Company Tax Return Forms Fillable

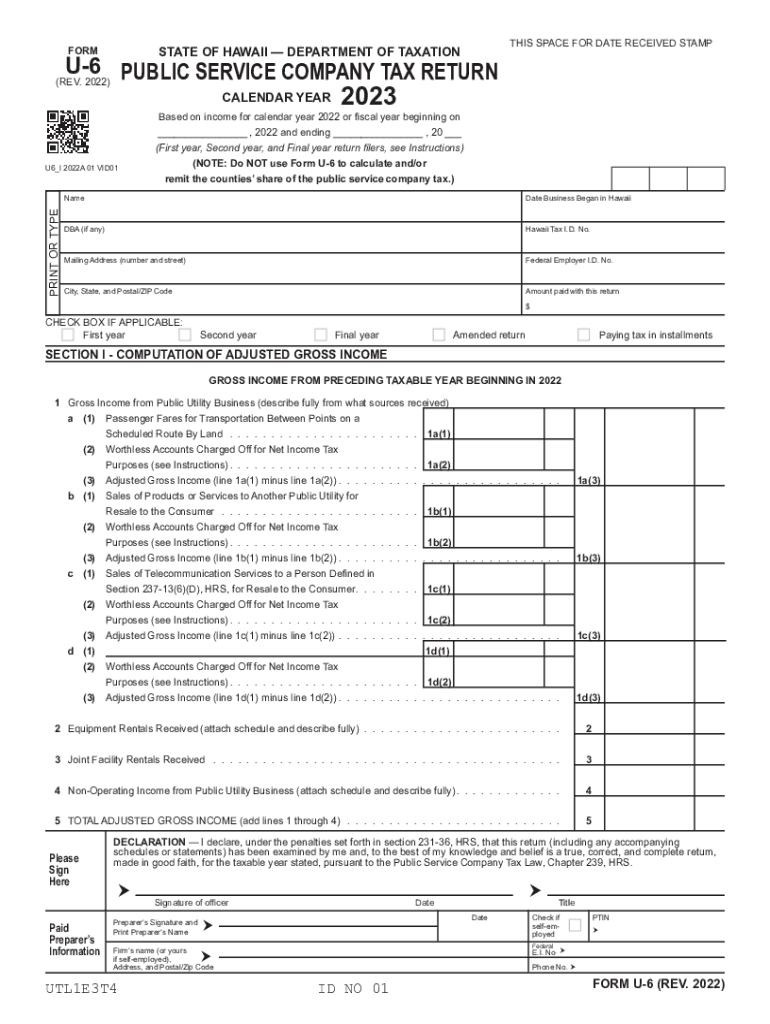

The Form U-6, Rev, is a tax return form specifically designed for public service companies in the United States. This form is utilized to report income, expenses, and other financial information pertinent to public service operations. It is essential for ensuring compliance with state and federal tax regulations. The fillable version of this form allows users to complete it digitally, facilitating easier submission and record-keeping.

How to use the Form U-6, Rev, Public Service Company Tax Return Forms Fillable

Using the Form U-6, Rev, involves several straightforward steps. First, access the fillable form through a reliable platform that supports digital signatures and document management. Next, enter the required information accurately, ensuring all financial data aligns with your company's records. After completing the form, review it for any errors before signing it electronically. Finally, submit the form according to your state’s guidelines, either online or through traditional mail.

Steps to complete the Form U-6, Rev, Public Service Company Tax Return Forms Fillable

Completing the Form U-6, Rev, involves the following steps:

- Gather necessary financial documents, including income statements and expense reports.

- Open the fillable form on your device.

- Input your company’s information in the designated fields.

- Detail your income and expenses accurately, ensuring all figures are correct.

- Review the completed form for accuracy and completeness.

- Sign the form electronically using a secure digital signature.

- Submit the form as per your state's submission requirements.

Key elements of the Form U-6, Rev, Public Service Company Tax Return Forms Fillable

The Form U-6, Rev, includes several key elements that are crucial for accurate reporting. These elements typically consist of:

- Company identification details, including name and address.

- Financial data such as total revenue, operating expenses, and net income.

- Tax computation sections to determine the amount owed or refund due.

- Signature section for authorized representatives of the company.

Filing Deadlines / Important Dates

It is vital to be aware of the filing deadlines associated with the Form U-6, Rev. Typically, public service companies must submit their tax returns by a specified date each year, which may vary by state. Missing these deadlines can result in penalties or interest on unpaid taxes. Therefore, keeping track of these dates is essential for compliance and financial planning.

Form Submission Methods (Online / Mail / In-Person)

The Form U-6, Rev, can be submitted through various methods, depending on state regulations. Common submission methods include:

- Online submission via state tax authority websites, which often provide secure portals for electronic filing.

- Mailing a printed copy of the completed form to the appropriate tax office.

- In-person submission at designated tax offices, if applicable.

Quick guide on how to complete form u 6 rev public service company tax return forms fillable

Effortlessly Prepare Form U 6, Rev , Public Service Company Tax Return Forms Fillable on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly substitute for traditional printed and signed documentation, allowing you to access the necessary forms and securely save them online. airSlate SignNow equips you with all the resources required to quickly create, modify, and eSign your documents without any delays. Manage Form U 6, Rev , Public Service Company Tax Return Forms Fillable on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

Your Simple Guide to Edit and eSign Form U 6, Rev , Public Service Company Tax Return Forms Fillable with Ease

- Find Form U 6, Rev , Public Service Company Tax Return Forms Fillable and click Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Create your eSignature using the Sign feature, which takes seconds and is legally equivalent to a conventional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, frustrating document searches, or mistakes that necessitate reprinting. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Modify and eSign Form U 6, Rev , Public Service Company Tax Return Forms Fillable to ensure excellent communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form u 6 rev public service company tax return forms fillable

Create this form in 5 minutes!

How to create an eSignature for the form u 6 rev public service company tax return forms fillable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form U 6, Rev, Public Service Company Tax Return Forms Fillable?

The Form U 6, Rev, Public Service Company Tax Return Forms Fillable is a tax form specifically designed for public service companies to report their revenue and expense data. This form ensures compliance with state regulations and helps streamline the filing process. Using fillable formats can save time and minimize errors in completing these important tax documents.

-

How can I fill out the Form U 6, Rev, Public Service Company Tax Return Forms Fillable?

To fill out the Form U 6, Rev, Public Service Company Tax Return Forms Fillable, you can use airSlate SignNow's easy-to-use platform. Our solution provides a step-by-step guide and intuitive features to help you complete the form accurately. Simply access the form through our service, add your information, and ensure it’s ready for submission.

-

What are the benefits of using airSlate SignNow for Form U 6, Rev, Public Service Company Tax Return Forms Fillable?

Using airSlate SignNow for Form U 6, Rev, Public Service Company Tax Return Forms Fillable offers numerous benefits, including a user-friendly interface, efficient document management, and easy collaboration. Our solution allows you to eSign documents securely, track progress, and store your forms safely. Plus, it helps reduce paper clutter and enhances your workflow.

-

Is there a cost associated with using airSlate SignNow to fill out the Form U 6, Rev, Public Service Company Tax Return Forms Fillable?

Yes, there is a cost associated with using airSlate SignNow; however, we provide a range of pricing plans to cater to different business needs. Our plans are designed to be cost-effective, ensuring you get the best value while using our services for Form U 6, Rev, Public Service Company Tax Return Forms Fillable. You can choose a plan that fits your budget and requirements.

-

Can I integrate airSlate SignNow with other software for handling Form U 6, Rev, Public Service Company Tax Return Forms Fillable?

Absolutely! airSlate SignNow offers seamless integrations with various software solutions, including popular CRM systems and document management tools. This makes it easy to incorporate Form U 6, Rev, Public Service Company Tax Return Forms Fillable into your existing workflow. Our integration capabilities enhance productivity and streamline document processes.

-

What types of documents can I manage with airSlate SignNow aside from Form U 6, Rev, Public Service Company Tax Return Forms Fillable?

In addition to the Form U 6, Rev, Public Service Company Tax Return Forms Fillable, airSlate SignNow allows you to manage a wide variety of documents, including contracts, agreements, and other tax forms. Our platform supports multiple document types, making it a versatile tool for your business. You can easily create, send, and eSign any necessary documents efficiently.

-

How secure is my information when using airSlate SignNow for Form U 6, Rev, Public Service Company Tax Return Forms Fillable?

Security is a top priority at airSlate SignNow. We use advanced encryption measures and maintain strict compliance protocols to ensure that your information, including details within the Form U 6, Rev, Public Service Company Tax Return Forms Fillable, is protected at all times. You can trust our platform with your sensitive data, knowing it is safe and secure.

Get more for Form U 6, Rev , Public Service Company Tax Return Forms Fillable

- Il sup ct rule 204 subpoena for a foreign action cover form

- Fillable online ccg n645 01 04 10 cook county clerk of form

- 12th judicial circuit courtcourt servicesfamily gal form

- Illinois statewide forms approved dissolution of marriagecivil union divorce no children

- 12 08 27 norway supreme court review of oslo district form

- Personal guarantee of rental agreement legalformsorg

- New occupant statement 425574239 form

- River bend ranch fay ranches form

Find out other Form U 6, Rev , Public Service Company Tax Return Forms Fillable

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online

- eSign Delaware Healthcare / Medical Living Will Now

- eSign Healthcare / Medical Form Florida Secure