Form 4684 Instructions

What is the Form 4684?

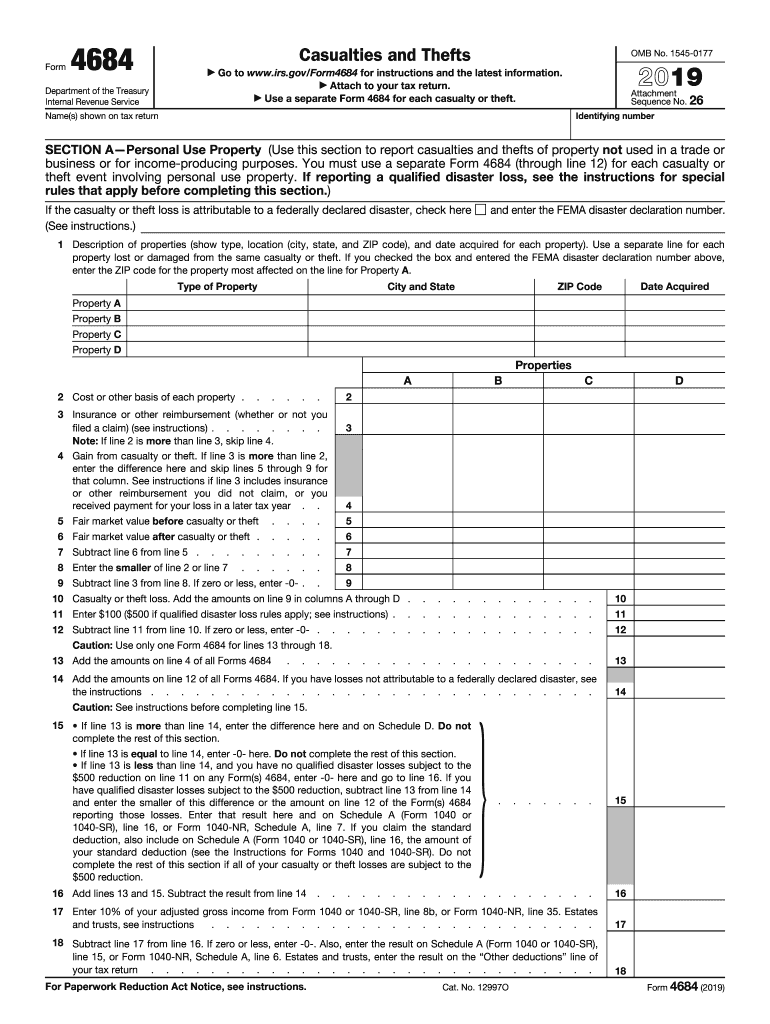

The IRS Form 4684 is used to report casualties and thefts for tax purposes. Taxpayers must complete this form to claim losses resulting from events such as natural disasters, accidents, or theft. The form helps individuals and businesses calculate the deductible loss for federal income tax purposes. Understanding how to fill out this form correctly is essential for ensuring compliance and maximizing potential deductions.

Steps to Complete the Form 4684

Completing the Form 4684 involves several key steps:

- Gather necessary documentation, including evidence of the loss, such as police reports or insurance claims.

- Determine the type of loss you are reporting: casualty or theft.

- Fill out the relevant sections of the form, providing details about the loss, including the date and nature of the incident.

- Calculate the amount of the loss, taking into account any insurance reimbursements.

- Attach the completed form to your tax return when filing.

IRS Guidelines for Form 4684

The IRS provides specific guidelines for completing Form 4684. Taxpayers must adhere to the instructions provided by the IRS to ensure accurate reporting. Key points include:

- Understanding the difference between personal and business losses.

- Knowing the applicable limits and thresholds for deductibility.

- Filing the form in conjunction with your annual tax return, typically Form 1040.

Legal Use of Form 4684

Form 4684 is legally binding when completed accurately and submitted with the appropriate documentation. It is crucial for taxpayers to maintain records that support the claims made on the form. This includes receipts, photographs, and any other evidence that substantiates the reported losses. Failure to comply with IRS regulations can lead to penalties or disallowance of the claimed deductions.

Filing Deadlines for Form 4684

Filing deadlines for Form 4684 align with the standard tax return deadlines. Typically, individuals must submit their tax returns by April fifteenth of the following year. If you are claiming a casualty or theft loss, it is advisable to file the form on time to avoid any complications or delays in processing your tax return.

Examples of Using Form 4684

Common scenarios for using Form 4684 include:

- Reporting losses from a natural disaster, such as a flood or hurricane.

- Claiming deductions for stolen property, including vehicles or personal belongings.

- Documenting losses from vandalism or other criminal activities.

Quick guide on how to complete 2015 form irs 4684 fill online printable fillable blank

Prepare Form 4684 Instructions with ease on any device

Web-based document management has gained traction among businesses and individuals. It offers a perfect eco-conscious alternative to traditional printed and signed documents, as you can access the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Form 4684 Instructions on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The easiest method to modify and eSign Form 4684 Instructions effortlessly

- Locate Form 4684 Instructions and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, cumbersome form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 4684 Instructions and guarantee outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2015 form irs 4684 fill online printable fillable blank

How to make an eSignature for your 2015 Form Irs 4684 Fill Online Printable Fillable Blank in the online mode

How to generate an eSignature for your 2015 Form Irs 4684 Fill Online Printable Fillable Blank in Google Chrome

How to generate an eSignature for putting it on the 2015 Form Irs 4684 Fill Online Printable Fillable Blank in Gmail

How to create an electronic signature for the 2015 Form Irs 4684 Fill Online Printable Fillable Blank right from your smart phone

How to generate an eSignature for the 2015 Form Irs 4684 Fill Online Printable Fillable Blank on iOS devices

How to make an eSignature for the 2015 Form Irs 4684 Fill Online Printable Fillable Blank on Android

People also ask

-

What is the 2019 Form 4684?

The 2019 Form 4684 is a tax form used by taxpayers to report casualties and theft losses. Understanding how to fill out the 2019 Form 4684 ensures you accurately document your losses for potential deductions. airSlate SignNow can streamline the process of electronically signing and sending your completed 2019 Form 4684.

-

How can I eSign the 2019 Form 4684 using airSlate SignNow?

You can easily eSign the 2019 Form 4684 with airSlate SignNow by uploading your document to our platform. Our user-friendly interface allows you to add your signature and initials quickly. Once signed, you can send the finalized 2019 Form 4684 directly to the necessary parties.

-

Is there a cost associated with using airSlate SignNow for the 2019 Form 4684?

airSlate SignNow offers various pricing plans, making it a cost-effective solution for businesses needing to eSign documents like the 2019 Form 4684. Our competitive rates ensure you get the features you need without breaking the bank. Visit our pricing page for more details on subscription options.

-

What features does airSlate SignNow provide for managing the 2019 Form 4684?

airSlate SignNow offers features like templates, bulk sending, and status tracking specifically designed for managing documents such as the 2019 Form 4684. These tools help you efficiently prepare and send several forms at once, while keeping track of their progress. Our platform is designed to enhance your workflow.

-

Can I integrate airSlate SignNow with other applications while handling the 2019 Form 4684?

Yes, airSlate SignNow supports integrations with various CRM, accounting, and productivity applications. This seamless integration allows you to manage your 2019 Form 4684 alongside your other business processes. Connect your tools easily for a more streamlined experience.

-

What are the benefits of using airSlate SignNow for my 2019 Form 4684?

Using airSlate SignNow for your 2019 Form 4684 can signNowly reduce the time spent on document management. Our platform enhances security, compliance, and accessibility, allowing you to focus on your core business tasks. Plus, the ability to eSign from any device makes the process convenient.

-

Is airSlate SignNow secure for handling the 2019 Form 4684?

Absolutely! airSlate SignNow prioritizes security and compliance to protect your sensitive information when handling the 2019 Form 4684. Our platform features encryption, secure storage, and compliance with industry regulations, ensuring that your data remains confidential and secure.

Get more for Form 4684 Instructions

- 501 2017 2018 form

- 2017 il 2210 computation of penalties for individuals form

- 2017 1042 t 2018 form

- Prior written notice to parents ohio department of education form

- 2015 form 1041 es internal revenue service irs

- Ma law 112917 retroactively taxes all 3rd pty paypal form

- Instructions for form 2210 794927945

- Form 482 for puerto rico individual income tax return

Find out other Form 4684 Instructions

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer