W10 Form

What is the W10 Form

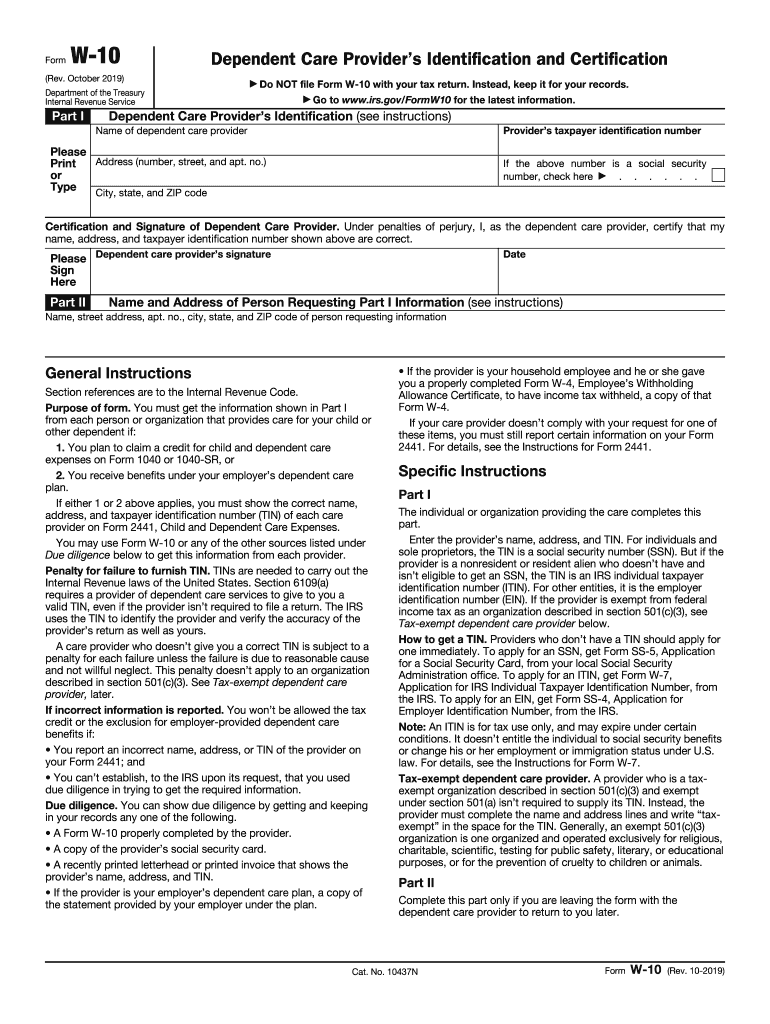

The W-10 form is a tax document used primarily for identifying dependents and providing necessary information related to tax deductions. It is often utilized by individuals who are claiming a dependent care credit or other tax benefits associated with dependents. This form is essential for accurately reporting information to the Internal Revenue Service (IRS) and ensuring that taxpayers receive the appropriate credits and deductions for which they qualify.

How to use the W10 Form

Using the W-10 form involves several steps to ensure that all required information is accurately reported. Taxpayers should first gather all necessary documentation regarding their dependents, including Social Security numbers and any relevant identification. Once the form is obtained, individuals can fill it out by providing details such as the dependent's name, date of birth, and relationship to the taxpayer. After completing the form, it should be submitted along with the taxpayer's annual tax return to the IRS.

Steps to complete the W10 Form

Completing the W-10 form requires careful attention to detail. Follow these steps to ensure accuracy:

- Gather all necessary information about your dependents, including their full names, Social Security numbers, and dates of birth.

- Obtain the W-10 form, which can typically be downloaded from the IRS website or obtained through tax preparation software.

- Fill out the form by entering the required information in the designated fields.

- Review the completed form for accuracy, ensuring that all information is correct and complete.

- Submit the W-10 form with your tax return to the IRS by the filing deadline.

Legal use of the W10 Form

The W-10 form is legally binding when used correctly in accordance with IRS regulations. It serves as a declaration of the taxpayer's eligibility for specific tax credits related to dependents. To ensure that the form is legally recognized, it must be filled out accurately and submitted on time. Failure to comply with IRS guidelines can result in penalties or denial of tax benefits.

Required Documents

When completing the W-10 form, certain documents are necessary to provide accurate information. These may include:

- Social Security cards for each dependent.

- Birth certificates or other identification documents to verify the relationship.

- Previous tax returns, if applicable, which may provide additional context for claims.

Filing Deadlines / Important Dates

Filing deadlines for the W-10 form align with the general tax filing deadlines set by the IRS. Typically, taxpayers must submit their forms by April fifteenth of each year. However, if additional time is needed, individuals may file for an extension, which can provide an additional six months to complete their tax returns. It is crucial to stay informed about any changes to deadlines to avoid penalties.

Quick guide on how to complete form w 10 rev october 2019 internal revenue service

Effortlessly prepare W10 Form on any device

Web-based document management has become increasingly favored by businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow provides you with all the features needed to create, modify, and electronically sign your documents swiftly without any hold-ups. Manage W10 Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to adjust and electronically sign W10 Form with ease

- Obtain W10 Form and click Get Form to begin.

- Utilize the features we offer to fill out your form.

- Emphasize relevant sections of the documents or conceal sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign feature, which takes just seconds and carries the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign W10 Form and guarantee effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form w 10 rev october 2019 internal revenue service

How to create an eSignature for your Form W 10 Rev October 2019 Internal Revenue Service online

How to generate an electronic signature for the Form W 10 Rev October 2019 Internal Revenue Service in Chrome

How to create an electronic signature for putting it on the Form W 10 Rev October 2019 Internal Revenue Service in Gmail

How to make an electronic signature for the Form W 10 Rev October 2019 Internal Revenue Service from your smart phone

How to make an electronic signature for the Form W 10 Rev October 2019 Internal Revenue Service on iOS devices

How to generate an electronic signature for the Form W 10 Rev October 2019 Internal Revenue Service on Android devices

People also ask

-

What is airSlate SignNow and how does it relate to w10 2019?

airSlate SignNow is a digital documentation solution that allows users to send and eSign documents seamlessly. With compatibility across various systems, including w10 2019, it ensures businesses can efficiently manage their documents regardless of the platform.

-

How much does airSlate SignNow cost for w10 2019 users?

airSlate SignNow offers competitive pricing plans suitable for various business sizes. For users implementing on w10 2019, there are flexible monthly and annual subscription options to choose from, allowing you to select what best fits your budget.

-

What features does airSlate SignNow offer for w10 2019 users?

The features of airSlate SignNow include customizable templates, automated workflows, and mobile access, all optimized for users on w10 2019. These features are designed to enhance efficiency and streamline the signing process for businesses.

-

Can airSlate SignNow integrate with other software on w10 2019?

Yes, airSlate SignNow supports various integrations with popular software tools that are compatible with w10 2019. This interoperability allows businesses to connect their existing applications seamlessly, enhancing productivity and workflow.

-

What are the benefits of using airSlate SignNow on w10 2019?

Using airSlate SignNow on w10 2019 offers businesses a user-friendly platform for eSigning and document management. Its advantages include increased turnaround times for document processing and reduced paper costs, making it an ideal choice for modern businesses.

-

Is airSlate SignNow secure for documents on w10 2019?

Yes, airSlate SignNow employs advanced security measures including encryption and secure cloud storage, ensuring your documents are safe even on w10 2019. This focus on security helps businesses maintain compliance while managing sensitive information.

-

How can I get started with airSlate SignNow on w10 2019?

Getting started with airSlate SignNow on w10 2019 is simple. Visit our website, sign up for a free trial, and you can quickly access all features designed to enhance your document workflow in a matter of minutes.

Get more for W10 Form

Find out other W10 Form

- How Can I Sign Alabama Personal loan contract template

- Can I Sign Arizona Personal loan contract template

- How To Sign Arkansas Personal loan contract template

- Sign Colorado Personal loan contract template Mobile

- How Do I Sign Florida Personal loan contract template

- Sign Hawaii Personal loan contract template Safe

- Sign Montana Personal loan contract template Free

- Sign New Mexico Personal loan contract template Myself

- Sign Vermont Real estate contracts Safe

- Can I Sign West Virginia Personal loan contract template

- How Do I Sign Hawaii Real estate sales contract template

- Sign Kentucky New hire forms Myself

- Sign Alabama New hire packet Online

- How Can I Sign California Verification of employment form

- Sign Indiana Home rental application Online

- Sign Idaho Rental application Free

- Sign South Carolina Rental lease application Online

- Sign Arizona Standard rental application Now

- Sign Indiana Real estate document Free

- How To Sign Wisconsin Real estate document