Form 8809

What is the Form 8809

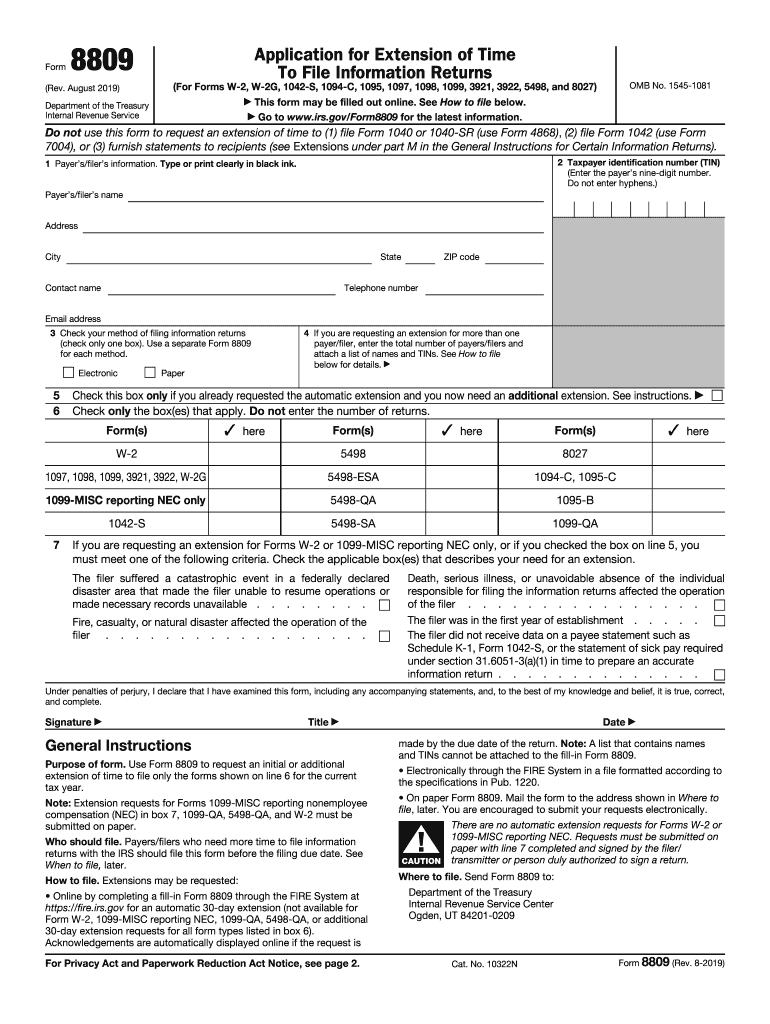

The Form 8809 is an official document used to apply for an extension of time to file certain information returns with the Internal Revenue Service (IRS). This form is particularly relevant for tax professionals and businesses that need additional time beyond the standard deadlines to submit forms such as the W-2 or 1099. Understanding the purpose of Form 8809 is crucial for ensuring compliance with IRS regulations and avoiding penalties associated with late filings.

How to use the Form 8809

To use Form 8809 effectively, individuals or businesses must fill it out accurately and submit it to the IRS. The form allows filers to request an automatic extension of time to file information returns. It is important to note that while this extension provides additional time for filing, it does not extend the deadline for paying any taxes owed. Proper completion of the form includes providing the necessary taxpayer information, selecting the type of returns for which the extension is requested, and signing the document.

Steps to complete the Form 8809

Completing Form 8809 involves several key steps:

- Gather necessary information, including your Employer Identification Number (EIN) and the type of forms for which you are requesting an extension.

- Fill out the form by entering your details in the designated fields, ensuring accuracy to avoid delays.

- Review the completed form for any errors or omissions.

- Sign and date the form to validate your request.

- Submit the form to the IRS either electronically or by mail, depending on your preference and the requirements for your specific situation.

Filing Deadlines / Important Dates

Understanding the filing deadlines associated with Form 8809 is essential for compliance. The form must be submitted by the due date of the information return for which an extension is being requested. For example, if you are filing a W-2, the deadline is typically January thirty-first. Filing Form 8809 on or before this date allows you to receive an automatic thirty-day extension, ensuring you have adequate time to prepare your returns without incurring penalties.

IRS Guidelines

The IRS provides specific guidelines for the use of Form 8809, including eligibility criteria and submission methods. It is important to follow these guidelines closely to ensure that your request for an extension is granted. The IRS allows for electronic submission of Form 8809, which can expedite the process and provide confirmation of receipt. Additionally, the IRS outlines the types of returns eligible for extension and the consequences of failing to file on time.

Legal use of the Form 8809

Form 8809 is legally binding when completed and submitted according to IRS regulations. This means that the information provided must be accurate and truthful, as providing false information can lead to penalties or legal repercussions. The form serves as a formal request for an extension, and its proper use ensures that taxpayers remain compliant with federal tax laws while managing their filing obligations effectively.

Quick guide on how to complete form 8809 rev august 2019 internal revenue service

Accomplish Form 8809 effortlessly on any gadget

Digital document management has gained traction among enterprises and individuals. It represents an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to produce, edit, and eSign your documents swiftly without any delays. Manage Form 8809 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to edit and eSign Form 8809 without breaking a sweat

- Locate Form 8809 and then click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Highlight pertinent sections of the documents or obscure sensitive details with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the details and then click on the Done button to preserve your changes.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form navigation, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Edit and eSign Form 8809 and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8809 rev august 2019 internal revenue service

How to generate an eSignature for your Form 8809 Rev August 2019 Internal Revenue Service online

How to make an electronic signature for your Form 8809 Rev August 2019 Internal Revenue Service in Google Chrome

How to create an eSignature for signing the Form 8809 Rev August 2019 Internal Revenue Service in Gmail

How to make an eSignature for the Form 8809 Rev August 2019 Internal Revenue Service from your mobile device

How to generate an eSignature for the Form 8809 Rev August 2019 Internal Revenue Service on iOS

How to make an electronic signature for the Form 8809 Rev August 2019 Internal Revenue Service on Android OS

People also ask

-

What are the typical Nebraska service center processing times in 2017?

The Nebraska service center processing times in 2017 varied based on the type of application being processed. Generally, forms like I-130 and I-485 saw processing times of several months. It's important to check the USCIS website for the most accurate and specific timeframes for your application type.

-

How can airSlate SignNow help with document processing related to Nebraska service center processing times 2017?

airSlate SignNow streamlines the process of sending and eSigning documents required for applications submitted to the Nebraska service center. With easy-to-use features, you can quickly prepare and send documents, ensuring compliance with relevant processing times from 2017.

-

Are there any fees associated with using airSlate SignNow for managing documents regarding the Nebraska service center processing times 2017?

Yes, airSlate SignNow offers various pricing plans based on your business's needs. These plans provide access to features that simplify document management, which can be especially helpful when dealing with the intricate requirements and timelines associated with Nebraska service center processing times in 2017.

-

What features does airSlate SignNow offer to assist with applications tied to the Nebraska service center processing times 2017?

airSlate SignNow provides features such as easy document eSigning, templates for repetitive tasks, and secure cloud storage. These tools are designed to help businesses manage their documentation effectively, making it easier to handle timelines like those seen in Nebraska service center processing times 2017.

-

Can I integrate airSlate SignNow with other tools to track Nebraska service center processing times in 2017?

Absolutely! airSlate SignNow can be integrated with various project management and CRM tools. This allows you to track your document status and stay updated with the Nebraska service center processing times in 2017 seamlessly.

-

What are the benefits of using airSlate SignNow when submitting documents to the Nebraska service center as of 2017?

Using airSlate SignNow offers several benefits including time savings, enhanced accuracy, and improved compliance when submitting documents. These advantages are particularly important given the complexities of Nebraska service center processing times in 2017.

-

Is airSlate SignNow suitable for individual users who need to manage their applications related to Nebraska service center processing times 2017?

Yes, airSlate SignNow is ideal for both individual users and businesses. Its user-friendly interface and affordability make it a great choice for anyone needing to manage their documents effectively amidst the complexities of Nebraska service center processing times in 2017.

Get more for Form 8809

- Schedule ct 1040wh if 20170912indd form

- 2018 form card

- Your 2017 return and payment for the full amount of tax due must be mailed by the due date of your federal return form

- 2011 irs form 1041 schedule d 1

- Form 515 2017 2018

- Irs form 8867 2018

- Arkansas offers certain taxpayers the opportunity to form

- 1099 b 2017 2018 form

Find out other Form 8809

- How To eSign Illinois Business Operations Stock Certificate

- Can I eSign Louisiana Car Dealer Quitclaim Deed

- eSign Michigan Car Dealer Operating Agreement Mobile

- Can I eSign Mississippi Car Dealer Resignation Letter

- eSign Missouri Car Dealer Lease Termination Letter Fast

- Help Me With eSign Kentucky Business Operations Quitclaim Deed

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later