Form 1041 Qft 2017

What is the Form 1041 QFT

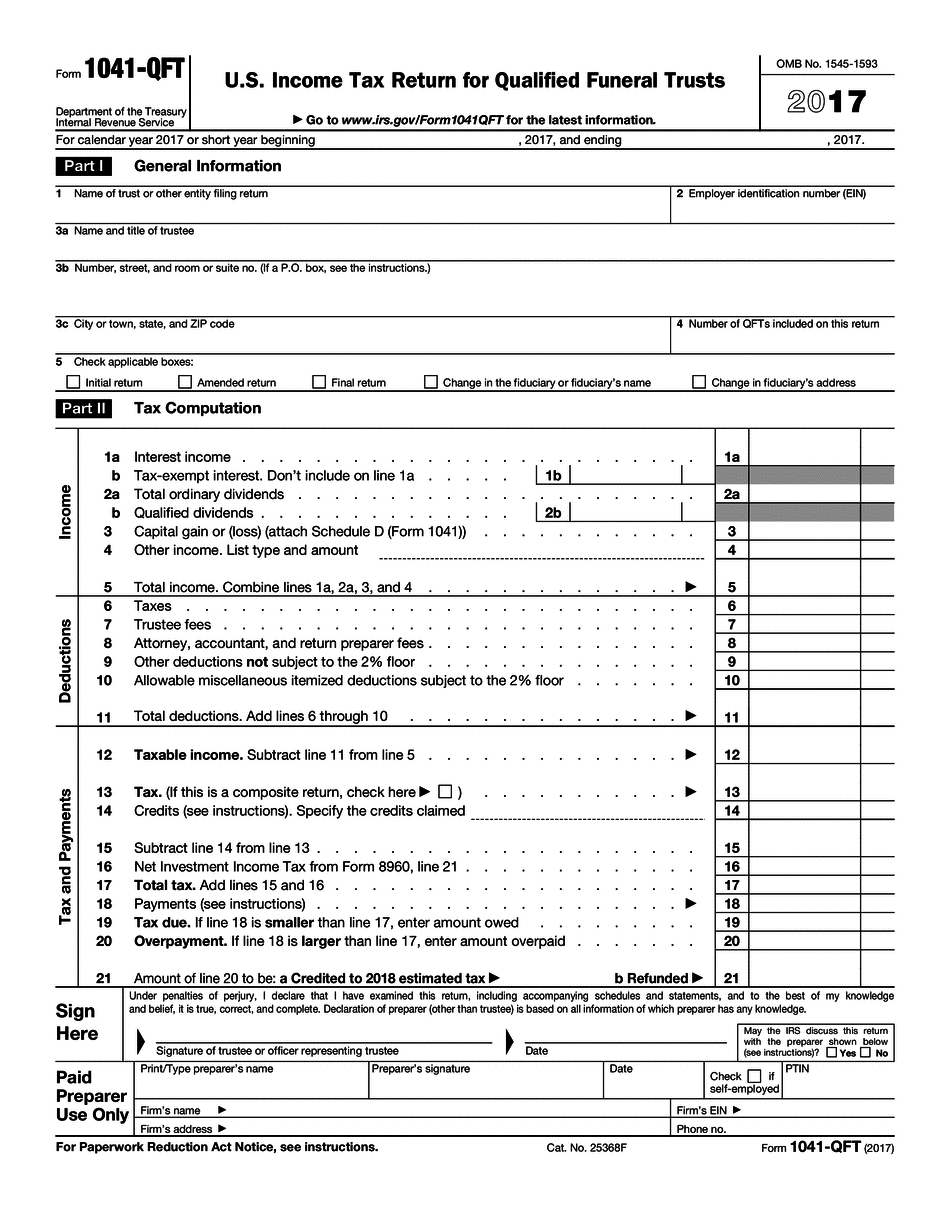

The Form 1041 QFT, or Qualified Funeral Trust, is a specialized tax form used in the United States for reporting income generated by funeral trusts. These trusts are established to manage funds set aside for funeral expenses, ensuring that the money is available when needed. The QFT allows trustees to report income, deductions, and distributions accurately, adhering to IRS regulations. Understanding the purpose and function of this form is essential for trustees and beneficiaries to ensure compliance with tax laws.

How to use the Form 1041 QFT

Using the Form 1041 QFT involves several steps to ensure accurate reporting of trust income. First, trustees must gather all relevant financial information, including income earned by the trust and any distributions made to beneficiaries. Next, the form must be filled out with precise details regarding the trust's income, deductions, and distributions. It is crucial to follow the IRS guidelines closely to avoid errors that could lead to penalties. After completing the form, trustees should file it by the designated deadline to maintain compliance.

Steps to complete the Form 1041 QFT

Completing the Form 1041 QFT requires careful attention to detail. The steps include:

- Gathering financial records related to the trust's income and expenses.

- Filling out the form, ensuring all required fields are completed accurately.

- Calculating the total income and allowable deductions.

- Reporting distributions made to beneficiaries during the tax year.

- Reviewing the form for accuracy before submission.

Following these steps helps ensure that the form is completed correctly, minimizing the risk of errors.

IRS Guidelines

The IRS provides specific guidelines for completing and filing the Form 1041 QFT. These guidelines include instructions on eligibility, necessary documentation, and filing deadlines. Trustees should familiarize themselves with the IRS instructions to understand the requirements for reporting income and distributions accurately. Adhering to these guidelines is essential to ensure compliance and avoid potential penalties for incorrect filings.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1041 QFT are critical to avoid penalties. Generally, the form must be filed by the fifteenth day of the fourth month following the end of the trust's tax year. For trusts operating on a calendar year, this means the form is typically due by April fifteenth. It is essential to keep track of these important dates to ensure timely submission and compliance with IRS regulations.

Required Documents

To complete the Form 1041 QFT, trustees must gather several key documents, including:

- Financial statements reflecting income earned by the trust.

- Records of any distributions made to beneficiaries.

- Documentation of allowable deductions.

- Any prior year tax returns related to the trust.

Having these documents on hand will facilitate accurate completion of the form and ensure compliance with IRS requirements.

Quick guide on how to complete form 1041 qft 2017

Discover the easiest method to complete and endorse your Form 1041 Qft

Are you still spending time preparing your official documents on paper instead of online? airSlate SignNow provides a superior way to finalize and sign your Form 1041 Qft and associated forms for public services. Our advanced eSignature solution equips you with all the tools necessary to manage documents swiftly and in compliance with official standards - comprehensive PDF editing, organizing, securing, signing, and sharing features all accessible within a user-friendly interface.

Only a few steps are needed to complete and sign your Form 1041 Qft:

- Upload the editable template to the editor using the Get Form button.

- Review what information is required in your Form 1041 Qft.

- Navigate through the fields with the Next button to avoid missing anything.

- Utilize Text, Check, and Cross tools to fill in the sections with your details.

- Revise the content using Text boxes or Images from the upper toolbar.

- Emphasize what is truly important or Obscure sections that are no longer relevant.

- Click on Sign to create a legally valid eSignature using your preferred method.

- Add the Date next to your signature and conclude your task with the Done button.

Store your finished Form 1041 Qft in the Documents directory within your profile, download it, or send it to your chosen cloud storage. Our service also offers adaptable form sharing. There's no need to print your templates when submitting them to the appropriate public office - do it via email, fax, or by requesting a USPS "snail mail" delivery from your account. Try it now!

Create this form in 5 minutes or less

Find and fill out the correct form 1041 qft 2017

FAQs

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

-

How do I fill out the Delhi Polytechnic 2017 form?

Delhi Polytechnic (CET DELHI) entrance examination form has been published. You can visit Welcome to CET Delhi and fill the online form. For more details you can call @ 7042426818

-

How do I fill out the SSC CHSL 2017-18 form?

Its very easy task, you have to just put this link in your browser SSC, this page will appearOn this page click on Apply buttonthere a dialog box appears, in that dialog box click on CHSL a link will come “ Click here to apply” and you will signNow to registration page.I hope you all have understood the procedure. All the best for your exam

-

How do I fill out the UPSEAT 2017 application forms?

UPESEAT is a placement test directed by the University of Petroleum and Energy Studies. This inclination examination is called as the University of Petroleum and Energy Studies Engineering Entrance Test (UPESEAT). It is essentially an essential sort examination which permits the possibility to apply for the different designing projects on the web. visit - HOW TO FILL THE UPSEAT 2017 APPLICATION FORMS

-

How do I fill out the JEE Advanced 2017 application form?

JEE Advanced Application Form 2017 is now available for all eligible candidates from April 28 to May 2, 2017 (5 PM). Registrations with late fee will be open from May 3 to May 4, 2017. The application form of JEE Advanced 2017 has been released only in online mode. visit - http://www.entrancezone.com/engi...

Create this form in 5 minutes!

How to create an eSignature for the form 1041 qft 2017

How to make an eSignature for your Form 1041 Qft 2017 online

How to make an eSignature for your Form 1041 Qft 2017 in Google Chrome

How to create an electronic signature for signing the Form 1041 Qft 2017 in Gmail

How to generate an electronic signature for the Form 1041 Qft 2017 from your smartphone

How to generate an eSignature for the Form 1041 Qft 2017 on iOS devices

How to generate an electronic signature for the Form 1041 Qft 2017 on Android OS

People also ask

-

What is Form 1041 Qft and why is it important?

Form 1041 Qft is a tax form used to report income, deductions, and credits for estates and trusts. It's essential for ensuring compliance with IRS regulations and accurately reporting the income generated by these entities. Understanding how to fill out Form 1041 Qft is crucial for fiduciaries and accountants managing trusts.

-

How can airSlate SignNow help with Form 1041 Qft?

airSlate SignNow provides an efficient platform for electronically signing and managing Form 1041 Qft documents. With our user-friendly interface, you can easily send, sign, and store your tax forms securely, streamlining the entire process of handling estate and trust documentation.

-

What features does airSlate SignNow offer for managing Form 1041 Qft?

airSlate SignNow offers a variety of features tailored for managing Form 1041 Qft, including customizable templates, secure eSignature capabilities, and document tracking. These features enhance efficiency, reduce paperwork, and ensure that all parties can access the necessary forms in a timely manner.

-

Is airSlate SignNow cost-effective for filing Form 1041 Qft?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses and individuals needing to manage Form 1041 Qft. With competitive pricing plans, you can streamline your document signing process without breaking the bank, making it an ideal choice for those handling tax documents.

-

Can I integrate airSlate SignNow with other software for Form 1041 Qft?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, enhancing your ability to manage Form 1041 Qft efficiently. This integration helps ensure that all your forms and documents are accessible and organized within your preferred systems.

-

What are the benefits of using airSlate SignNow for Form 1041 Qft?

Using airSlate SignNow for Form 1041 Qft offers numerous benefits, including enhanced security, ease of use, and improved turnaround times for document processing. By digitizing your signature process, you can save time, reduce errors, and ensure that your tax forms are completed accurately and promptly.

-

Is airSlate SignNow suitable for both individuals and businesses dealing with Form 1041 Qft?

Yes, airSlate SignNow is suitable for both individuals and businesses managing Form 1041 Qft. Whether you're an accountant, a fiduciary, or an individual handling your estate's paperwork, our platform provides the tools you need for efficient document management and eSigning.

Get more for Form 1041 Qft

- Certification of groundwater availability tceq ch 230 form

- Duplicate title 2011 2019 form

- Tc 852 form

- State of utah division of occupational amp professional dopl utah form

- Printable utah state functional ability evaluation medical report form 2010

- Utah dopl alarm licensing form

- Mo mo 1041 fill and sign printable template form

- 3k 1 formfill out and use this pdf

Find out other Form 1041 Qft

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free