1099 Oid Form

What is the 1099 Oid

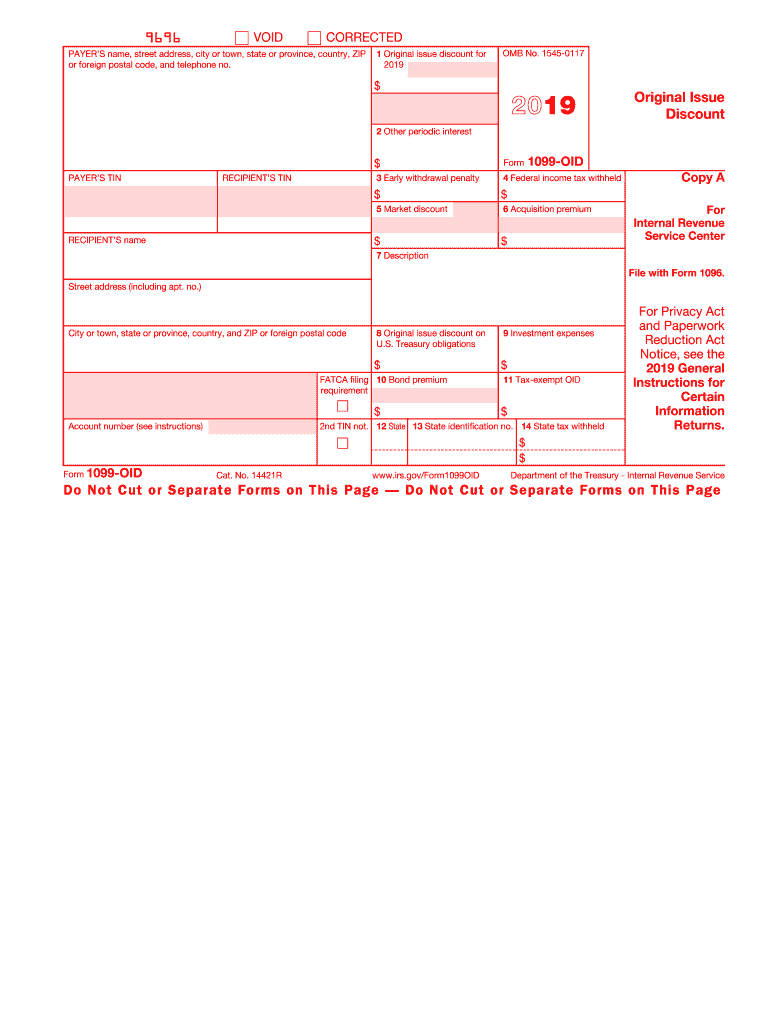

The 1099 Oid form, officially known as the Original Issue Discount (OID) form, is used to report interest income from certain types of debt instruments. This form is crucial for taxpayers who have received interest income from bonds or other financial instruments that were issued at a discount. The IRS requires this information to ensure that taxpayers accurately report their income and comply with tax regulations. The 1099 Oid is typically issued by financial institutions or corporations that have sold these debt instruments.

How to use the 1099 Oid

Using the 1099 Oid involves understanding how to report the income accurately on your tax return. Taxpayers must include the information from the 1099 Oid in their income calculations. This includes the amount of original issue discount that has been accrued during the tax year. It is essential to keep this form on hand when preparing your tax return, as it provides the necessary details for reporting interest income correctly. Failure to report this income can lead to penalties or audits by the IRS.

Steps to complete the 1099 Oid

Completing the 1099 Oid involves several straightforward steps:

- Gather all relevant financial documents, including any statements from financial institutions that issued the OID.

- Fill out the form with accurate information, including the issuer's name, taxpayer identification number, and the amount of original issue discount.

- Ensure that all figures are correct and that you have included any necessary supporting documentation.

- Submit the completed form to the IRS and provide a copy to the recipient, if applicable.

IRS Guidelines

The IRS provides specific guidelines for the use of the 1099 Oid. Taxpayers should refer to IRS Publication 1212, which outlines the rules for original issue discounts and how to report them. This publication includes examples and detailed instructions on completing the form. It is important to follow these guidelines closely to ensure compliance and avoid potential issues with the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the 1099 Oid are crucial for compliance. Generally, the form must be submitted to the IRS by the end of February if filed on paper, or by the end of March if filed electronically. Recipients must also receive their copies by the end of January. It is advisable to mark these dates on your calendar to ensure timely submission and avoid penalties.

Penalties for Non-Compliance

Failure to file the 1099 Oid accurately and on time can result in penalties imposed by the IRS. These penalties can vary based on how late the form is filed and whether the failure to file was intentional or accidental. Taxpayers may face fines for each form not filed or for incorrect information provided. It is essential to adhere to filing requirements to avoid these financial repercussions.

Quick guide on how to complete 2019 form 1099 oid original issue discount

Accomplish 1099 Oid effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents rapidly without delays. Handle 1099 Oid on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and electronically sign 1099 Oid without hassle

- Locate 1099 Oid and click Get Form to begin.

- Use the tools provided to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your PC.

Eliminate the worries of lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs with a few clicks from any device of your choice. Modify and electronically sign 1099 Oid and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 form 1099 oid original issue discount

How to generate an electronic signature for the 2019 Form 1099 Oid Original Issue Discount online

How to generate an electronic signature for your 2019 Form 1099 Oid Original Issue Discount in Google Chrome

How to generate an eSignature for signing the 2019 Form 1099 Oid Original Issue Discount in Gmail

How to generate an eSignature for the 2019 Form 1099 Oid Original Issue Discount from your mobile device

How to create an eSignature for the 2019 Form 1099 Oid Original Issue Discount on iOS

How to create an electronic signature for the 2019 Form 1099 Oid Original Issue Discount on Android OS

People also ask

-

What is a 1099 OID 2019 form?

The 1099 OID 2019 form is used to report original issue discount income that you have received. It's important for taxpayers to accurately report this income to avoid any IRS penalties. Understanding how to manage your 1099 OID 2019 forms can help streamline your tax filing process.

-

How can airSlate SignNow help with 1099 OID 2019 forms?

airSlate SignNow provides a seamless way to eSign and send 1099 OID 2019 forms quickly and securely. Our platform simplifies document handling, ensuring that you can manage your tax documents efficiently. With airSlate SignNow, you can save time and eliminate the hassle associated with paper forms.

-

Is there a cost associated with using airSlate SignNow for 1099 OID 2019 documents?

Yes, there is a cost to use airSlate SignNow, but it's designed to be a cost-effective solution for businesses handling 1099 OID 2019 forms. We offer various pricing plans tailored to meet your needs, allowing you to choose the plan that best fits your budget. It's an investment that can save you time and improve your document management.

-

What features does airSlate SignNow offer for managing 1099 OID 2019 forms?

airSlate SignNow offers features such as templates for 1099 OID 2019 forms, cloud storage, and secure eSignature options. These features ensure that your documents are not only easy to create but also secure and accessible from anywhere. Additionally, our platform allows for real-time tracking of your documents.

-

How secure is airSlate SignNow for transmitting 1099 OID 2019 forms?

Security is a top priority at airSlate SignNow. We use industry-standard encryption protocols to ensure that your 1099 OID 2019 forms are transmitted safely. You can trust that your sensitive financial information is protected throughout the eSigning process.

-

Can I integrate airSlate SignNow with other tools for handling 1099 OID 2019 forms?

Absolutely! airSlate SignNow integrates with a variety of applications to enhance your workflow when managing 1099 OID 2019 forms. You can connect with popular tools like Google Drive, Salesforce, and many others to streamline your document handling and eSigning processes.

-

What are the benefits of using airSlate SignNow for 1099 OID 2019 forms?

By using airSlate SignNow for your 1099 OID 2019 forms, you benefit from faster processing times, enhanced security, and ease of use. Our platform allows you to manage multiple documents simultaneously, reducing the paperwork burden. It's a practical solution that can help you focus on your core business activities.

Get more for 1099 Oid

- In ssc form

- Gift tax return questionnaire form 709

- Location codes on il department of revenue st 2 x form

- Form a 1 alabama department of revenue

- 1745 request for information

- Form 2478 missouri department of revenue

- Missouri form mo 3nr partnership s corporation withholding exemption

- Revised 010117 webstersalestax form

Find out other 1099 Oid

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors