Form

What is the Form

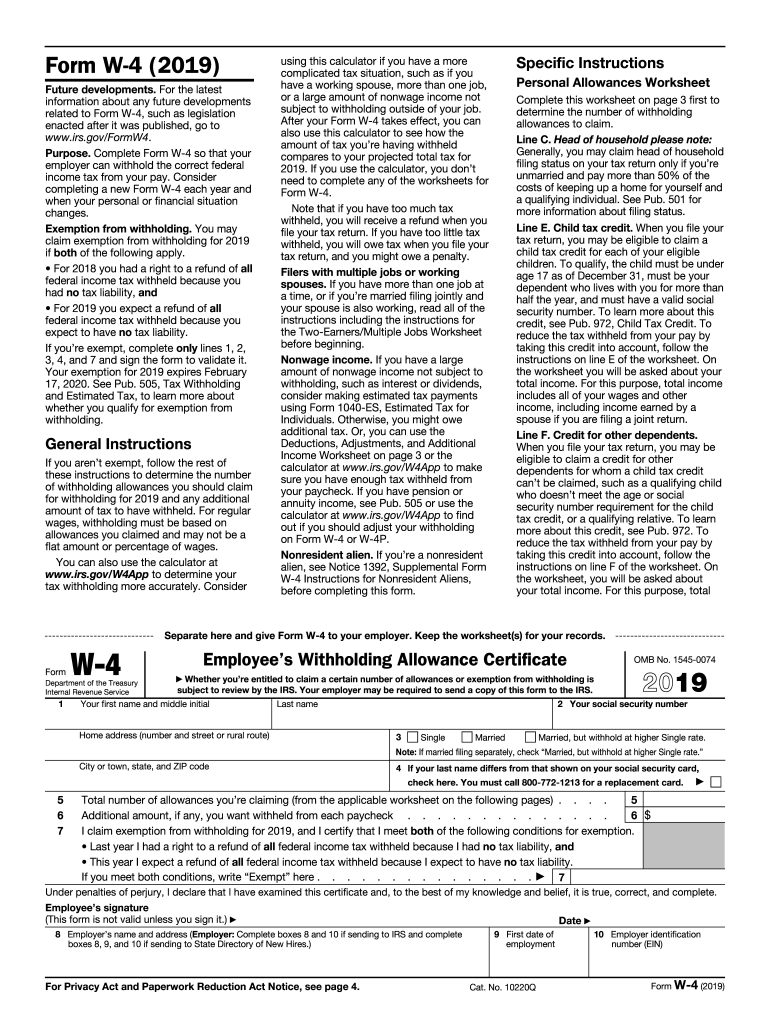

The 2019 W-4 form, officially known as the Employee's Withholding Certificate, is a crucial document used by employees in the United States to inform their employers about their tax situation. This form helps employers determine the correct amount of federal income tax to withhold from an employee's paycheck. By providing information such as filing status, number of allowances, and additional withholding amounts, employees can tailor their tax withholding to better match their expected tax liability for the year.

How to use the Form

Using the 2019 W-4 form involves a few straightforward steps. First, employees should complete the form by providing personal information, including their name, address, Social Security number, and filing status. Next, they should indicate the number of allowances they are claiming, which directly affects the amount of tax withheld. Employees may also choose to specify any additional amount they wish to withhold. After filling out the form, it should be submitted to the employer's payroll department, ensuring that the correct withholding begins with the next paycheck.

Steps to complete the Form

Completing the 2019 W-4 form requires careful attention to detail. Here are the essential steps:

- Provide your personal information, including your name, address, and Social Security number.

- Select your filing status: single, married filing jointly, married filing separately, or head of household.

- Determine the number of allowances you are eligible to claim based on your personal and financial situation.

- If applicable, indicate any additional amount you want withheld from each paycheck.

- Sign and date the form to certify its accuracy.

Legal use of the Form

The 2019 W-4 form is legally binding when completed accurately and submitted to an employer. It is essential for ensuring compliance with federal tax laws. Employers are required to withhold the appropriate amount of federal income tax based on the information provided on the W-4. Failure to submit a valid W-4 may result in the employer withholding taxes at the highest rate, which could lead to over-withholding and potential tax refunds at year-end.

IRS Guidelines

The IRS provides specific guidelines for completing the 2019 W-4 form. These guidelines include instructions on how to calculate allowances and the implications of claiming certain statuses. Employees are encouraged to review the IRS instructions carefully to ensure they are accurately reflecting their tax situation. The IRS also recommends that employees review their W-4 periodically, especially after significant life changes such as marriage, divorce, or the birth of a child, as these can affect tax withholding.

Filing Deadlines / Important Dates

While the 2019 W-4 form does not have a specific filing deadline, it is essential for employees to submit it to their employer as soon as possible to ensure accurate withholding for the tax year. Employers typically need to process the W-4 before the first paycheck of the year to implement the new withholding amounts. Additionally, employees should be aware of the annual tax filing deadline, which is usually April 15, to ensure they are prepared for their tax obligations.

Quick guide on how to complete for 2019 you expect a refund of all

Prepare Form effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly replacement for conventional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Form on any device using airSlate SignNow Android or iOS applications and streamline any document-related process today.

The simplest way to modify and eSign Form with ease

- Find Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to preserve your changes.

- Choose how you would like to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate issues related to lost or misplaced documents, tedious form searching, or errors requiring new copies to be printed. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Alter and eSign Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the for 2019 you expect a refund of all

How to generate an electronic signature for your For 2019 You Expect A Refund Of All online

How to generate an electronic signature for the For 2019 You Expect A Refund Of All in Chrome

How to create an electronic signature for signing the For 2019 You Expect A Refund Of All in Gmail

How to make an eSignature for the For 2019 You Expect A Refund Of All right from your mobile device

How to generate an eSignature for the For 2019 You Expect A Refund Of All on iOS devices

How to make an electronic signature for the For 2019 You Expect A Refund Of All on Android

People also ask

-

What is the 2019 W4 form and why is it important?

The 2019 W4 form is crucial for employees to determine the amount of federal income tax withholding from their paychecks. Completing this form accurately ensures employees pay the right amount of taxes throughout the year, avoiding surprises during tax season.

-

How can airSlate SignNow help me manage my 2019 W4 documents?

airSlate SignNow provides a secure and efficient platform to send, receive, and eSign your 2019 W4 documents. With our easy-to-use interface, you can seamlessly handle the paperwork required for tax withholding without any hassle.

-

Is there a cost associated with using airSlate SignNow for my 2019 W4?

Yes, airSlate SignNow offers various pricing plans to fit your business needs, including options for unlimited document sending and signing. You can choose a plan that best supports your requirement for managing 2019 W4 forms efficiently.

-

What features does airSlate SignNow offer for completing the 2019 W4?

Our platform includes features like automated reminders, document templates, and secure sharing options to simplify the process of completing the 2019 W4. Additionally, you can track your documents in real-time to ensure everything is processed on time.

-

Can I integrate airSlate SignNow with other software for my 2019 W4 forms?

Absolutely! airSlate SignNow easily integrates with various applications, including HR and accounting software. This ensures that your 2019 W4 forms sync seamlessly with your existing workflows and systems.

-

What are the advantages of eSigning my 2019 W4 through airSlate SignNow?

eSigning your 2019 W4 with airSlate SignNow streamlines the document process, making it quicker and more efficient. You also benefit from enhanced security features that protect your sensitive information while ensuring compliance.

-

How does airSlate SignNow ensure the security of my 2019 W4 documents?

At airSlate SignNow, we prioritize the security of your documents. Your 2019 W4 is encrypted during transmission and storage, and we comply with various regulations to keep your data safe from unauthorized access.

Get more for Form

Find out other Form

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document

- Can I eSign Hawaii High Tech Word

- How Can I eSign Hawaii High Tech Form