1120s Form

What is the 1120S?

The 1120S form is a tax return used by S corporations in the United States to report income, deductions, and credits. Unlike traditional corporations, S corporations pass income directly to shareholders, allowing them to avoid double taxation. This form is essential for S corporations as it helps determine the tax obligations of the business and its shareholders. The 1120S must be filed annually with the IRS, and it includes various sections that capture financial data, shareholder information, and specific deductions applicable to S corporations.

Steps to Complete the 1120S

Completing the 1120S form involves several key steps to ensure accurate reporting. First, gather all necessary financial documents, including income statements, balance sheets, and records of expenses. Next, fill out the form by entering the business's income, deductions, and credits. Pay special attention to the shareholder information section, as this is crucial for determining each shareholder's tax obligations. Once completed, review the form for accuracy, ensuring all calculations are correct. Finally, sign and date the form before submission to the IRS.

Filing Deadlines / Important Dates

The deadline for filing the 1120S form is typically the fifteenth day of the third month following the end of the corporation's tax year. For most S corporations operating on a calendar year, this means the form is due by March 15. If additional time is needed, S corporations can file for an extension, allowing up to six months to submit the form. However, it is important to note that any taxes owed must still be paid by the original deadline to avoid penalties.

IRS Guidelines

The IRS provides specific guidelines for completing and filing the 1120S form. These guidelines include instructions on eligibility for S corporation status, the types of income that must be reported, and the deductions that can be claimed. It is essential for S corporations to adhere to these guidelines to ensure compliance and avoid potential audits. Additionally, the IRS updates these guidelines periodically, so staying informed about any changes is crucial for accurate tax reporting.

Required Documents

To complete the 1120S form accurately, several documents are required. These include financial statements such as profit and loss statements, balance sheets, and documentation of all business expenses. Shareholder information, including names, addresses, and ownership percentages, must also be collected. Additionally, any supporting documentation for deductions, such as receipts or invoices, should be organized and ready for review. Having these documents prepared in advance can streamline the completion process and ensure compliance with IRS requirements.

Penalties for Non-Compliance

Failure to file the 1120S form on time or inaccuracies in reporting can lead to significant penalties. The IRS may impose fines for late submissions, which can accumulate over time. Additionally, incorrect reporting can result in audits, further complicating the tax situation for the S corporation. It is crucial for businesses to understand these potential penalties and ensure timely and accurate filing to avoid unnecessary financial burdens.

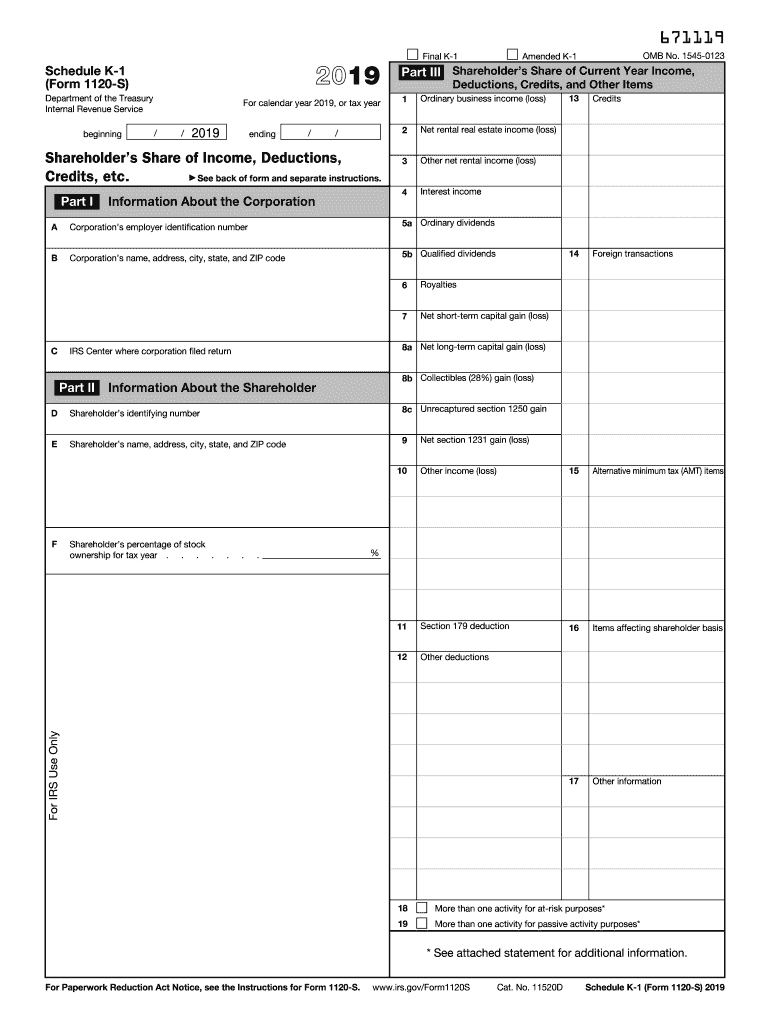

Quick guide on how to complete 2019 schedule k 1 form 1120 s internal revenue service

Complete 1120s smoothly on any device

Digital document management has become increasingly favored by companies and individuals alike. It serves as an ideal sustainable alternative to traditional printed and signed files, allowing you to access the correct form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without any holdups. Handle 1120s on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to edit and electronically sign 1120s effortlessly

- Locate 1120s and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or obscure sensitive information using the tools that airSlate SignNow provides specifically for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you would like to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate issues of lost or misfiled documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from your preferred device. Edit and electronically sign 1120s and ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 schedule k 1 form 1120 s internal revenue service

How to create an eSignature for your 2019 Schedule K 1 Form 1120 S Internal Revenue Service in the online mode

How to create an eSignature for your 2019 Schedule K 1 Form 1120 S Internal Revenue Service in Google Chrome

How to make an electronic signature for putting it on the 2019 Schedule K 1 Form 1120 S Internal Revenue Service in Gmail

How to generate an eSignature for the 2019 Schedule K 1 Form 1120 S Internal Revenue Service from your smart phone

How to generate an electronic signature for the 2019 Schedule K 1 Form 1120 S Internal Revenue Service on iOS devices

How to generate an eSignature for the 2019 Schedule K 1 Form 1120 S Internal Revenue Service on Android

People also ask

-

What is the 2019 Schedule K-1 Form?

The 2019 Schedule K-1 Form is a tax document used to report income, deductions, and credits from partnerships and S corporations to individual partners. Accurate completion of the 2019 Schedule K-1 Form is crucial for tax compliance, ensuring that all tax obligations are met efficiently.

-

How can airSlate SignNow help with the 2019 Schedule K-1 Form?

airSlate SignNow simplifies the signing and submission process of the 2019 Schedule K-1 Form. With our user-friendly eSignature platform, you can easily send, sign, and store your Schedule K-1 documents securely and efficiently.

-

Is there a cost associated with using airSlate SignNow for the 2019 Schedule K-1 Form?

Yes, airSlate SignNow offers a variety of pricing plans to suit different needs, including options for individuals and businesses. Explore our cost-effective solutions tailored to streamline the management of your 2019 Schedule K-1 Form and other documents.

-

Can I integrate airSlate SignNow with other software for managing the 2019 Schedule K-1 Form?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, making it easy to manage your 2019 Schedule K-1 Form along with your financial documents. This integration enhances productivity and ensures your documents are in sync.

-

What are the benefits of using airSlate SignNow for my 2019 Schedule K-1 Form?

Using airSlate SignNow for your 2019 Schedule K-1 Form offers numerous benefits, including fast eSigning, secure document storage, and easy access from any device. Our platform ensures compliance and efficiency in completing tax forms like the 2019 Schedule K-1.

-

Is airSlate SignNow user-friendly for completing the 2019 Schedule K-1 Form?

Yes, airSlate SignNow is designed for ease of use, even for those unfamiliar with eSigning. The intuitive interface guides users through the process of completing their 2019 Schedule K-1 Form quickly and with minimal hassle.

-

What types of documents can I manage besides the 2019 Schedule K-1 Form with airSlate SignNow?

In addition to the 2019 Schedule K-1 Form, airSlate SignNow allows you to manage a wide range of documents including contracts, agreements, and consent forms. This versatility makes it a comprehensive tool for all your eSignature needs.

Get more for 1120s

- 1608157815831576 15781588 15821610 2011 form

- Delegation of service agreement for physician assistant in utah form

- Tc 706 form

- Dopl ap 041 form

- Here vermont gov governor vermont form

- Redetermination form

- Vdacs registration form

- Operating authority certificate application for non emergency medical transportation carriers instructions california form

Find out other 1120s

- Sign Oklahoma Bill of Lading Easy

- Can I Sign Massachusetts Credit Memo

- How Can I Sign Nevada Agreement to Extend Debt Payment

- Sign South Dakota Consumer Credit Application Computer

- Sign Tennessee Agreement to Extend Debt Payment Free

- Sign Kentucky Outsourcing Services Contract Simple

- Sign Oklahoma Outsourcing Services Contract Fast

- How Can I Sign Rhode Island Outsourcing Services Contract

- Sign Vermont Outsourcing Services Contract Simple

- Sign Iowa Interview Non-Disclosure (NDA) Secure

- Sign Arkansas Resignation Letter Simple

- Sign California Resignation Letter Simple

- Sign Florida Leave of Absence Agreement Online

- Sign Florida Resignation Letter Easy

- Sign Maine Leave of Absence Agreement Safe

- Sign Massachusetts Leave of Absence Agreement Simple

- Sign Connecticut Acknowledgement of Resignation Fast

- How To Sign Massachusetts Resignation Letter

- Sign New Mexico Resignation Letter Now

- How Do I Sign Oklahoma Junior Employment Offer Letter