Delaware Individual Resident Income Tax Return 2023-2026

What is the Delaware Individual Resident Income Tax Return

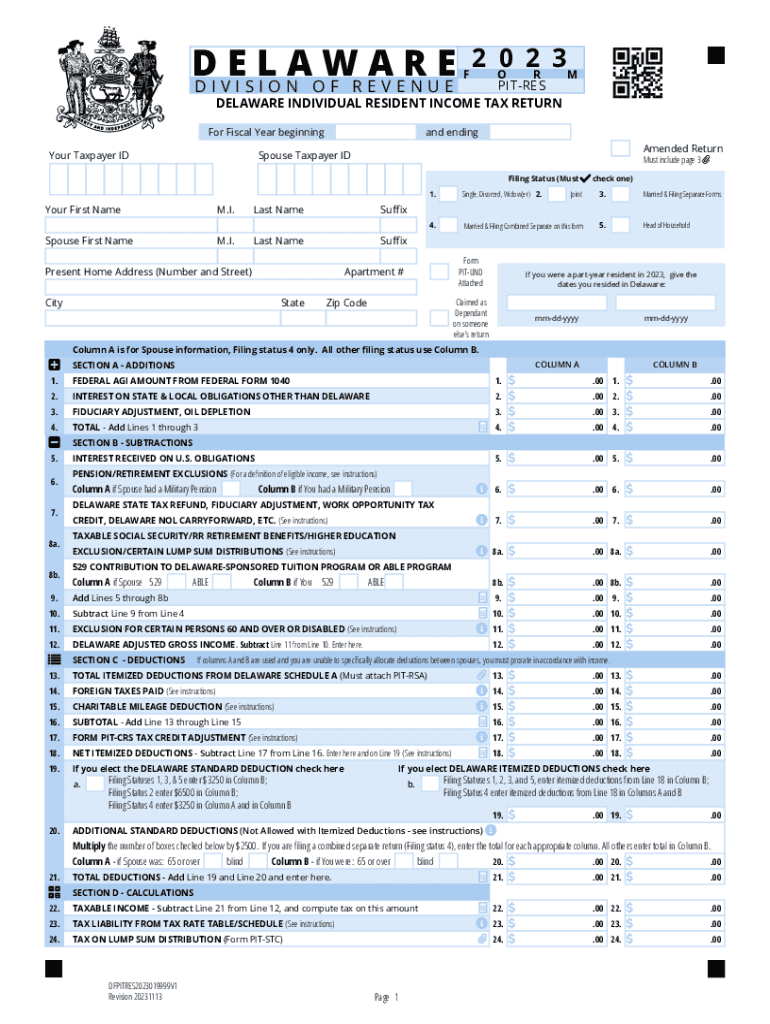

The Delaware Individual Resident Income Tax Return is a tax form used by residents of Delaware to report their income and calculate their state tax liability. This form is essential for individuals who earn income within the state, as it helps ensure compliance with Delaware tax laws. The return includes various sections where taxpayers must provide information about their income sources, deductions, and credits applicable to their situation.

Steps to complete the Delaware Individual Resident Income Tax Return

Completing the Delaware Individual Resident Income Tax Return involves several key steps:

- Gather necessary documentation, including W-2 forms, 1099s, and other income statements.

- Determine your filing status, which can affect your tax rate and deductions.

- Fill out the form by entering your personal information, income details, and any applicable deductions or credits.

- Review the completed form for accuracy and ensure all required information is included.

- Submit the form by the designated deadline, either electronically or by mail.

Required Documents

To accurately complete the Delaware Individual Resident Income Tax Return, taxpayers should prepare the following documents:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Records of other income, such as interest or dividends

- Documentation for deductions, including receipts for business expenses, medical expenses, and charitable contributions

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the Delaware Individual Resident Income Tax Return. Typically, the deadline aligns with the federal tax filing deadline, which is April 15. However, if this date falls on a weekend or holiday, the deadline may be adjusted. Taxpayers should also be aware of any extensions that may apply, as well as deadlines for estimated tax payments if applicable.

Form Submission Methods

The Delaware Individual Resident Income Tax Return can be submitted through various methods:

- Online: Taxpayers can file electronically through approved e-filing services.

- Mail: Completed forms can be printed and sent to the appropriate state tax office address.

- In-Person: Taxpayers may also choose to submit their forms in person at designated state tax offices.

Penalties for Non-Compliance

Failure to file the Delaware Individual Resident Income Tax Return or pay any taxes owed can result in penalties. These may include:

- Late filing penalties, which can accumulate over time.

- Interest on unpaid taxes, which is charged from the due date until the tax is paid.

- Potential legal actions for severe cases of tax evasion or fraud.

Quick guide on how to complete delaware individual resident income tax return

Prepare Delaware Individual Resident Income Tax Return seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents quickly without delays. Manage Delaware Individual Resident Income Tax Return on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to edit and eSign Delaware Individual Resident Income Tax Return effortlessly

- Search for Delaware Individual Resident Income Tax Return and click Get Form to begin.

- Use the tools we offer to complete your form.

- Highlight important sections of your documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Verify the information and click the Done button to save your modifications.

- Choose how you would like to share your form, either via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign Delaware Individual Resident Income Tax Return and ensure exceptional communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct delaware individual resident income tax return

Create this form in 5 minutes!

How to create an eSignature for the delaware individual resident income tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Delaware Individual Resident Income Tax Return?

A Delaware Individual Resident Income Tax Return is a form that residents of Delaware must file to report their income and calculate their state tax liability. This return is essential for ensuring compliance with state tax laws and can affect your overall tax obligations. Understanding this process is crucial for residents to avoid penalties and ensure accurate tax reporting.

-

How can airSlate SignNow help with filing my Delaware Individual Resident Income Tax Return?

airSlate SignNow provides an easy-to-use platform for eSigning and sending documents, including your Delaware Individual Resident Income Tax Return. With our solution, you can securely sign and share your tax documents with tax professionals or state agencies. This streamlines the filing process and ensures that your return is submitted on time.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are beneficial for managing your Delaware Individual Resident Income Tax Return. These features help you organize your tax documents efficiently and ensure that all necessary signatures are obtained. Additionally, our platform allows for easy collaboration with tax advisors.

-

Is airSlate SignNow cost-effective for filing tax returns?

Yes, airSlate SignNow is a cost-effective solution for managing your Delaware Individual Resident Income Tax Return. Our pricing plans are designed to fit various budgets, making it accessible for individuals and businesses alike. By using our platform, you can save time and reduce the costs associated with traditional document handling.

-

Can I integrate airSlate SignNow with other tax software?

Absolutely! airSlate SignNow can be integrated with various tax software solutions to enhance your experience when filing your Delaware Individual Resident Income Tax Return. This integration allows for seamless data transfer and ensures that your documents are easily accessible. You can streamline your workflow and improve efficiency by connecting our platform with your preferred tax tools.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for your Delaware Individual Resident Income Tax Return offers numerous benefits, including enhanced security, ease of use, and quick turnaround times. Our platform ensures that your sensitive tax information is protected while allowing you to manage documents from anywhere. This flexibility and security make it an ideal choice for tax-related document management.

-

How does airSlate SignNow ensure the security of my tax documents?

airSlate SignNow prioritizes the security of your documents, including your Delaware Individual Resident Income Tax Return, by employing advanced encryption and secure storage solutions. We comply with industry standards to protect your sensitive information from unauthorized access. You can trust that your tax documents are safe while using our platform.

Get more for Delaware Individual Resident Income Tax Return

- Wage agreement 497323777 form

- Interrogatories to plaintiff for motor vehicle occurrence oregon form

- Interrogatories to defendant for motor vehicle accident oregon form

- Llc notices resolutions and other operations forms package oregon

- Worker request for reconsideration spanish oregon form

- Worker request for reconsideration oregon form

- Insurer request for reconsideration oregon form

- Oregon motion form

Find out other Delaware Individual Resident Income Tax Return

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed