Apply for an Extension of Time to File an Income Tax Return 2019

What is the Apply For An Extension Of Time To File An Income Tax Return

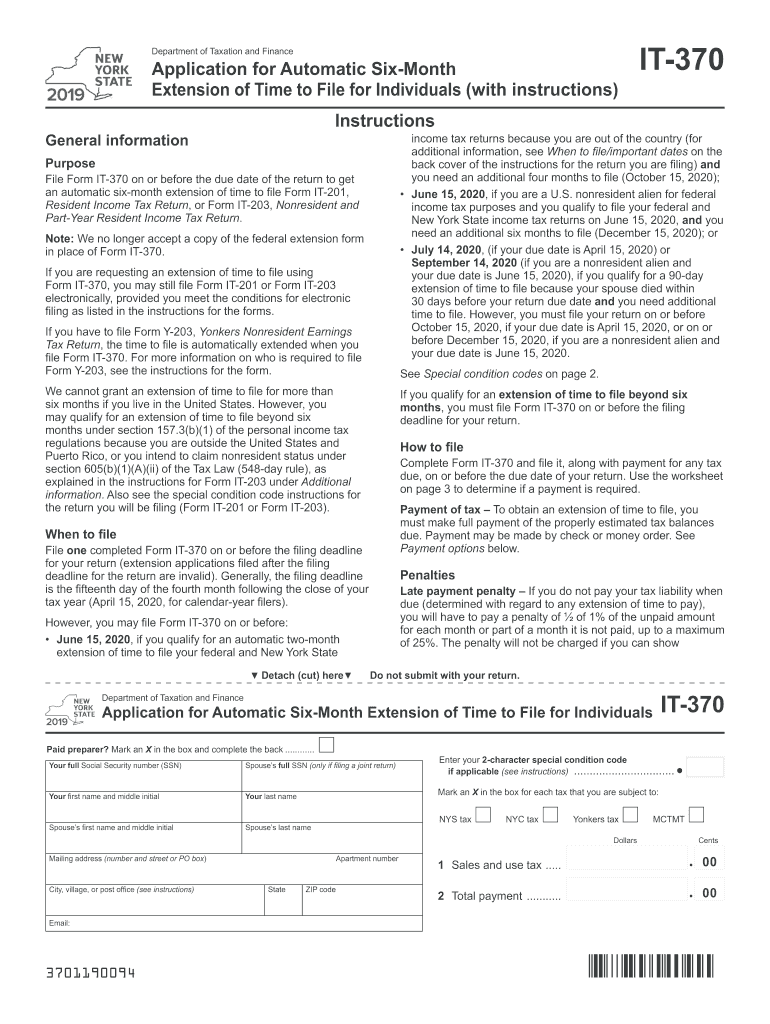

The Apply For An Extension Of Time To File An Income Tax Return, specifically the NY State Form IT-370, allows taxpayers in New York to request additional time to file their state income tax returns. This extension provides an additional six months, moving the filing deadline from April fifteenth to October fifteenth. However, it is important to note that this extension is solely for filing the return; any taxes owed must still be paid by the original due date to avoid penalties and interest.

Steps to complete the Apply For An Extension Of Time To File An Income Tax Return

Completing the NY State Form IT-370 involves several key steps:

- Gather necessary information, including your Social Security number, estimated tax liability, and any payments made.

- Fill out the form accurately, ensuring all required fields are completed.

- Submit the form electronically through an approved e-filing service or print and mail it to the appropriate address provided by the New York State Department of Taxation and Finance.

- Keep a copy of the submitted form for your records.

Legal use of the Apply For An Extension Of Time To File An Income Tax Return

The NY State Form IT-370 is legally recognized for extending the time to file your income tax return. To ensure compliance with state laws, it is essential to submit the form by the original filing deadline. This form is governed by New York State tax regulations, which stipulate that the extension does not extend the time to pay any taxes due. Failure to adhere to these regulations can result in penalties.

Filing Deadlines / Important Dates

For the NY State Form IT-370, the primary deadline is April fifteenth. This is when taxpayers must submit the form to obtain the six-month extension. The final deadline for filing the actual tax return, after an extension is granted, is October fifteenth. It is crucial to remember that any taxes owed must be paid by the original deadline to avoid incurring interest or penalties.

Required Documents

To complete the NY State Form IT-370, you will need several documents:

- Your previous year’s tax return for reference.

- Income statements, such as W-2s or 1099s, to estimate your current year’s tax liability.

- Any records of tax payments made throughout the year.

Eligibility Criteria

Eligibility for using the NY State Form IT-370 generally includes any individual or entity required to file a New York State income tax return. This includes residents, non-residents, and part-year residents. However, those who are not required to file a return for the tax year are not eligible for an extension. It is important to assess your filing status and tax situation before applying for the extension.

Quick guide on how to complete apply for an extension of time to file an income tax return

Effortlessly prepare Apply For An Extension Of Time To File An Income Tax Return on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the resources you need to create, alter, and eSign your documents swiftly without delays. Manage Apply For An Extension Of Time To File An Income Tax Return on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-based procedure today.

The easiest method to modify and eSign Apply For An Extension Of Time To File An Income Tax Return without breaking a sweat

- Obtain Apply For An Extension Of Time To File An Income Tax Return and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Mark important parts of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and then click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device of your choosing. Edit and eSign Apply For An Extension Of Time To File An Income Tax Return and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct apply for an extension of time to file an income tax return

Create this form in 5 minutes!

How to create an eSignature for the apply for an extension of time to file an income tax return

The way to make an eSignature for your PDF in the online mode

The way to make an eSignature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The best way to make an electronic signature from your smart phone

The way to make an electronic signature for a PDF on iOS devices

The best way to make an electronic signature for a PDF file on Android OS

People also ask

-

What is the NY State Form IT 370, and how can SignNow help with it?

The NY State Form IT 370 is a request for an extension of time to file your New York State income tax return. With airSlate SignNow, you can easily fill out, sign, and send this form electronically. Our platform ensures that you can complete the IT 370 efficiently and securely.

-

How much does airSlate SignNow cost for filing the NY State Form IT 370?

airSlate SignNow offers various pricing plans to cater to different business needs. By utilizing our platform, you can file your NY State Form IT 370 at an affordable rate, saving both time and resources. Check our pricing page for more details on subscription options.

-

What features does SignNow offer for managing the NY State Form IT 370?

SignNow provides features such as electronic signatures, document templates, and cloud storage specifically for forms like the NY State Form IT 370. These tools facilitate a straightforward and efficient filing process. With our platform, you can track document status and collaborate seamlessly with others.

-

Can I integrate airSlate SignNow with my existing accounting software for the NY State Form IT 370?

Yes, airSlate SignNow supports integrations with various accounting software platforms. This means you can easily manage your NY State Form IT 370 alongside your financial documents. Integrating helps improve workflow efficiency by keeping all related documentation in one place.

-

Is it safe to submit the NY State Form IT 370 using airSlate SignNow?

Absolutely! airSlate SignNow uses advanced security measures, including encryption, to protect your sensitive data while submitting the NY State Form IT 370. We prioritize your privacy and ensure that your documents are secure throughout the signing process.

-

What benefits does airSlate SignNow provide for small businesses filing the NY State Form IT 370?

For small businesses, airSlate SignNow offers a cost-effective solution to manage the NY State Form IT 370 efficiently. Our platform streamlines the filing process, reducing the time spent on document preparation and ensuring compliance. Additionally, electronic signatures reduce paper waste and enhance productivity.

-

How can I access customer support for questions related to the NY State Form IT 370?

airSlate SignNow provides dedicated customer support to assist with any inquiries regarding the NY State Form IT 370. You can signNow out via email, live chat, or phone during business hours. Our team is ready to help you navigate any challenges you may encounter.

Get more for Apply For An Extension Of Time To File An Income Tax Return

Find out other Apply For An Extension Of Time To File An Income Tax Return

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form