Hi 144 Form 2018

What is the Hi 144 Form

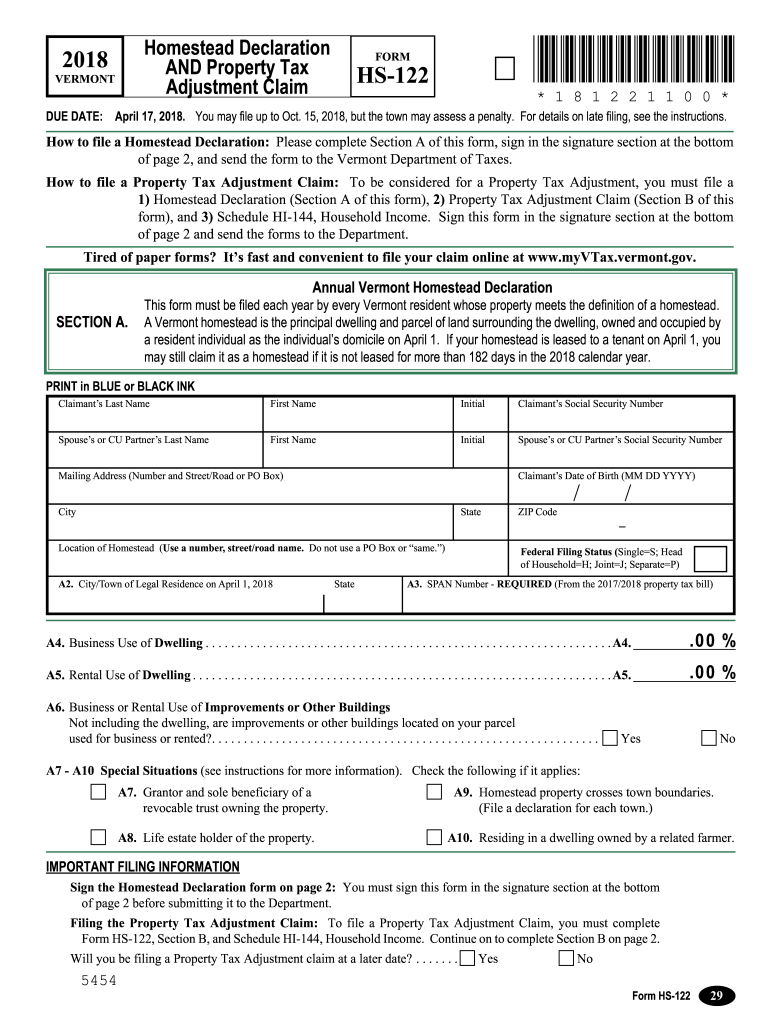

The Hi 144 Form is a specific document used in the United States for reporting certain tax-related information. It is essential for individuals and businesses to accurately complete this form to comply with federal regulations. The form typically includes sections for personal identification, income reporting, and deductions, ensuring that all necessary information is captured for tax assessment purposes. Understanding the purpose of the Hi 144 Form is crucial for effective tax management and compliance.

How to use the Hi 144 Form

Using the Hi 144 Form involves several key steps. First, gather all necessary documentation, such as income statements and identification numbers. Next, access the form, which can be filled out online or printed for manual completion. Carefully follow the instructions provided on the form to ensure all fields are completed accurately. After filling out the form, review it for any errors before submission. This careful approach helps to avoid delays or complications with the tax filing process.

Steps to complete the Hi 144 Form

Completing the Hi 144 Form can be streamlined by following these steps:

- Gather all required documents, including income records and personal information.

- Access the Hi 144 Form through a reliable platform, such as signNow.

- Fill in the form fields accurately, ensuring that all information is complete.

- Review the completed form for any mistakes or missing information.

- Submit the form electronically or print it out for mailing, depending on your preference.

Legal use of the Hi 144 Form

The Hi 144 Form must be used in accordance with IRS guidelines to ensure its legal validity. This includes adhering to specific filing deadlines and ensuring that all information provided is truthful and accurate. Misuse of the form, such as providing false information or failing to submit it on time, can lead to penalties and legal repercussions. Therefore, it is important to understand the legal implications of using the Hi 144 Form and to follow all regulations closely.

Filing Deadlines / Important Dates

Filing deadlines for the Hi 144 Form are critical to avoid penalties. Typically, forms must be submitted by April fifteenth of each year for the previous tax year. However, extensions may be available under certain circumstances. It is important to stay informed about any changes to deadlines, especially during tax season, to ensure timely submission and compliance with IRS requirements.

Form Submission Methods

The Hi 144 Form can be submitted through various methods, including:

- Online submission via secure eSignature platforms like signNow.

- Mailing a printed version of the form to the appropriate IRS address.

- In-person submission at designated IRS offices, if necessary.

Choosing the right submission method can enhance the efficiency of the filing process and ensure that the form is received on time.

Eligibility Criteria

To complete the Hi 144 Form, individuals must meet specific eligibility criteria. Generally, this includes being a U.S. citizen or resident alien and having a valid Social Security number. Additionally, the form may be applicable to individuals with certain income levels or specific tax situations. Understanding these criteria is essential to determine if the Hi 144 Form is the correct document for your tax reporting needs.

Quick guide on how to complete hi 144 2018 form

Your assistance manual on how to prepare your Hi 144 Form

If you’re wondering how to create and submit your Hi 144 Form, here are a few brief instructions on how to simplify tax processing signNowly.

To begin, you simply need to set up your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is an extremely user-friendly and robust document solution that enables you to modify, draft, and finalize your income tax documents effortlessly. With its editor, you can alternate between text, check boxes, and eSignatures and revert to change responses when necessary. Streamline your tax management with advanced PDF editing, eSigning, and user-friendly sharing.

Follow the instructions below to complete your Hi 144 Form in just a few minutes:

- Create your account and start working on PDFs within minutes.

- Utilize our catalog to locate any IRS tax form; explore various versions and schedules.

- Click Retrieve form to open your Hi 144 Form in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Utilize the Sign Tool to append your legally-binding eSignature (if required).

- Examine your document and rectify any mistakes.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Please be aware that filing on paper may heighten return errors and prolong reimbursements. Naturally, before e-filing your taxes, verify the IRS website for submission regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct hi 144 2018 form

FAQs

-

How do I fill out the IIFT 2018 application form?

Hi!IIFT MBA (IB) Application Form 2018 – The last date to submit the Application Form of IIFT 2018 has been extended. As per the initial notice, the last date to submit the application form was September 08, 2017. However, now the candidates may submit it untill September 15, 2017. The exam date for IIFT 2018 has also been shifted to December 03, 2017. The candidates will only be issued the admit card, if they will submit IIFT application form and fee in the prescribed format. Before filling the IIFT application form, the candidates must check the eligibility criteria because ineligible candidates will not be granted admission. The application fee for candidates is Rs. 1550, however, the candidates belonging to SC/STPWD category only need to pay Rs. 775. Check procedure to submit IIFT Application Form 2018, fee details and more information from the article below.Latest – Last date to submit IIFT application form extended until September 15, 2017.IIFT 2018 Application FormThe application form of IIFT MBA 2018 has only be released online, on http://tedu.iift.ac.in. The candidates must submit it before the laps of the deadline, which can be checked from the table below.Application form released onJuly 25, 2017Last date to submit Application form(for national candidates)September 08, 2017 September 15, 2017Last date to submit the application form(by Foreign National and NRI)February 15, 2018IIFT MBA IB entrance exam will be held onNovember 26, 2017 December 03, 2017IIFT 2018 Application FeeThe candidates should take note of the application fee before submitting the application form. The fee amount is as given below and along with it, the medium to submit the fee are also mentioned.Fee amount for IIFT 2018 Application Form is as given below:General/OBC candidatesRs 1550SC/ST/PH candidatesRs 775Foreign National/NRI/Children of NRI candidatesUS$ 80 (INR Rs. 4500)The medium to submit the application fee of IIFT 2018 is as below:Credit CardsDebit Cards (VISA/Master)Demand Draft (DD)Candidates who will submit the application fee via Demand Draft will be required to submit a DD, in favour of Indian Institute of Foreign Trade, payable at New Delhi.Procedure to Submit IIFT MBA Application Form 2018Thank you & Have a nice day! :)

-

How do I fill out the CAT 2018 application form?

The procedure for filling up the CAT Application form is very simple. I’ll try to explain it to you in simple words.I have provided a link below for CAT registration.See, first you have to register, then fill in details in the application form, upload images, pay the registration fee and finally submit the form.Now, to register online, you have to enter details such as your name, date of birth, email id, mobile number and choose your country. You must and must enter your own personal email id and mobile number, as you will receive latest updates on CAT exam through email and SMS only.Submit the registration details, after which an OTP will be sent to the registered email id and mobile number.Once the registration part is over, you will get the Login credentials.Next, you need to fill in your personal details, academic details, work experience details, etc.Upload scanned images of your photograph, and signature as per the specifications.Pay the registration fee, which is Rs. 950 for SC/ST/PWD category candidates and Rs. 1900 for all other categories by online mode (Credit Card/ Debit Card/ Net Banking).Final step - Submit the form and do not forget to take the print out of the application form. if not print out then atleast save it somewhere.CAT 2018 Registration (Started): Date, Fees, CAT 2018 Online Application iimcat.ac.in

-

How do I fill out the NTSE form 2017- 2018 Jharkhand online?

You cannot gove NTSE online or at your own level you have to belong to a school which is conducting ntse. Then download the form online from the page of ntse, fill it and submit it to your school along with fee. If your school is not conducting ntse, sorry to say but you cannot give ntse. It can only be given through, no institutions are allowed to conduct thos exam.

-

How do I fill out the NEET application form for 2018?

For the academic session of 2018-2019, NEET 2018 will be conducted on 6th May 2018.The application form for the same had been released on 8th February 2018.Steps to Fill NEET 2018 Application Form:Registration: Register yourself on the official website before filling the application form.Filling Up The Form: Fill up the application form by providing personal information (like name, father’s name, address, etc.), academic details.Uploading The Images: Upload the scanned images of their photograph, signature and right-hand index finger impression.Payment of The Application Fees: Pay the application fees for NEET 2018 in both online and offline mode. You can pay through credit/debit card/net banking or through e-challan.For details, visit this site: NEET 2018 Application Form Released - Apply Now!

-

How do I fill out the JEE Main 2018 application form?

How to fill application form for JEE main 2018?Following is the Step By Step procedure for filling of Application Form.Before filling the form you must check the eligibility criteria for application.First of all, go to the official website of CBSE Joint Entrance Exam Main 2018. After that, click on the "Apply for JEE Main 2018" link.Then there will be some important guidelines on the page. Applicants must read those guidelines carefully before going further.In the next step, click on "Proceed to Apply Online" link.After that, fill all the asked details from you for authentication purpose and click Submit.Application Form is now visible to you.Fill all your personal and academic information.Then, Verify Your Full Details before you submit the application form.After that, the applicants have to Upload Scanned Images of their passport sized photograph and their signature.Then, click Browse and select the images which you have scanned for uploading.After Uploading the scanned images of your their passport sized photograph and their signature.At last, pay the application fee either through online transaction or offline mode according to your convenience.After submitting the fee payment, again go to the login page and enter your allotted Application Number and Password.Then, Print Acknowledgement Page.Besides this, the candidates must keep this hard copy of the application confirmation receipt safe for future reference.

Create this form in 5 minutes!

How to create an eSignature for the hi 144 2018 form

How to create an eSignature for your Hi 144 2018 Form in the online mode

How to generate an eSignature for your Hi 144 2018 Form in Chrome

How to make an electronic signature for putting it on the Hi 144 2018 Form in Gmail

How to create an electronic signature for the Hi 144 2018 Form from your mobile device

How to create an eSignature for the Hi 144 2018 Form on iOS

How to generate an eSignature for the Hi 144 2018 Form on Android devices

People also ask

-

What is the Hi 144 Form and how does it work with airSlate SignNow?

The Hi 144 Form is a crucial document used for various business processes, and with airSlate SignNow, you can easily create, send, and eSign this form. Our platform streamlines the signing process, ensuring that your Hi 144 Form is completed efficiently and securely. With intuitive features, you can manage your documents and track their status in real-time.

-

Is airSlate SignNow suitable for handling the Hi 144 Form?

Absolutely! airSlate SignNow is designed to handle various forms, including the Hi 144 Form, efficiently. Our user-friendly interface allows users to customize the Hi 144 Form to meet their specific needs, ensuring a seamless signing experience for all parties involved.

-

What are the pricing options for using airSlate SignNow with the Hi 144 Form?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Whether you need basic eSigning capabilities for the Hi 144 Form or advanced features for larger teams, we have a plan that fits your budget and requirements. Explore our pricing page to find the best option for your business.

-

Can I integrate airSlate SignNow with other applications for the Hi 144 Form?

Yes, airSlate SignNow offers integrations with various applications to enhance your workflow when handling the Hi 144 Form. You can connect our platform with popular tools like Google Drive, Salesforce, and Dropbox, ensuring that your document management processes are streamlined and efficient.

-

What security measures does airSlate SignNow implement for the Hi 144 Form?

Security is a top priority at airSlate SignNow. When using our platform for the Hi 144 Form, you can rest assured that your documents are protected with industry-standard encryption and authentication protocols. We ensure that your data remains confidential and secure throughout the signing process.

-

How can airSlate SignNow improve my workflow with the Hi 144 Form?

By using airSlate SignNow for the Hi 144 Form, you can signNowly improve your workflow by reducing the time spent on manual processing. Our automated features allow for quick document creation, easy sharing, and instant eSigning, helping you streamline your business operations and increase productivity.

-

What are the benefits of using airSlate SignNow for the Hi 144 Form?

Using airSlate SignNow for the Hi 144 Form offers numerous benefits, including enhanced efficiency, cost-effectiveness, and a user-friendly interface. Our platform simplifies the eSigning process, allowing you to manage your documents faster and with greater accuracy, ultimately saving you time and resources.

Get more for Hi 144 Form

- Form sev fee

- Prha housing application form

- Wood county hospital financial assistance form

- Application for marriage license pagkuha na pahintulot form

- Instructions for form 540 personal income tax booklet instructions for form 540 personal income tax booklet

- Directdeposit authorization agreement form

- Duvcw membership app page23 duvcw form

- Commercial hvac service contract template form

Find out other Hi 144 Form

- Sign Texas Insurance Business Plan Template Later

- Sign Ohio Legal Last Will And Testament Mobile

- Sign Ohio Legal LLC Operating Agreement Mobile

- Sign Oklahoma Legal Cease And Desist Letter Fast

- Sign Oregon Legal LLC Operating Agreement Computer

- Sign Pennsylvania Legal Moving Checklist Easy

- Sign Pennsylvania Legal Affidavit Of Heirship Computer

- Sign Connecticut Life Sciences Rental Lease Agreement Online

- Sign Connecticut Life Sciences Affidavit Of Heirship Easy

- Sign Tennessee Legal LLC Operating Agreement Online

- How To Sign Tennessee Legal Cease And Desist Letter

- How Do I Sign Tennessee Legal Separation Agreement

- Sign Virginia Insurance Memorandum Of Understanding Easy

- Sign Utah Legal Living Will Easy

- Sign Virginia Legal Last Will And Testament Mobile

- How To Sign Vermont Legal Executive Summary Template

- How To Sign Vermont Legal POA

- How Do I Sign Hawaii Life Sciences Business Plan Template

- Sign Life Sciences PPT Idaho Online

- Sign Life Sciences PPT Idaho Later