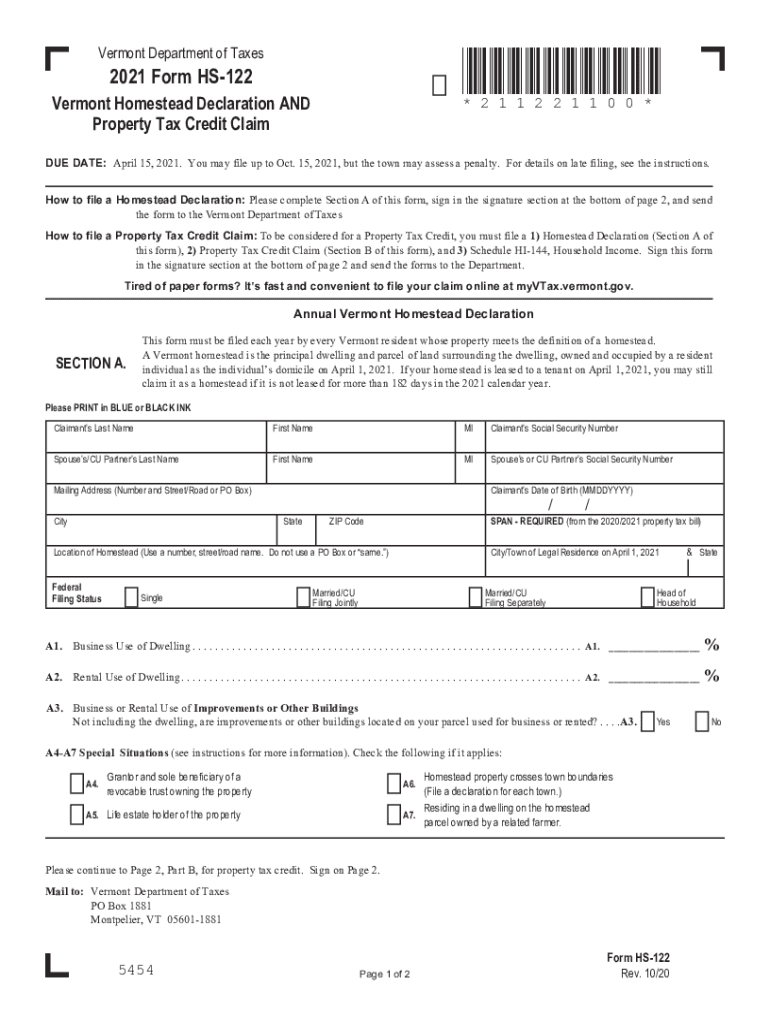

Filing a Vermont Property Tax Credit Claim on a Homestead 2021

Understanding the Vermont Property Tax Credit Claim on a Homestead

The Vermont Property Tax Credit Claim on a Homestead, commonly referred to as the Vermont form HI 144, is designed to assist homeowners in claiming a property tax credit based on their income and property value. This form is essential for those who meet specific eligibility criteria, allowing them to reduce their property tax burden. By filing this claim, residents can receive financial relief, making homeownership more affordable in Vermont.

Steps to Complete the Vermont Property Tax Credit Claim on a Homestead

Completing the Vermont form HI 144 involves several key steps to ensure accuracy and compliance. Begin by gathering necessary documents, including proof of income and property tax information. Next, fill out the form with accurate details regarding your property and income. It is crucial to double-check all entries for correctness. Once completed, submit the form by the designated deadline to the appropriate state authority, ensuring you retain copies for your records.

Eligibility Criteria for the Vermont Property Tax Credit Claim on a Homestead

To qualify for the Vermont form HI 144, applicants must meet specific eligibility criteria. Generally, homeowners must occupy the property as their primary residence and have a total household income below a certain threshold. Additionally, applicants must provide proof of property ownership and tax payments. Understanding these requirements is vital for ensuring that your claim is valid and accepted.

Required Documents for Filing the Vermont Property Tax Credit Claim

When preparing to file the Vermont form HI 144, several documents are necessary to support your claim. These typically include:

- Proof of income, such as tax returns or pay stubs.

- Documentation of property ownership, like a deed or mortgage statement.

- Records of property tax payments made during the tax year.

Having these documents ready will streamline the filing process and help avoid delays in processing your claim.

Form Submission Methods for the Vermont Property Tax Credit Claim

The Vermont form HI 144 can be submitted through various methods, providing flexibility for applicants. You may choose to file online, which is often the quickest option. Alternatively, you can submit the form by mail, ensuring it is sent to the correct state office. In-person submissions may also be available at designated locations. Regardless of the method chosen, ensure that you keep a copy of your submission for your records.

Key Elements of the Vermont Property Tax Credit Claim on a Homestead

The Vermont form HI 144 includes several key elements that applicants must understand. These elements encompass personal information, property details, and income calculations. Each section of the form is designed to gather pertinent information that will determine eligibility for the property tax credit. Familiarizing yourself with these components will aid in accurately completing the form and maximizing your potential benefits.

Quick guide on how to complete filing a vermont property tax credit claim on a homestead

Complete Filing A Vermont Property Tax Credit Claim On A Homestead effortlessly on any device

Digital document management has gained immense popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without any hold-ups. Manage Filing A Vermont Property Tax Credit Claim On A Homestead on any device using airSlate SignNow’s Android or iOS applications and enhance any document-centric process today.

How to modify and electronically sign Filing A Vermont Property Tax Credit Claim On A Homestead with ease

- Locate Filing A Vermont Property Tax Credit Claim On A Homestead and click on Get Form to begin.

- Utilize the tools available to finalize your document.

- Emphasize pertinent sections of your documents or obscure sensitive details using tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, time-consuming form searches, or errors requiring the printing of new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Filing A Vermont Property Tax Credit Claim On A Homestead and ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct filing a vermont property tax credit claim on a homestead

Create this form in 5 minutes!

How to create an eSignature for the filing a vermont property tax credit claim on a homestead

The way to create an electronic signature for a PDF document in the online mode

The way to create an electronic signature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

How to make an eSignature from your mobile device

The best way to create an eSignature for a PDF document on iOS devices

How to make an eSignature for a PDF file on Android devices

People also ask

-

What is hi 144 in relation to airSlate SignNow?

Hi 144 refers to the unique identifier for our customizable eSigning solutions with airSlate SignNow. This feature allows businesses to streamline their document workflows effectively while ensuring secure electronic signatures. By using hi 144, you can enhance your document management processes.

-

How much does airSlate SignNow cost for using hi 144 features?

The pricing for airSlate SignNow's hi 144 features varies based on your subscription plan. We offer flexible pricing tiers to accommodate all business sizes, ensuring you get the best value for your investment. Whether you are a small business or a large enterprise, there is a suitable plan available.

-

What are the main features of airSlate SignNow's hi 144?

The hi 144 features include customizable document templates, advanced eSigning capabilities, and seamless integration with popular business applications. These features are designed to enhance user experience and streamline the signing process. With airSlate SignNow, you can manage all your signing needs efficiently.

-

What benefits does airSlate SignNow offer with hi 144?

Using hi 144 with airSlate SignNow provides numerous benefits, including improved efficiency and faster turnaround times for document signing. Businesses can reduce paper usage and enhance their sustainability efforts while ensuring compliance. The intuitive interface also makes it easy for anyone to use.

-

Can I integrate hi 144 functionality with other tools?

Absolutely! The airSlate SignNow platform offers seamless integrations with a variety of business tools and applications, enhancing the functionality of hi 144. Whether you're using CRM systems, cloud storage services, or project management tools, airSlate SignNow can easily fit into your existing workflows.

-

Is airSlate SignNow's hi 144 solution secure?

Yes, security is a top priority with airSlate SignNow's hi 144 solution. We employ advanced encryption and compliance measures to ensure that all documents remain confidential and secure. This allows businesses to confidently handle sensitive information without compromising data integrity.

-

How does airSlate SignNow help with document tracking using hi 144?

The hi 144 features in airSlate SignNow include robust document tracking capabilities. You can easily monitor the status of your documents, receiving real-time notifications for any updates. This transparency ensures that you are always in control of your document workflow.

Get more for Filing A Vermont Property Tax Credit Claim On A Homestead

Find out other Filing A Vermont Property Tax Credit Claim On A Homestead

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online