Form 760ES, Estimated Income Tax Payment Vouchers for Individuals Form 760ES, Estimated Income Tax Payment Vouchers for Individu 2024

Understanding the 760ES Form for Estimated Income Tax Payments

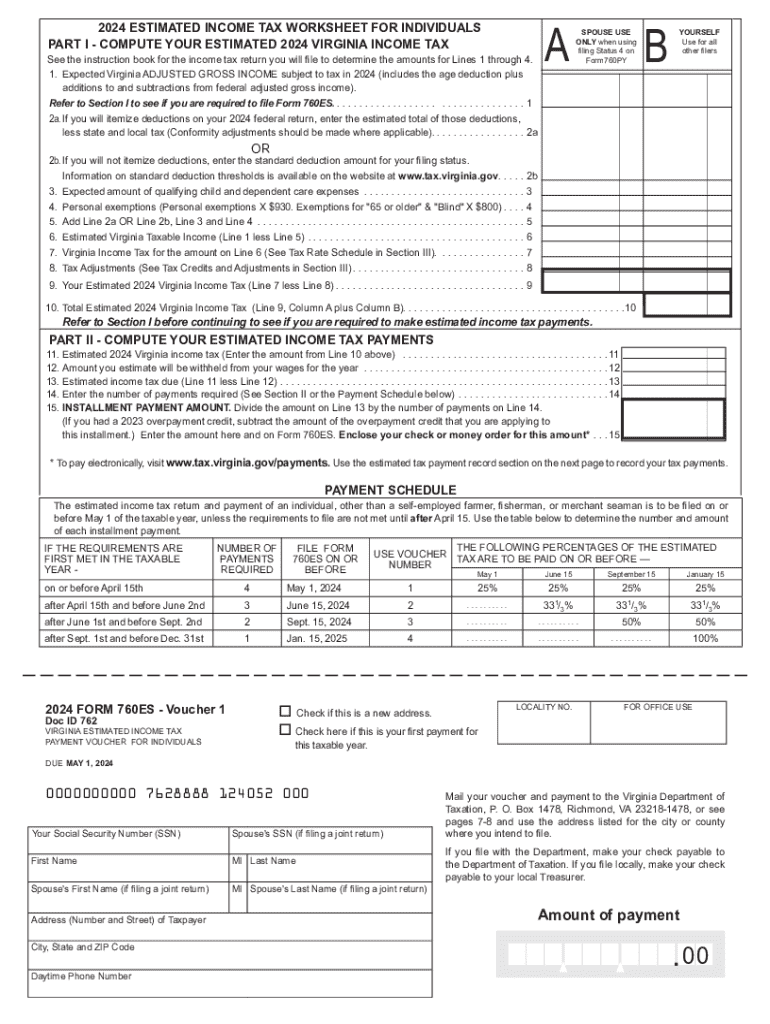

The 760ES form, known as the Estimated Income Tax Payment Vouchers for Individuals, is essential for Virginia taxpayers who need to make estimated tax payments throughout the year. This form is particularly relevant for individuals who expect to owe tax of $1,000 or more when they file their annual return. It helps ensure that taxpayers meet their tax obligations and avoid penalties for underpayment.

How to Obtain the 760ES Form

Taxpayers can easily obtain the 760ES form through several methods. The form is available online on the Virginia Department of Taxation’s website, where users can download and print it. Additionally, physical copies can be requested from local tax offices or by contacting the Virginia Department of Taxation directly. It is advisable to ensure you have the correct version for the current tax year to avoid any issues with filing.

Steps to Complete the 760ES Form

Completing the 760ES form involves several straightforward steps:

- Gather necessary financial information, including your expected income and deductions for the year.

- Calculate your estimated tax liability using the appropriate tax rates.

- Fill out the form with your personal information, including your name, address, and Social Security number.

- Enter the calculated estimated tax amount for each payment period.

- Review the form for accuracy before submission.

Key Elements of the 760ES Form

The 760ES form includes several key elements that taxpayers must be aware of:

- Taxpayer Information: This section requires personal details to identify the taxpayer.

- Payment Amounts: Taxpayers must indicate the estimated payment amounts for each quarter.

- Due Dates: The form specifies deadlines for each estimated payment to avoid penalties.

Legal Use of the 760ES Form

The 760ES form is legally required for individuals who expect to owe a certain amount of tax. Proper use of this form helps taxpayers comply with state tax laws and avoid potential penalties. It is crucial to make timely payments as outlined in the form to ensure compliance with Virginia tax regulations.

Filing Deadlines for the 760ES Form

Taxpayers should be aware of the filing deadlines associated with the 760ES form. Payments are typically due on specific dates throughout the year, often in April, June, September, and January of the following year. Missing these deadlines can result in penalties and interest on the unpaid amounts, making it essential to adhere to the schedule provided on the form.

Create this form in 5 minutes or less

Find and fill out the correct form 760es estimated income tax payment vouchers for individuals form 760es estimated income tax payment vouchers for

Create this form in 5 minutes!

How to create an eSignature for the form 760es estimated income tax payment vouchers for individuals form 760es estimated income tax payment vouchers for

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2011 Virginia form and why is it important?

The 2011 Virginia form is a specific document required for various legal and financial transactions in Virginia. It is essential for ensuring compliance with state regulations and can impact your business operations. Using airSlate SignNow, you can easily fill out and eSign this form, streamlining your workflow.

-

How can airSlate SignNow help me with the 2011 Virginia form?

airSlate SignNow provides a user-friendly platform to complete and eSign the 2011 Virginia form efficiently. Our solution allows you to upload, edit, and send the form securely, ensuring that all necessary information is captured accurately. This saves you time and reduces the risk of errors.

-

Is there a cost associated with using airSlate SignNow for the 2011 Virginia form?

Yes, airSlate SignNow offers various pricing plans tailored to meet your needs. Our plans are cost-effective, allowing you to choose the best option for handling the 2011 Virginia form and other documents. You can start with a free trial to explore our features before committing.

-

What features does airSlate SignNow offer for the 2011 Virginia form?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking for the 2011 Virginia form. These tools enhance your document management process, making it easier to collaborate with others and ensure timely completion of forms.

-

Can I integrate airSlate SignNow with other applications for the 2011 Virginia form?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to manage the 2011 Virginia form alongside your existing tools. This integration enhances productivity and ensures that all your documents are in one place for easy access.

-

What are the benefits of using airSlate SignNow for the 2011 Virginia form?

Using airSlate SignNow for the 2011 Virginia form offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are signed and stored securely, giving you peace of mind while managing important forms.

-

Is airSlate SignNow compliant with legal standards for the 2011 Virginia form?

Yes, airSlate SignNow is fully compliant with legal standards for electronic signatures, making it a reliable choice for the 2011 Virginia form. Our solution adheres to the Electronic Signatures in Global and National Commerce (ESIGN) Act, ensuring that your signed documents are legally binding.

Get more for Form 760ES, Estimated Income Tax Payment Vouchers For Individuals Form 760ES, Estimated Income Tax Payment Vouchers For Individu

- Durga saptashati beej mantra by avdhoot baba pdf form

- Tyvek wristband template microsoft word form

- Wells fargo bank statement pdf 2022 form

- Theory x and theory y questionnaire form

- The mandate operational manual pdf download form

- Welderwelding operator certificate form

- Direct transfer form for registered investments

- Direct transfer form for registered investments 782249198

Find out other Form 760ES, Estimated Income Tax Payment Vouchers For Individuals Form 760ES, Estimated Income Tax Payment Vouchers For Individu

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer