Form 760 Es 2015

What is the Form 760 Es

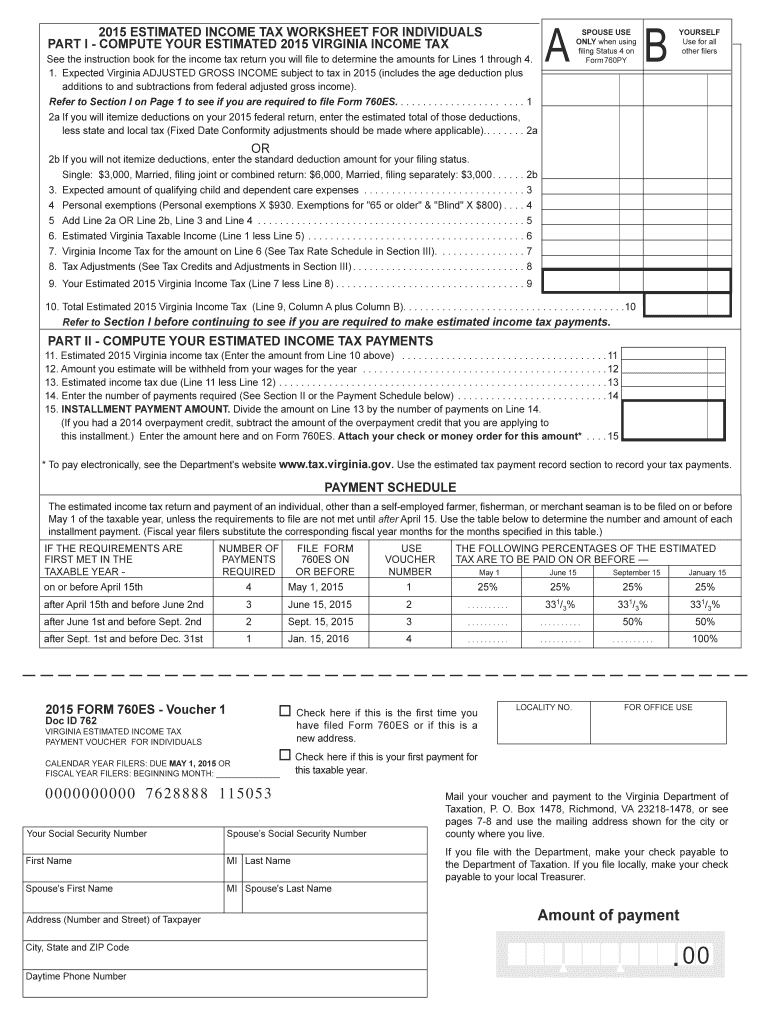

The Form 760 Es is a tax form used by individuals in the United States to make estimated tax payments. This form is particularly relevant for those who expect to owe tax of $1,000 or more when filing their annual tax return. It allows taxpayers to pay their estimated taxes quarterly, ensuring they meet their tax obligations and avoid penalties for underpayment. The form is essential for self-employed individuals, freelancers, and others whose income is not subject to withholding.

How to use the Form 760 Es

Using the Form 760 Es involves several straightforward steps. First, taxpayers need to estimate their total income for the year and calculate the expected tax liability. This includes considering any deductions and credits that may apply. Once the estimated tax is determined, the taxpayer fills out the form, indicating the amount to be paid for each quarter. Payments can be made electronically or by mail, depending on individual preferences and state regulations.

Steps to complete the Form 760 Es

Completing the Form 760 Es requires careful attention to detail. Follow these steps for accurate completion:

- Gather necessary financial documents, including income statements and previous tax returns.

- Estimate your total income and applicable deductions for the year.

- Calculate your expected tax liability based on the estimated income.

- Fill out the Form 760 Es with the calculated amounts for each quarter.

- Review the form for accuracy before submission.

- Submit the form along with the payment by the due dates specified by the IRS.

Legal use of the Form 760 Es

The legal use of the Form 760 Es is governed by IRS regulations, which stipulate that taxpayers must file and pay estimated taxes if they expect to owe a certain amount. Compliance with these regulations is crucial to avoid penalties and interest on unpaid taxes. Using the form correctly ensures that taxpayers fulfill their obligations under U.S. tax law, maintaining good standing with the IRS.

Filing Deadlines / Important Dates

Taxpayers must adhere to specific deadlines when submitting the Form 760 Es. Generally, estimated tax payments are due on the 15th of April, June, September, and January of the following year. It is essential to mark these dates on your calendar to avoid late payments, which can result in penalties. Keeping track of these deadlines helps ensure that you remain compliant with tax regulations.

Required Documents

To accurately complete the Form 760 Es, several documents are necessary. Taxpayers should have their income statements, such as W-2s or 1099s, as well as records of any deductions or credits they plan to claim. Additionally, previous tax returns can provide valuable information for estimating current tax liabilities. Having these documents organized will streamline the completion process.

Quick guide on how to complete form 760 es 2015

Complete Form 760 Es effortlessly on any device

Online document management has become increasingly popular among companies and individuals. It offers a perfect eco-friendly substitute for conventional printed and signed documents, as you can easily find the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Form 760 Es on any device using airSlate SignNow's Android or iOS applications and streamline any document-focused process today.

The simplest way to modify and eSign Form 760 Es with ease

- Obtain Form 760 Es and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant parts of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal authority as a traditional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you want to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of missing or lost documents, tedious form searches, or mistakes that require new document copies to be printed. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Edit and eSign Form 760 Es and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 760 es 2015

Create this form in 5 minutes!

How to create an eSignature for the form 760 es 2015

How to generate an electronic signature for the Form 760 Es 2015 online

How to make an eSignature for your Form 760 Es 2015 in Chrome

How to generate an electronic signature for putting it on the Form 760 Es 2015 in Gmail

How to create an eSignature for the Form 760 Es 2015 right from your mobile device

How to create an eSignature for the Form 760 Es 2015 on iOS devices

How to make an electronic signature for the Form 760 Es 2015 on Android devices

People also ask

-

What is Form 760 Es and how can it benefit my business?

Form 760 Es is a crucial document for taxpayers in Virginia, specifically for those making estimated tax payments. By using airSlate SignNow to manage Form 760 Es, businesses can streamline their tax processes, ensuring that they meet filing deadlines with ease and accuracy.

-

How does airSlate SignNow simplify the process of signing Form 760 Es?

airSlate SignNow simplifies the signing process for Form 760 Es by providing a user-friendly platform that allows users to eSign documents securely and efficiently. With just a few clicks, you can send, sign, and manage your Form 760 Es, reducing the time spent on paperwork.

-

Is airSlate SignNow cost-effective for handling Form 760 Es?

Yes, airSlate SignNow offers a cost-effective solution for managing Form 760 Es. Our pricing plans are designed to accommodate businesses of all sizes, providing flexible options that ensure you only pay for what you need while streamlining your document signing process.

-

Can I integrate airSlate SignNow with other software for managing Form 760 Es?

Absolutely! airSlate SignNow integrates seamlessly with many popular business tools, allowing for efficient management of Form 760 Es alongside your existing workflows. This integration capability enhances productivity by connecting your eSigning process with your preferred applications.

-

What features does airSlate SignNow offer for Form 760 Es?

airSlate SignNow offers a variety of features tailored for Form 760 Es, including customizable templates, real-time tracking, and secure cloud storage. These features help ensure that your documents are handled efficiently and securely throughout the signing process.

-

How secure is airSlate SignNow when signing Form 760 Es?

Security is a top priority at airSlate SignNow, especially when it comes to sensitive documents like Form 760 Es. We use advanced encryption methods and comply with industry standards to ensure that your documents remain confidential and protected during the signing process.

-

Can I use airSlate SignNow on mobile devices for Form 760 Es?

Yes, airSlate SignNow is fully optimized for mobile devices, allowing you to manage and sign Form 760 Es on the go. Whether you’re using a smartphone or tablet, you can access your documents and complete the signing process anytime, anywhere.

Get more for Form 760 Es

- Advanced nurse practitioner application commerce commerce alaska form

- Nassau parking application form

- Consent permanent form

- Online greene county indiana sheriff department application form

- Vietnam visa form filable

- Sunbiz articles of incorporation 2013 form

- Ccc 931 form

- Stanford transcript request form

Find out other Form 760 Es

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy