Virginia Form Tax 2020

What is the Virginia Form Tax

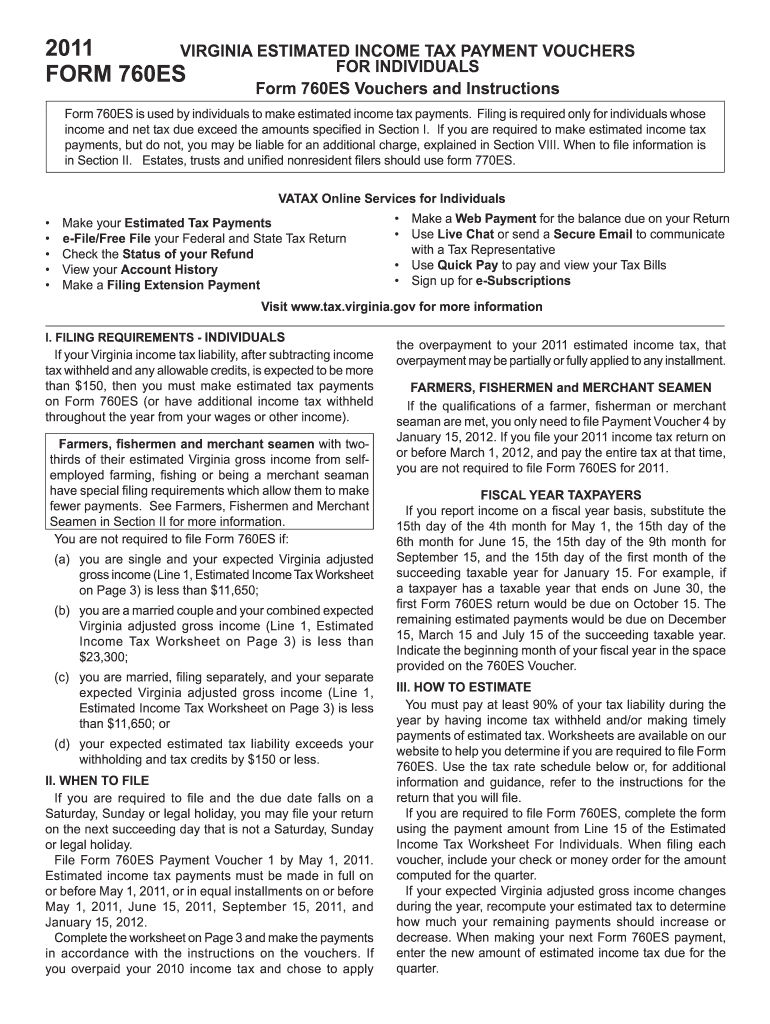

The Virginia Form Tax refers to the official tax forms required by the state of Virginia for individuals and businesses to report their income and calculate their tax liabilities. This form is essential for ensuring compliance with state tax laws and is used to determine the amount of tax owed or the refund due to the taxpayer. The Virginia Form Tax may include various types, such as individual income tax forms, corporate tax forms, and other specific tax-related documents that cater to different taxpayer scenarios.

How to use the Virginia Form Tax

Using the Virginia Form Tax involves several steps to ensure accurate completion and submission. Taxpayers must first gather relevant financial information, including income statements, deductions, and credits. Next, they should fill out the form accurately, ensuring that all required fields are completed. Once the form is filled out, it can be submitted electronically or via traditional mail, depending on the taxpayer's preference and the specific requirements of the form.

Steps to complete the Virginia Form Tax

Completing the Virginia Form Tax involves a systematic approach:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Review the instructions provided with the form to understand the requirements and any specific calculations needed.

- Fill out the form accurately, ensuring that all personal and financial information is correct.

- Double-check the completed form for any errors or omissions.

- Submit the form electronically through an authorized e-filing service or mail it to the designated address.

Legal use of the Virginia Form Tax

The Virginia Form Tax is legally binding when completed and submitted according to state regulations. It must be filled out truthfully and accurately, as any discrepancies can lead to penalties or audits. The use of electronic signatures is permissible, provided that the e-signature complies with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). This ensures that the form holds legal weight in the eyes of the law.

Filing Deadlines / Important Dates

Filing deadlines for the Virginia Form Tax are crucial for compliance. Typically, individual income tax returns are due by May 1 each year. However, extensions may be available, allowing taxpayers to file later, usually until November 1. It is important to check for any specific deadlines related to business taxes or other forms, as these can vary. Missing these deadlines can result in penalties and interest on unpaid taxes.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the Virginia Form Tax. The most efficient method is electronic submission through authorized e-filing services, which can expedite processing and reduce errors. Alternatively, forms can be mailed to the appropriate state tax office, ensuring that they are postmarked by the filing deadline. In-person submission is also an option at designated tax offices, providing assistance if needed.

Quick guide on how to complete 2011 virginia form tax

Complete Virginia Form Tax effortlessly on any device

Online document management has become increasingly popular with organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage Virginia Form Tax on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Virginia Form Tax effortlessly

- Find Virginia Form Tax and click on Get Form to begin.

- Use the tools we offer to fill out your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specially provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Virginia Form Tax and ensure seamless communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2011 virginia form tax

Create this form in 5 minutes!

How to create an eSignature for the 2011 virginia form tax

How to create an eSignature for a PDF file in the online mode

How to create an eSignature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The way to create an electronic signature straight from your smartphone

How to generate an eSignature for a PDF file on iOS devices

The way to create an electronic signature for a PDF document on Android

People also ask

-

What is Virginia Form Tax and how can airSlate SignNow help?

Virginia Form Tax refers to the specific state forms required for tax filing in Virginia. airSlate SignNow simplifies this process by allowing users to easily send and eSign these documents digitally, ensuring compliance and reducing processing time.

-

How does airSlate SignNow ensure the security of my Virginia Form Tax documents?

airSlate SignNow prioritizes security by using advanced encryption protocols for all documents, including Virginia Form Tax files. Additionally, the platform complies with industry standards such as GDPR and HIPAA, giving users peace of mind regarding their sensitive information.

-

What are the pricing plans for airSlate SignNow regarding Virginia Form Tax filing?

airSlate SignNow offers flexible pricing plans tailored to suit different business needs for filing Virginia Form Tax documents. Users can choose from monthly or annual subscriptions, with various features included to enhance their eSignature experience.

-

Can I integrate airSlate SignNow with other software for managing Virginia Form Tax?

Yes, airSlate SignNow provides a range of integrations with popular applications like Google Workspace, Microsoft Office, and various CRM systems. This flexibility allows businesses to streamline their workflow and manage Virginia Form Tax alongside other critical documents.

-

What features does airSlate SignNow offer for managing Virginia Form Tax?

airSlate SignNow includes user-friendly features such as template creation, bulk sending, and tracking capabilities for Virginia Form Tax documents. These tools help users manage their tax forms efficiently and ensure timely execution.

-

Is there a mobile application available for signing Virginia Form Tax with airSlate SignNow?

Yes, airSlate SignNow offers a mobile application that allows users to eSign Virginia Form Tax documents on the go. This accessibility ensures that users can complete their tax tasks anytime and anywhere, enhancing convenience.

-

How can airSlate SignNow improve the efficiency of my Virginia Form Tax submission process?

By using airSlate SignNow, you can signNowly speed up the submission of Virginia Form Tax documents through digital signatures and automation. This streamlined process reduces delays associated with traditional paper methods, allowing for quicker resolutions.

Get more for Virginia Form Tax

Find out other Virginia Form Tax

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself