2022 Form 760ES, Estimated Income Tax Payment Vouchers for Individuals 2022 Form 760ES, Estimated Income Tax Payment Vouchers Fo 2022

What is the 2022 Form 760ES?

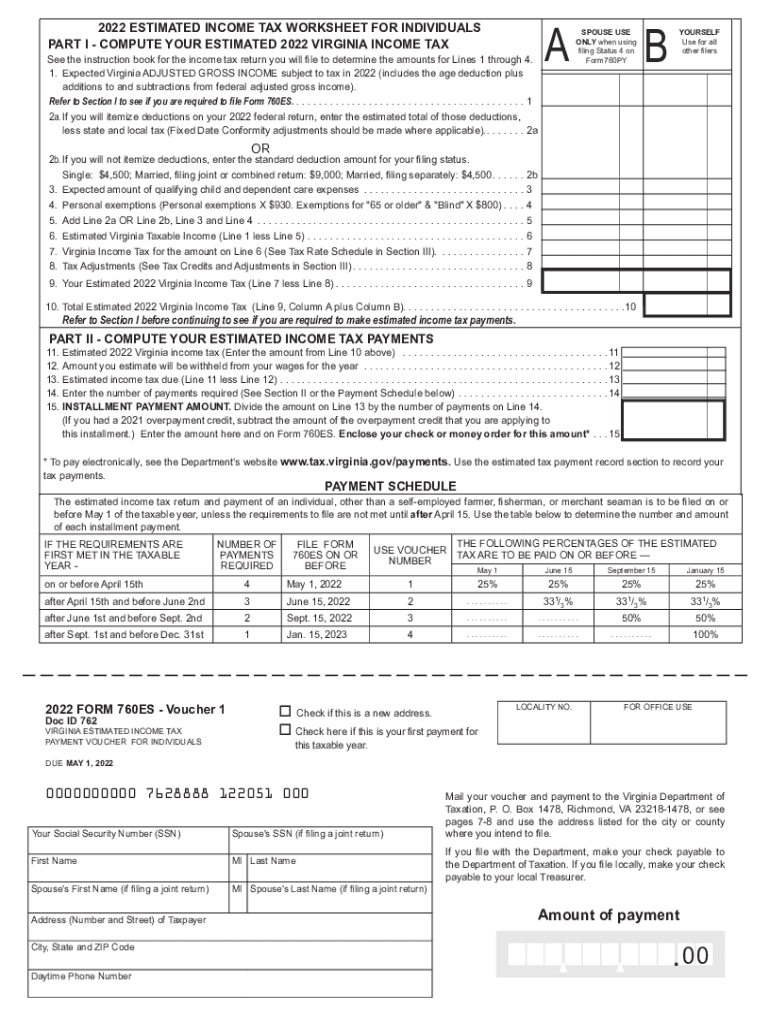

The 2022 Form 760ES, also known as the Estimated Income Tax Payment Vouchers for Individuals, is a crucial document for Virginia taxpayers. This form is designed for individuals who expect to owe tax of $150 or more when they file their Virginia tax return. It allows taxpayers to make estimated tax payments throughout the year, ensuring they meet their tax obligations and avoid penalties. The form consists of multiple vouchers that can be submitted with payments at various intervals, typically quarterly.

How to use the 2022 Form 760ES

Using the 2022 Form 760ES involves several straightforward steps. First, determine your estimated tax liability for the year based on your income, deductions, and credits. Next, calculate the amount you need to pay each quarter. Fill out the appropriate voucher for each payment period, ensuring that you include your name, address, and Social Security number. Finally, submit the completed voucher along with your payment to the Virginia Department of Taxation by the specified deadlines.

Steps to complete the 2022 Form 760ES

Completing the 2022 Form 760ES requires careful attention to detail. Start by gathering your financial information, including income and deductions. Follow these steps:

- Obtain the 2022 Form 760ES from the Virginia Department of Taxation website or other authorized sources.

- Fill in your personal information, including your name, address, and Social Security number.

- Calculate your estimated tax liability based on your expected income for the year.

- Divide your estimated tax by the number of payment periods to determine the amount due for each quarter.

- Complete each voucher and retain copies for your records.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the 2022 Form 760ES to avoid penalties. Estimated tax payments are typically due on the following dates:

- First payment: April 15, 2022

- Second payment: June 15, 2022

- Third payment: September 15, 2022

- Fourth payment: January 15, 2023

Make sure to submit your payments by these dates to remain compliant with Virginia tax laws.

Penalties for Non-Compliance

Failing to submit your estimated tax payments on time can result in penalties and interest charges. Virginia imposes a penalty if you do not pay at least 90% of your current year's tax or 100% of the previous year's tax. Additionally, interest accrues on any unpaid balance from the due date until payment is received. Understanding these penalties can help you avoid unnecessary costs and ensure timely compliance with your tax obligations.

Key elements of the 2022 Form 760ES

The 2022 Form 760ES includes several key elements that taxpayers must complete accurately. Each voucher requires:

- Your full name and address

- Your Social Security number

- The amount of estimated tax payment

- The payment period for which the voucher is being submitted

Ensuring that all information is correct and complete will facilitate smooth processing of your payments.

Quick guide on how to complete 2022 form 760es estimated income tax payment vouchers for individuals 2022 form 760es estimated income tax payment vouchers for

Accomplish 2022 Form 760ES, Estimated Income Tax Payment Vouchers For Individuals 2022 Form 760ES, Estimated Income Tax Payment Vouchers Fo effortlessly on any gadget

Managing documents online has become increasingly popular among businesses and individuals alike. It offers a remarkable eco-friendly alternative to traditional printed and signed documents, allowing you to easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, amend, and electronically sign your documents promptly without delays. Handle 2022 Form 760ES, Estimated Income Tax Payment Vouchers For Individuals 2022 Form 760ES, Estimated Income Tax Payment Vouchers Fo on any device using airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

The easiest way to modify and electronically sign 2022 Form 760ES, Estimated Income Tax Payment Vouchers For Individuals 2022 Form 760ES, Estimated Income Tax Payment Vouchers Fo with ease

- Locate 2022 Form 760ES, Estimated Income Tax Payment Vouchers For Individuals 2022 Form 760ES, Estimated Income Tax Payment Vouchers Fo and click Get Form to begin.

- Use the tools we offer to fill out your form.

- Highlight pertinent sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which only takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your updates.

- Choose how you want to send your form, via email, text (SMS), or invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form hunting, or errors that require reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Alter and electronically sign 2022 Form 760ES, Estimated Income Tax Payment Vouchers For Individuals 2022 Form 760ES, Estimated Income Tax Payment Vouchers Fo to ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 form 760es estimated income tax payment vouchers for individuals 2022 form 760es estimated income tax payment vouchers for

Create this form in 5 minutes!

How to create an eSignature for the 2022 form 760es estimated income tax payment vouchers for individuals 2022 form 760es estimated income tax payment vouchers for

How to make an electronic signature for your PDF file online

How to make an electronic signature for your PDF file in Google Chrome

The best way to make an e-signature for signing PDFs in Gmail

How to create an e-signature right from your mobile device

The best way to generate an electronic signature for a PDF file on iOS

How to create an e-signature for a PDF on Android devices

People also ask

-

What are Virginia estimated tax payments and who needs to make them?

Virginia estimated tax payments are advance payments made towards your expected state tax liability. Generally, individuals and businesses whose tax liability is expected to be over a certain threshold are required to make these payments. Understanding how to navigate Virginia estimated tax payments can help you avoid penalties and ensure you're fully compliant with state tax laws.

-

How do I calculate my Virginia estimated tax payments?

To calculate your Virginia estimated tax payments, first determine your expected tax liability for the year, based on your income and deductions. You can use last year's tax return as a guide. Virginia estimated tax payments are usually calculated by dividing your estimated tax liability by four, ensuring you pay the correct amount throughout the year.

-

When are the deadlines for Virginia estimated tax payments?

Virginia estimated tax payments are generally due quarterly, with deadlines falling on April 15, June 15, September 15, and January 15 of the following year. Being mindful of these dates is crucial to avoid late payments and potential penalties. For more detailed guidance, refer to the Virginia Department of Taxation's resources on estimated tax payments.

-

What are the penalties for not making Virginia estimated tax payments?

If you fail to make your Virginia estimated tax payments on time, you may face penalties and interest on the unpaid amount. The Virginia Department of Taxation typically assesses penalties based on the underpayment amount. Staying informed about your Virginia estimated tax payments is essential to avoid these costs.

-

Can airSlate SignNow help in managing Virginia estimated tax payments?

Yes! airSlate SignNow simplifies the process by allowing users to eSign and store important tax documents securely. By keeping your Virginia estimated tax payments and related documents organized, you'll ensure you're prepared when it’s time to make your payments. Our solution provides a convenient way to manage all your tax-related documents in one place.

-

What is the cost of using airSlate SignNow for tax document management?

airSlate SignNow offers cost-effective pricing plans tailored for businesses of all sizes. Our subscription packages provide access to features necessary for managing your Virginia estimated tax payments and other document workflows efficiently. Explore our pricing page for more details to find the best plan for your needs.

-

Are there integrations available for airSlate SignNow to assist with Virginia estimated tax payments?

Absolutely! airSlate SignNow integrates with various accounting and financial software, making it easier to manage your Virginia estimated tax payments. These integrations streamline data transfer and reduce errors associated with manual entry, ensuring that your tax information is accurate and up-to-date.

Get more for 2022 Form 760ES, Estimated Income Tax Payment Vouchers For Individuals 2022 Form 760ES, Estimated Income Tax Payment Vouchers Fo

- Warranty deed from individual to a trust arizona form

- Warranty deed from husband and wife to trust arizona form

- Warranty deed from husband to himself and wife arizona form

- Arizona husband wife 497296910 form

- Easement arizona form

- Arizona correction deed form

- Quitclaim deed from husband and wife to husband and wife arizona form

- Warranty deed from husband and wife to husband and wife arizona form

Find out other 2022 Form 760ES, Estimated Income Tax Payment Vouchers For Individuals 2022 Form 760ES, Estimated Income Tax Payment Vouchers Fo

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document