California Form 592 F Foreign Partner or Member Annual Return 2024

What is the California Form 592 F Foreign Partner Or Member Annual Return

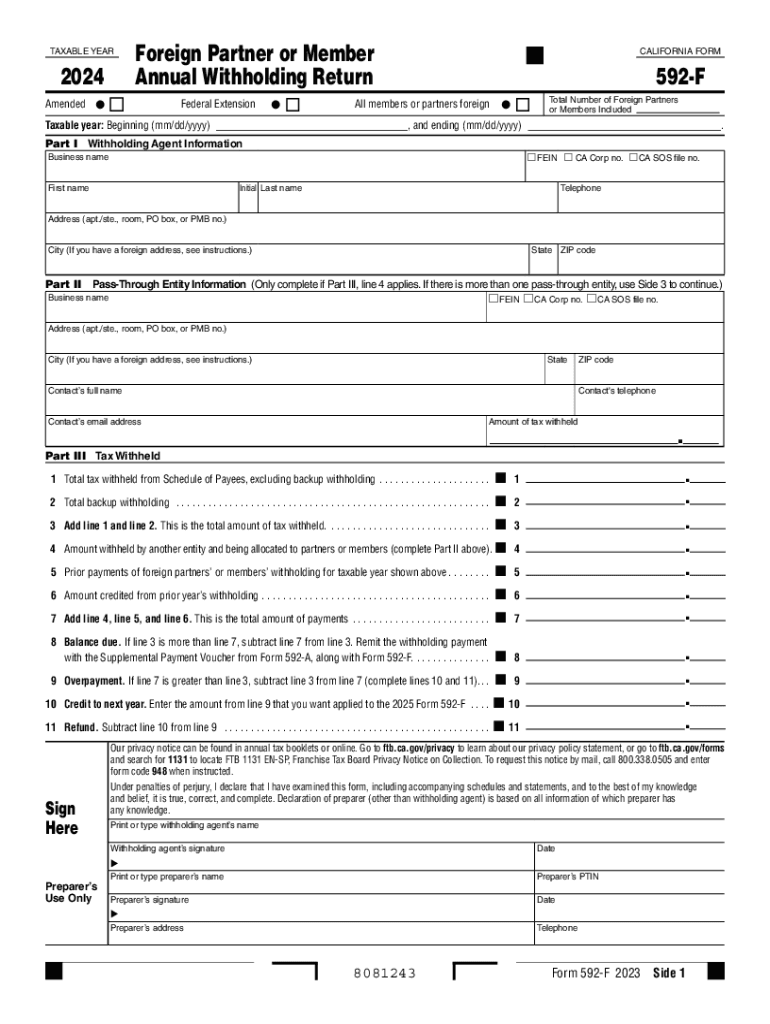

The California Form 592 F is designed for foreign partners or members of a partnership or limited liability company (LLC) that are engaged in business activities in California. This form is essential for reporting income derived from California sources, ensuring compliance with state tax obligations. It allows foreign entities to report their share of income, deductions, and credits, thereby facilitating the accurate calculation of California tax liabilities.

Steps to complete the California Form 592 F Foreign Partner Or Member Annual Return

Completing the California Form 592 F involves several key steps:

- Gather necessary information, including the foreign partner's identification details and income sources.

- Fill out the form with accurate income figures, deductions, and any applicable credits.

- Ensure that all calculations are correct to avoid discrepancies that could lead to penalties.

- Review the completed form for completeness and accuracy before submission.

Key elements of the California Form 592 F Foreign Partner Or Member Annual Return

Understanding the key elements of the California Form 592 F is crucial for accurate reporting. The form typically includes:

- Identification of the foreign partner or member.

- Details of income sourced from California.

- Deductions and credits applicable to the foreign partner.

- Signature and date to certify the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the California Form 592 F are critical to avoid penalties. Generally, the form must be filed by the 15th day of the third month following the close of the taxable year. For calendar year filers, this typically means a due date of March 15. It is important to stay informed about any changes to these deadlines, as they can vary based on specific circumstances or legislative updates.

Legal use of the California Form 592 F Foreign Partner Or Member Annual Return

The legal use of the California Form 592 F is governed by California tax laws and regulations. It is required for foreign partners or members to ensure compliance with state tax obligations. Failure to file this form can result in penalties, interest on unpaid taxes, and potential legal ramifications. Therefore, it is essential for foreign entities engaged in California business activities to understand their obligations regarding this form.

How to obtain the California Form 592 F Foreign Partner Or Member Annual Return

The California Form 592 F can be obtained through the California Franchise Tax Board (FTB) website. It is available as a downloadable PDF, which can be printed and filled out manually. Additionally, the form may be accessible through tax preparation software that supports California tax filings, making it easier for users to complete their returns accurately.

Create this form in 5 minutes or less

Find and fill out the correct california form 592 f foreign partner or member annual return

Create this form in 5 minutes!

How to create an eSignature for the california form 592 f foreign partner or member annual return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2021 California 592F form?

The 2021 California 592F form is a tax form used by non-resident individuals and entities to report California source income. It is essential for ensuring compliance with California tax laws. By using airSlate SignNow, you can easily eSign and send this form securely.

-

How can airSlate SignNow help with the 2021 California 592F?

airSlate SignNow simplifies the process of completing and submitting the 2021 California 592F form. Our platform allows you to fill out the form electronically, eSign it, and send it directly to the relevant authorities, saving you time and reducing errors.

-

What are the pricing options for using airSlate SignNow for the 2021 California 592F?

airSlate SignNow offers various pricing plans to accommodate different business needs. Whether you are a small business or a large enterprise, you can find a plan that fits your budget while ensuring you can efficiently manage the 2021 California 592F form and other documents.

-

Are there any features specifically for the 2021 California 592F in airSlate SignNow?

Yes, airSlate SignNow includes features tailored for the 2021 California 592F, such as customizable templates and automated workflows. These features help streamline the document preparation process, making it easier to manage tax forms and ensure compliance.

-

Can I integrate airSlate SignNow with other software for the 2021 California 592F?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to connect your existing tools for a seamless experience. This means you can easily manage the 2021 California 592F alongside your other business processes.

-

What are the benefits of using airSlate SignNow for the 2021 California 592F?

Using airSlate SignNow for the 2021 California 592F provides numerous benefits, including enhanced security, ease of use, and cost-effectiveness. Our platform ensures that your documents are securely stored and easily accessible, making tax season less stressful.

-

Is airSlate SignNow compliant with California regulations for the 2021 California 592F?

Yes, airSlate SignNow is designed to comply with California regulations, ensuring that your use of the 2021 California 592F form meets all legal requirements. We prioritize compliance and security to give you peace of mind while managing your documents.

Get more for California Form 592 F Foreign Partner Or Member Annual Return

Find out other California Form 592 F Foreign Partner Or Member Annual Return

- eSign Alaska High Tech Lease Template Myself

- eSign Colorado High Tech Claim Computer

- eSign Idaho Healthcare / Medical Residential Lease Agreement Simple

- eSign Idaho Healthcare / Medical Arbitration Agreement Later

- How To eSign Colorado High Tech Forbearance Agreement

- eSign Illinois Healthcare / Medical Resignation Letter Mobile

- eSign Illinois Healthcare / Medical Job Offer Easy

- eSign Hawaii High Tech Claim Later

- How To eSign Hawaii High Tech Confidentiality Agreement

- How Do I eSign Hawaii High Tech Business Letter Template

- Can I eSign Hawaii High Tech Memorandum Of Understanding

- Help Me With eSign Kentucky Government Job Offer

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast

- eSign Kentucky Healthcare / Medical Last Will And Testament Free

- eSign Maine Healthcare / Medical LLC Operating Agreement Now

- eSign Louisiana High Tech LLC Operating Agreement Safe

- eSign Massachusetts Government Quitclaim Deed Fast

- How Do I eSign Massachusetts Government Arbitration Agreement

- eSign Maryland High Tech Claim Fast