California Form 592 F Foreign Partner or Member Annual Return 2021

What is the California Form 592 F Foreign Partner Or Member Annual Return

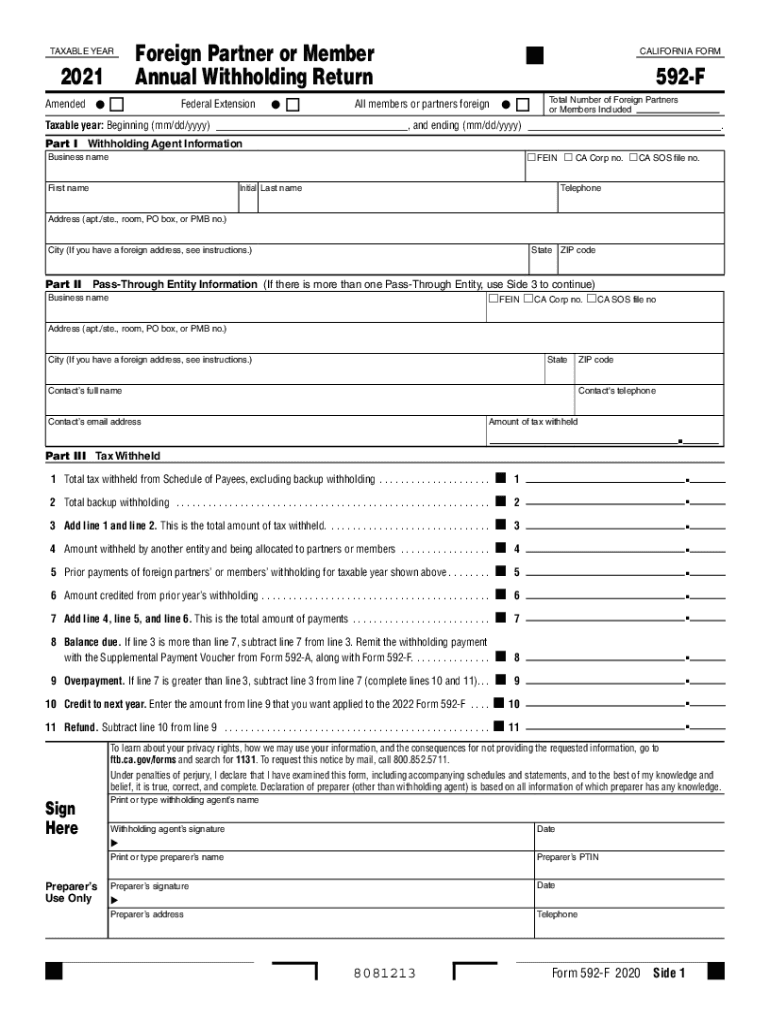

The California Form 592 F is a tax document specifically designed for foreign partners or members of partnerships and limited liability companies (LLCs) that conduct business in California. This form is essential for reporting income that is sourced from California and is allocated to foreign partners. It ensures that the California Franchise Tax Board (FTB) receives accurate information regarding the income earned by foreign entities, which may be subject to California tax laws. By completing this form, foreign partners can comply with state regulations and ensure proper tax treatment of their earnings.

Steps to complete the California Form 592 F Foreign Partner Or Member Annual Return

Completing the California Form 592 F involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents related to the partnership or LLC, including income statements and allocation schedules. Next, fill out the form by providing details such as the partnership's name, address, and federal employer identification number (EIN). It is important to accurately report the income allocated to each foreign partner, including any deductions or credits applicable. Finally, review the completed form for accuracy before submitting it to the California FTB, either online or by mail.

Legal use of the California Form 592 F Foreign Partner Or Member Annual Return

The California Form 592 F is legally binding when completed and submitted according to state regulations. To ensure its legal standing, the form must be filled out accurately, reflecting the true income and allocations for each foreign partner. Compliance with California tax laws, including adherence to deadlines and submission methods, is crucial. The form must also be signed by an authorized representative of the partnership or LLC to validate its contents. By following these legal requirements, foreign partners can protect their interests and avoid potential penalties.

Filing Deadlines / Important Dates

Filing deadlines for the California Form 592 F are critical to ensure compliance with state tax laws. Typically, the form is due on the 15th day of the third month following the close of the partnership's taxable year. For partnerships operating on a calendar year, this means the due date is March 15. It is essential to stay informed about any changes to deadlines or extensions that may be applicable, as late submissions can result in penalties and interest charges. Keeping a calendar of important dates can help ensure timely filing.

Required Documents

To complete the California Form 592 F, several documents are necessary. These include financial statements that outline income earned by the partnership or LLC, allocation schedules that detail how income is divided among partners, and any relevant tax documentation that supports deductions or credits claimed. Additionally, foreign partners may need to provide identification information, such as a taxpayer identification number (TIN) or foreign tax identification number (FTIN). Ensuring all required documents are gathered beforehand can streamline the completion process.

Examples of using the California Form 592 F Foreign Partner Or Member Annual Return

Using the California Form 592 F can vary based on the specific circumstances of each partnership. For instance, a partnership with foreign investors earning rental income from California properties must report this income using the form. Another example includes an LLC with foreign members that conducts business in California and needs to report the income allocated to those members. Each example highlights the importance of accurately reporting income and complying with state tax obligations to avoid penalties.

Quick guide on how to complete 2021 california form 592 f foreign partner or member annual return

Easily prepare California Form 592 F Foreign Partner Or Member Annual Return on any device

Web-based document management has become increasingly favored by companies and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, alter, and electronically sign your documents swiftly without delays. Manage California Form 592 F Foreign Partner Or Member Annual Return on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to alter and eSign California Form 592 F Foreign Partner Or Member Annual Return effortlessly

- Locate California Form 592 F Foreign Partner Or Member Annual Return and click Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Alter and eSign California Form 592 F Foreign Partner Or Member Annual Return and guarantee excellent communication at every stage of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 california form 592 f foreign partner or member annual return

Create this form in 5 minutes!

How to create an eSignature for the 2021 california form 592 f foreign partner or member annual return

The way to make an electronic signature for a PDF file online

The way to make an electronic signature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

How to generate an electronic signature from your mobile device

The way to generate an eSignature for a PDF file on iOS

How to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is ca 592f and how does it relate to airSlate SignNow?

The ca 592f form is often required for withholding purposes related to non-resident tax obligations. airSlate SignNow simplifies this process by allowing users to securely eSign and send documents like ca 592f quickly and efficiently, ensuring compliance.

-

How can airSlate SignNow help with sending ca 592f forms?

With airSlate SignNow, you can easily prepare and send ca 592f forms for electronic signatures. The platform provides a user-friendly interface that accelerates the signing process, allowing for faster completion of tax documentation.

-

What are the pricing options for using airSlate SignNow for ca 592f forms?

airSlate SignNow offers various pricing plans that cater to businesses of all sizes. You can choose a plan that best fits your needs for managing documents like the ca 592f, ensuring you get a cost-effective solution for your eSignature requirements.

-

Are there any specific features in airSlate SignNow for handling ca 592f forms?

Yes, airSlate SignNow includes features that support the efficient management of ca 592f forms, such as templates, reminders, and automation options. These features help streamline the workflow and ensure that your documents are signed and returned promptly.

-

Can I integrate airSlate SignNow with other platforms for managing ca 592f forms?

Absolutely! airSlate SignNow offers seamless integrations with various applications like CRM systems and cloud storage services. This allows you to effortlessly manage ca 592f forms alongside other business operations and improve overall efficiency.

-

How secure is airSlate SignNow when handling sensitive ca 592f documents?

Security is a top priority at airSlate SignNow. The platform employs advanced encryption and security protocols to protect your ca 592f documents, ensuring that sensitive information is kept safe during the signing process.

-

What are the benefits of using airSlate SignNow for my ca 592f forms?

Using airSlate SignNow for ca 592f forms offers numerous benefits, including speed, convenience, and cost savings. The ability to eSign from anywhere enhances collaboration and reduces turnaround time for tax documentation.

Get more for California Form 592 F Foreign Partner Or Member Annual Return

Find out other California Form 592 F Foreign Partner Or Member Annual Return

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation