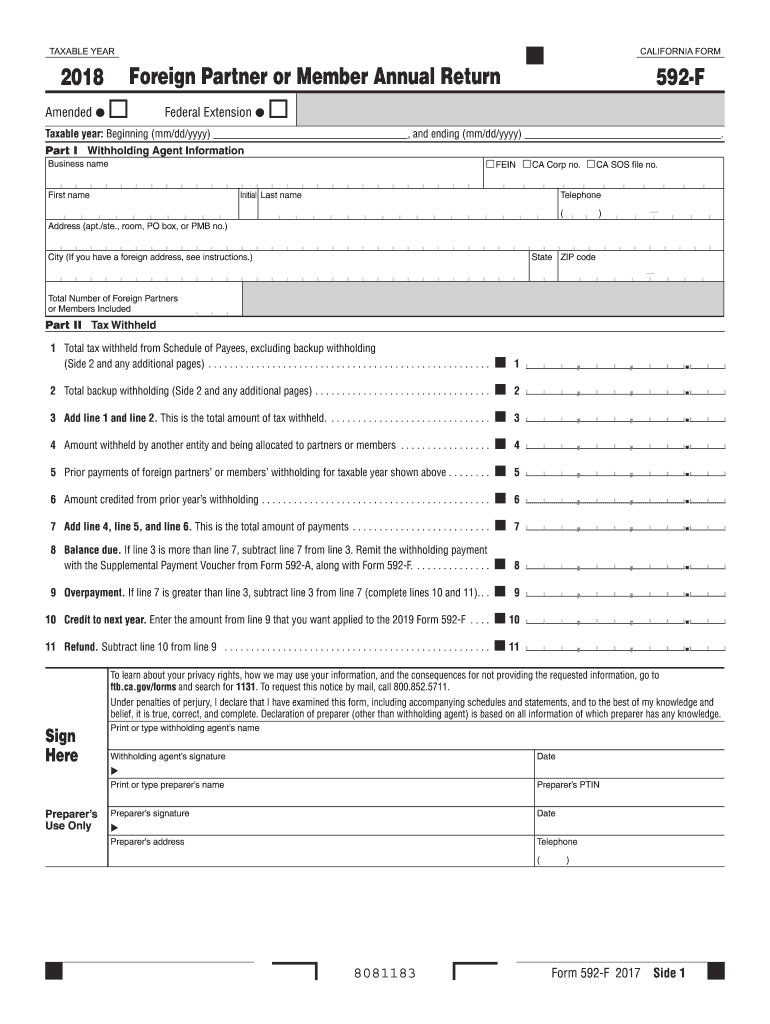

Form 592 F Foreign Partner or Member Annual Return Form 592 F Foreign Partner or Member Annual Return 2018

What is the Form 592 F Foreign Partner Or Member Annual Return

The Form 592 F Foreign Partner Or Member Annual Return is a tax document used by foreign partners or members of a partnership in the United States. This form is essential for reporting income and tax withheld on behalf of foreign partners who are not U.S. residents. It ensures compliance with U.S. tax regulations and provides the necessary information for the Internal Revenue Service (IRS) to assess tax obligations accurately. By filing this form, partnerships can report distributions made to foreign partners and any tax withheld, which is crucial for maintaining transparency and fulfilling legal requirements.

Steps to Complete the Form 592 F Foreign Partner Or Member Annual Return

Completing the Form 592 F requires careful attention to detail. Here are the key steps to follow:

- Gather necessary information about the foreign partners, including their names, addresses, and tax identification numbers.

- Determine the total income earned by the partnership during the tax year.

- Calculate the amount of tax withheld from distributions to each foreign partner.

- Fill out the form accurately, ensuring all sections are completed, including the partner's information and tax withheld.

- Review the completed form for accuracy before submission.

- Submit the form to the IRS by the specified deadline, either electronically or by mail.

Legal Use of the Form 592 F Foreign Partner Or Member Annual Return

The legal use of the Form 592 F is critical for partnerships with foreign partners. This form serves as a declaration of income and taxes withheld, which helps ensure compliance with U.S. tax laws. Filing the form correctly is vital to avoid penalties and legal repercussions. It provides a clear record of the partnership's financial activities concerning foreign partners, which can be essential during audits or reviews by the IRS. Proper execution and timely submission of the form are necessary to maintain the partnership's good standing and fulfill its tax obligations.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Form 592 F is crucial for compliance. Generally, the form must be submitted by the fifteenth day of the third month following the close of the partnership's tax year. For partnerships operating on a calendar year, this typically means the deadline is March 15. It is important to stay informed about any changes to these deadlines, as late submissions can result in penalties and interest on any unpaid taxes.

Required Documents

To complete the Form 592 F, several documents are necessary. These include:

- Partnership agreement outlining the distribution of income among partners.

- Records of income earned by the partnership during the tax year.

- Documentation of taxes withheld from distributions to foreign partners.

- Identification numbers for foreign partners, such as a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

Having these documents ready will streamline the process of completing the form and ensure accuracy in reporting.

Who Issues the Form 592 F Foreign Partner Or Member Annual Return

The Form 592 F is issued by the Internal Revenue Service (IRS), the federal agency responsible for tax collection and enforcement in the United States. This form is specifically designed for partnerships that have foreign partners and need to report income and tax withheld. The IRS provides guidelines and instructions for completing the form, ensuring that partnerships understand their obligations and the necessary steps for compliance.

Quick guide on how to complete 2018 form 592 f foreign partner or member annual return 2018 form 592 f foreign partner or member annual return

Effortlessly Prepare Form 592 F Foreign Partner Or Member Annual Return Form 592 F Foreign Partner Or Member Annual Return on Any Device

Digital document management has gained traction among organizations and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, edit, and eSign your documents promptly without delays. Handle Form 592 F Foreign Partner Or Member Annual Return Form 592 F Foreign Partner Or Member Annual Return on any device with airSlate SignNow apps for Android or iOS and enhance any document-related process today.

How to Edit and eSign Form 592 F Foreign Partner Or Member Annual Return Form 592 F Foreign Partner Or Member Annual Return with Ease

- Obtain Form 592 F Foreign Partner Or Member Annual Return Form 592 F Foreign Partner Or Member Annual Return and then select Get Form to commence.

- Make use of the tools we offer to fill out your document.

- Emphasize pertinent sections of the document or redact sensitive details using the tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to retain your modifications.

- Select how you wish to deliver your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Alter and eSign Form 592 F Foreign Partner Or Member Annual Return Form 592 F Foreign Partner Or Member Annual Return and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2018 form 592 f foreign partner or member annual return 2018 form 592 f foreign partner or member annual return

Create this form in 5 minutes!

How to create an eSignature for the 2018 form 592 f foreign partner or member annual return 2018 form 592 f foreign partner or member annual return

How to generate an electronic signature for your 2018 Form 592 F Foreign Partner Or Member Annual Return 2018 Form 592 F Foreign Partner Or Member Annual Return in the online mode

How to make an eSignature for the 2018 Form 592 F Foreign Partner Or Member Annual Return 2018 Form 592 F Foreign Partner Or Member Annual Return in Google Chrome

How to make an eSignature for signing the 2018 Form 592 F Foreign Partner Or Member Annual Return 2018 Form 592 F Foreign Partner Or Member Annual Return in Gmail

How to make an eSignature for the 2018 Form 592 F Foreign Partner Or Member Annual Return 2018 Form 592 F Foreign Partner Or Member Annual Return straight from your smartphone

How to create an eSignature for the 2018 Form 592 F Foreign Partner Or Member Annual Return 2018 Form 592 F Foreign Partner Or Member Annual Return on iOS devices

How to create an eSignature for the 2018 Form 592 F Foreign Partner Or Member Annual Return 2018 Form 592 F Foreign Partner Or Member Annual Return on Android

People also ask

-

What is the Form 592 F Foreign Partner Or Member Annual Return?

The Form 592 F Foreign Partner Or Member Annual Return is a crucial document that U.S. partnerships must file to report the income of foreign partners. This form is essential for compliance with tax regulations and helps avoid penalties. By using airSlate SignNow, you can easily eSign and send this form securely.

-

How does airSlate SignNow help with the Form 592 F Foreign Partner Or Member Annual Return?

airSlate SignNow streamlines the process of completing the Form 592 F Foreign Partner Or Member Annual Return by providing an intuitive platform for eSigning and sharing necessary documents. Our solution ensures that your documents are legally binding and can be easily tracked. This reduces the time and effort needed to manage your compliance requirements.

-

What are the benefits of using airSlate SignNow for Form 592 F Foreign Partner Or Member Annual Return?

Using airSlate SignNow for the Form 592 F Foreign Partner Or Member Annual Return offers several benefits, including an easy-to-use interface, cost effectiveness, and comprehensive tracking of your documents. You can also enjoy increased security features that protect sensitive information. This ensures that your submissions are both fast and reliable.

-

Is there a cost associated with filing the Form 592 F Foreign Partner Or Member Annual Return through airSlate SignNow?

Yes, there is a subscription cost associated with using airSlate SignNow for the Form 592 F Foreign Partner Or Member Annual Return. However, our pricing is competitive and designed to offer exceptional value for the comprehensive features. With signNow, you can signNowly reduce the time spent on paperwork, which ultimately saves you money.

-

Can airSlate SignNow integrate with my existing accounting software for Form 592 F Foreign Partner Or Member Annual Return?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software to enhance your workflow for the Form 592 F Foreign Partner Or Member Annual Return. This feature allows you to sync data and documents effortlessly, enabling you to file your returns accurately and on time.

-

What security measures does airSlate SignNow have for the Form 592 F Foreign Partner Or Member Annual Return?

airSlate SignNow employs industry-leading security measures to protect your data when you manage the Form 592 F Foreign Partner Or Member Annual Return. This includes encryption, secure data storage, and compliant eSigning practices. You can rest assured that your sensitive information is well-protected throughout the entire signing process.

-

How can I send the Form 592 F Foreign Partner Or Member Annual Return electronically using airSlate SignNow?

With airSlate SignNow, sending the Form 592 F Foreign Partner Or Member Annual Return electronically is simple and efficient. After eSigning, you can quickly send the signed document directly to the relevant parties through email or a secure link. This feature greatly accelerates the process, helping you meet submission deadlines.

Get more for Form 592 F Foreign Partner Or Member Annual Return Form 592 F Foreign Partner Or Member Annual Return

Find out other Form 592 F Foreign Partner Or Member Annual Return Form 592 F Foreign Partner Or Member Annual Return

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe

- Electronic signature Kentucky Standard rental application Fast

- Electronic signature Arkansas Real estate document Online

- Electronic signature Oklahoma Real estate document Mobile

- Electronic signature Louisiana Real estate forms Secure

- Electronic signature Louisiana Real estate investment proposal template Fast

- Electronic signature Maine Real estate investment proposal template Myself

- eSignature Alabama Pet Addendum to Lease Agreement Simple

- eSignature Louisiana Pet Addendum to Lease Agreement Safe

- eSignature Minnesota Pet Addendum to Lease Agreement Fast

- Electronic signature South Carolina Real estate proposal template Fast

- Electronic signature Rhode Island Real estate investment proposal template Computer

- How To Electronic signature Virginia Real estate investment proposal template

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template

- How To Electronic signature Kentucky Investment Contract

- Electronic signature Tennessee Consulting Agreement Template Fast

- How To Electronic signature California General Power of Attorney Template