592 F Franchise Tax Board CA Gov 2020

Understanding the 592 F Form

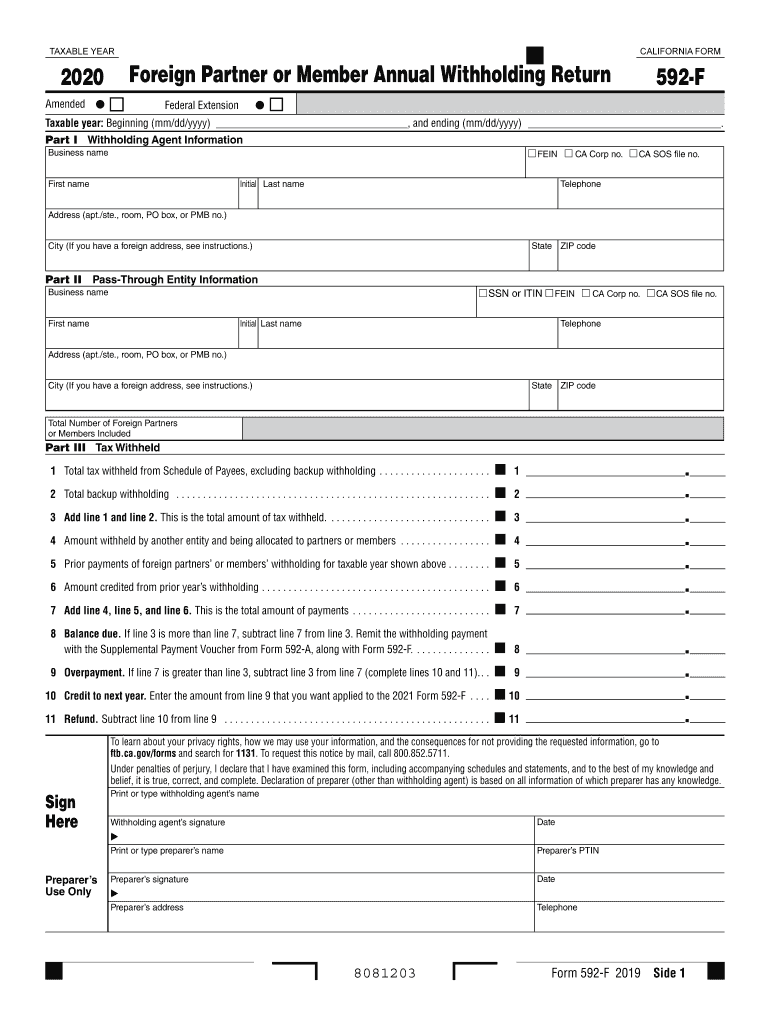

The 592 F form is a crucial document issued by the California Franchise Tax Board. It serves as a reporting tool for withholding on payments made to foreign entities. This form is essential for ensuring compliance with California's tax regulations, particularly for businesses that engage with non-resident individuals or entities. By accurately completing and submitting the 592 F form, taxpayers can avoid potential penalties and ensure that they meet their tax obligations.

Steps to Complete the 592 F Form

Completing the 592 F form involves several steps to ensure accuracy and compliance. Here’s a straightforward guide:

- Gather necessary information about the foreign payee, including their name, address, and taxpayer identification number.

- Determine the type of income being paid and the applicable withholding rate.

- Fill out the form with the required details, ensuring all sections are completed accurately.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the California Franchise Tax Board by the specified deadline.

Legal Use of the 592 F Form

The legal validity of the 592 F form hinges on its proper completion and submission. When filled out correctly, it serves as a legal declaration of the withholding tax obligations for payments made to foreign entities. The form must be submitted in accordance with California tax laws to ensure that the withholding is recognized by the state. Failure to comply with these regulations can result in penalties, making it essential for businesses to understand their responsibilities regarding this form.

Required Documents for the 592 F Form

To complete the 592 F form, certain documents and information are necessary. These include:

- The foreign payee's identification details, such as their name and address.

- The payee's taxpayer identification number, if applicable.

- Documentation supporting the nature of the payment and the withholding rate, such as contracts or invoices.

Having these documents ready will streamline the process of filling out the form and help ensure compliance with tax regulations.

Filing Deadlines for the 592 F Form

Timely submission of the 592 F form is crucial to avoid penalties. The form must be filed by the specified deadlines set by the California Franchise Tax Board. Typically, this includes deadlines associated with the payment of the income and the corresponding withholding tax. It is advisable to check the official guidelines for the most current deadlines to ensure compliance.

Form Submission Methods

The 592 F form can be submitted through various methods, providing flexibility for taxpayers. Options typically include:

- Online submission through the California Franchise Tax Board's website.

- Mailing the completed form to the appropriate address as specified by the tax board.

- In-person submission at designated tax offices, if applicable.

Choosing the right submission method can help ensure that the form is processed efficiently and in a timely manner.

Quick guide on how to complete 592 f franchise tax board cagov

Prepare 592 F Franchise Tax Board CA gov effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can obtain the appropriate form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and without any holdups. Handle 592 F Franchise Tax Board CA gov on any device with airSlate SignNow apps for Android or iOS and enhance any document-related process today.

How to modify and electronically sign 592 F Franchise Tax Board CA gov with ease

- Obtain 592 F Franchise Tax Board CA gov and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign tool, which only takes seconds and carries the same legal validity as a traditional ink signature.

- Review the information and click the Done button to save your changes.

- Choose your preferred method to send your form, whether via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign 592 F Franchise Tax Board CA gov to ensure outstanding communication at every step of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 592 f franchise tax board cagov

Create this form in 5 minutes!

How to create an eSignature for the 592 f franchise tax board cagov

How to make an electronic signature for your PDF file in the online mode

How to make an electronic signature for your PDF file in Chrome

The best way to make an eSignature for putting it on PDFs in Gmail

How to create an eSignature from your smartphone

The best way to generate an electronic signature for a PDF file on iOS devices

How to create an eSignature for a PDF file on Android

People also ask

-

What is the 592 F form and why is it important?

The 592 F form is a crucial document for reporting California-source income of foreign partners, particularly for tax compliance. Understanding how to complete the 592 F form ensures that businesses remain compliant with state regulations and avoid potential penalties.

-

How can airSlate SignNow help with the 592 F form?

airSlate SignNow streamlines the process of filling and signing your 592 F form by providing an intuitive platform that allows users to eSign documents securely. This eliminates the hassles of printing and mailing, making it faster and more efficient to submit the 592 F form.

-

Is there a cost associated with using airSlate SignNow to complete the 592 F form?

Yes, airSlate SignNow offers several pricing plans that cater to different business needs. The pricing is competitive and reflects the value of tools available for handling documents like the 592 F form, ensuring an efficient workflow.

-

Can I integrate airSlate SignNow with other software for managing the 592 F form?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, allowing you to manage the 592 F form alongside your other business processes. This integration helps improve productivity and keeps all your documents organized.

-

What features does airSlate SignNow offer for processing the 592 F form?

airSlate SignNow provides features like customizable templates, secure cloud storage, and real-time collaboration, all of which are beneficial for processing the 592 F form. These features ensure that your documents are easily accessible and can be completed efficiently.

-

Is airSlate SignNow user-friendly for completing the 592 F form?

Yes, airSlate SignNow is designed with user experience in mind, making it intuitive and easy to navigate for completing the 592 F form. You don’t need extensive technical skills to fill out and eSign your documents.

-

How secure is airSlate SignNow when submitting the 592 F form?

airSlate SignNow prioritizes security, employing advanced encryption and security measures to protect your data during the submission of the 592 F form. You can feel confident that your information remains safe and secure.

Get more for 592 F Franchise Tax Board CA gov

Find out other 592 F Franchise Tax Board CA gov

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney

- Electronic signature Kentucky Car Dealer LLC Operating Agreement Safe

- Electronic signature Louisiana Car Dealer Lease Template Now

- Electronic signature Maine Car Dealer Promissory Note Template Later

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free

- How Do I Electronic signature Hawaii Business Operations Forbearance Agreement

- Electronic signature Massachusetts Car Dealer Operating Agreement Free

- How To Electronic signature Minnesota Car Dealer Credit Memo

- Electronic signature Mississippi Car Dealer IOU Now

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed