FTB 1123 Forms of Ownership California Franchise Tax 2023

Understanding the 2021 California F Tax Form

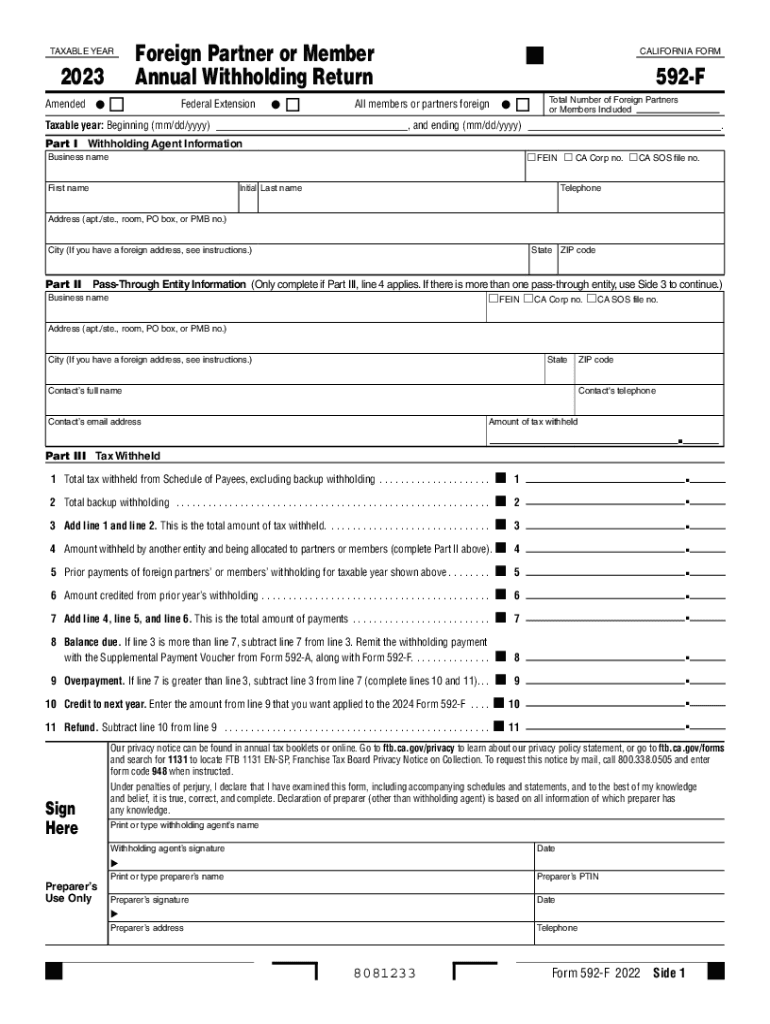

The 2021 California F tax form, also known as the California 592F, is essential for foreign partners in partnerships or LLCs that conduct business in California. This form is used to report California source income and is crucial for ensuring compliance with state tax laws. It provides the Franchise Tax Board (FTB) with the necessary information to assess tax obligations for foreign entities. Understanding the purpose and requirements of the 2021 California F is vital for accurate reporting and avoiding penalties.

Steps to Complete the 2021 California F Tax Form

Completing the 2021 California F tax form requires careful attention to detail. Here are the key steps involved:

- Gather all necessary documentation, including income statements and partner information.

- Fill out the form accurately, ensuring all income sourced from California is reported.

- Calculate the tax due based on the income reported on the form.

- Review the completed form for accuracy before submission.

- Submit the form electronically or via mail, adhering to the specified deadlines.

Required Documents for Filing the 2021 California F Tax Form

To successfully file the 2021 California F tax form, certain documents must be prepared in advance. These include:

- Partnership or LLC operating agreements.

- Income statements detailing California-sourced income.

- Identification information for all foreign partners.

- Previous tax returns, if applicable, for reference.

Having these documents ready will streamline the filing process and help ensure compliance with California tax regulations.

Filing Deadlines for the 2021 California F Tax Form

It is essential to be aware of the filing deadlines for the 2021 California F tax form to avoid penalties. The due date for filing is typically the 15th day of the fourth month following the close of the taxable year, which for most entities is April 15. If additional time is needed, an extension can be requested, but it is crucial to understand that this does not extend the time for payment of any taxes owed.

Penalties for Non-Compliance with the 2021 California F Tax Form

Failure to file the 2021 California F tax form on time or inaccurately reporting information can result in significant penalties. These may include:

- Late filing penalties, which can accumulate over time.

- Interest on any unpaid taxes, compounding the total amount owed.

- Potential legal consequences for failure to comply with state tax laws.

Understanding these penalties emphasizes the importance of timely and accurate filing.

Digital vs. Paper Version of the 2021 California F Tax Form

When completing the 2021 California F tax form, taxpayers have the option to file digitally or submit a paper version. The digital version offers several advantages:

- Faster processing times, leading to quicker confirmations from the FTB.

- Reduced risk of errors through built-in validation checks.

- Convenience of filing from any location with internet access.

Choosing the digital option can enhance the efficiency of the filing process and ensure compliance with state requirements.

Quick guide on how to complete ftb 1123 forms of ownership california franchise tax

Complete FTB 1123 Forms Of Ownership California Franchise Tax effortlessly on any device

Digital document handling has become increasingly favored by companies and individuals alike. It offers an ideal eco-conscious option to traditional printed and signed documents, allowing you to access the necessary form and securely keep it online. airSlate SignNow equips you with all the resources required to create, edit, and electronically sign your documents rapidly without any hold-ups. Manage FTB 1123 Forms Of Ownership California Franchise Tax on any device using the airSlate SignNow Android or iOS applications and enhance any document-based task today.

How to modify and eSign FTB 1123 Forms Of Ownership California Franchise Tax with ease

- Locate FTB 1123 Forms Of Ownership California Franchise Tax and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow specially provides for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form navigation, or errors that require printing fresh copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign FTB 1123 Forms Of Ownership California Franchise Tax and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ftb 1123 forms of ownership california franchise tax

Create this form in 5 minutes!

How to create an eSignature for the ftb 1123 forms of ownership california franchise tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to the 2021 california f?

airSlate SignNow is a powerful eSignature solution that allows businesses to send and sign documents electronically. In relation to the 2021 california f, it streamlines the entire process, making it easier for companies to comply with California's legal and regulatory requirements for document signing.

-

How much does airSlate SignNow cost, especially for the 2021 california f?

The pricing for airSlate SignNow is competitive and varies based on the features you choose. For businesses handling the 2021 california f, flexible pricing plans ensure cost-effectiveness while providing essential functionalities needed for electronic signatures and document management.

-

What features does airSlate SignNow offer for the 2021 california f?

airSlate SignNow offers a variety of features tailored for the 2021 california f, including customizable templates, real-time tracking of document status, and secure cloud storage. These functionalities enhance workflow efficiency and ensure compliance with California’s signing regulations.

-

Can airSlate SignNow help with compliance for the 2021 california f?

Absolutely! airSlate SignNow is designed to help businesses adhere to the compliance requirements outlined in the 2021 california f. Its legally binding electronic signatures and audit trails support adherence to California laws and regulations surrounding document execution.

-

Is airSlate SignNow easy to use for signing documents under the 2021 california f?

Yes, airSlate SignNow is renowned for its user-friendly interface, making it particularly easy to use for signing documents under the 2021 california f. The intuitive design allows users to quickly navigate and complete their signing tasks without extensive training.

-

What benefits does airSlate SignNow provide for businesses focusing on the 2021 california f?

For businesses working with the 2021 california f, airSlate SignNow provides numerous benefits including increased efficiency, reduced paper use, and enhanced security for sensitive documents. These advantages help improve operational workflows while ensuring compliance in the signing process.

-

Does airSlate SignNow integrate with other applications for the 2021 california f?

Yes, airSlate SignNow seamlessly integrates with various applications important for managing the 2021 california f. These integrations facilitate better data management and streamline communication between tools used for document handling and eSigning.

Get more for FTB 1123 Forms Of Ownership California Franchise Tax

Find out other FTB 1123 Forms Of Ownership California Franchise Tax

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form

- eSign Michigan Car Insurance Quotation Form Online

- eSign Michigan Car Insurance Quotation Form Mobile

- eSignature Massachusetts Mechanic's Lien Online

- eSignature Massachusetts Mechanic's Lien Free

- eSign Ohio Car Insurance Quotation Form Mobile

- eSign North Dakota Car Insurance Quotation Form Online

- eSign Pennsylvania Car Insurance Quotation Form Mobile

- eSignature Nevada Mechanic's Lien Myself

- eSign California Life-Insurance Quote Form Online

- How To eSignature Ohio Mechanic's Lien

- eSign Florida Life-Insurance Quote Form Online

- eSign Louisiana Life-Insurance Quote Form Online

- How To eSign Michigan Life-Insurance Quote Form

- Can I eSign Colorado Business Insurance Quotation Form