IncomeExpense Form 20201 PDF

What is the IncomeExpense Form 20201 pdf

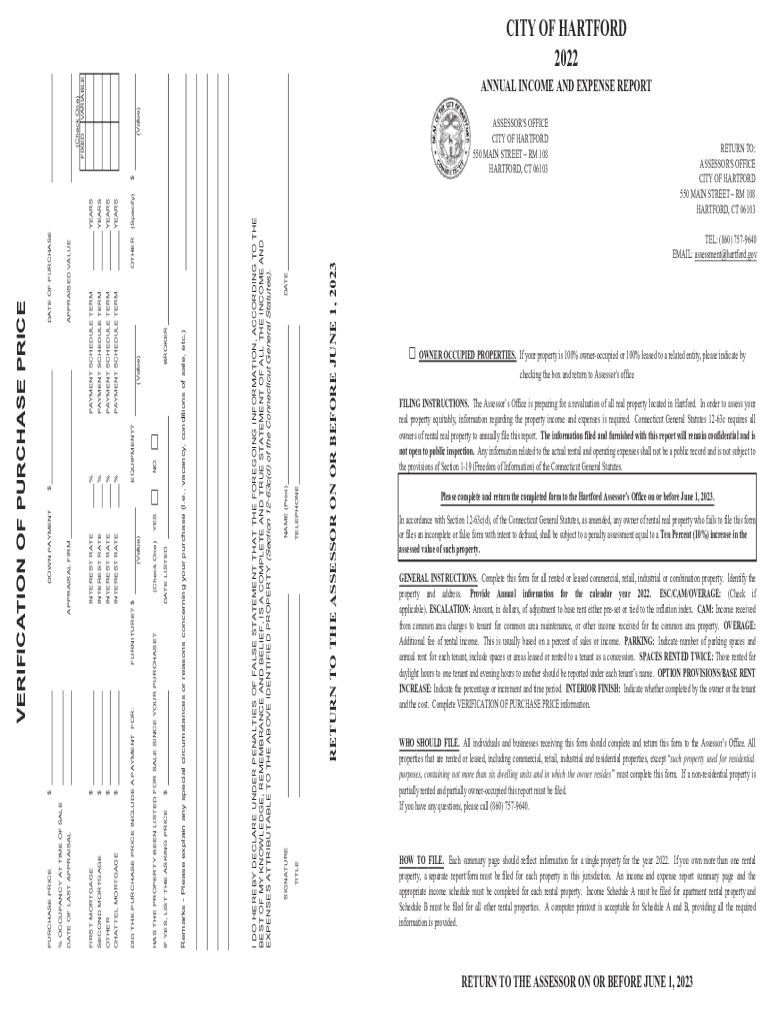

The IncomeExpense Form 20201 pdf is a financial document used primarily for reporting income and expenses for various purposes, including tax filings and financial assessments. This form is crucial for individuals and businesses to maintain accurate records of their earnings and expenditures. It helps users track their financial performance and is often required by the Internal Revenue Service (IRS) for tax compliance.

How to use the IncomeExpense Form 20201 pdf

Using the IncomeExpense Form 20201 pdf involves several straightforward steps. First, download the form from a reliable source. Next, fill in the required fields, including personal information, income sources, and detailed expense categories. Ensure that all entries are accurate and supported by relevant documentation. After completing the form, review it for any errors before submitting it to the appropriate authority, such as the IRS or your financial institution.

Steps to complete the IncomeExpense Form 20201 pdf

Completing the IncomeExpense Form 20201 pdf requires careful attention to detail. Follow these steps:

- Download the form from a trusted source.

- Provide your personal information, including name, address, and Social Security number.

- List all sources of income, such as wages, freelance earnings, or rental income.

- Detail your expenses, categorizing them into sections like business costs, personal expenses, and deductions.

- Attach any necessary documentation, such as receipts or bank statements, to support your entries.

- Review the completed form for accuracy and completeness.

- Submit the form according to the specified guidelines.

Key elements of the IncomeExpense Form 20201 pdf

The IncomeExpense Form 20201 pdf includes several key elements that are essential for accurate reporting. These elements typically consist of:

- Personal Information: Name, address, and identification details.

- Income Section: A comprehensive list of all income sources.

- Expense Section: Detailed categories for different types of expenses.

- Total Income and Expenses: Calculations that summarize financial performance.

- Signature Line: A space for the individual to sign and date the form, confirming its accuracy.

Legal use of the IncomeExpense Form 20201 pdf

The IncomeExpense Form 20201 pdf is legally recognized for various financial reporting purposes. It is essential for compliance with IRS regulations and can be used in audits or financial reviews. Properly completing and submitting this form ensures that individuals and businesses adhere to legal requirements, minimizing the risk of penalties or legal issues related to financial misreporting.

Filing Deadlines / Important Dates

Filing deadlines for the IncomeExpense Form 20201 pdf can vary based on the specific requirements of the IRS or other governing bodies. Generally, individuals must submit their forms by the tax filing deadline, which is typically April fifteenth for most taxpayers. It is important to stay informed about any changes in deadlines or requirements to ensure timely submission and compliance.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the incomeexpense form 20201 pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IncomeExpense Form 20201 pdf?

The IncomeExpense Form 20201 pdf is a standardized document used for reporting income and expenses for tax purposes. It simplifies the process of tracking financial data, making it easier for businesses and individuals to prepare their tax returns accurately.

-

How can I access the IncomeExpense Form 20201 pdf?

You can easily access the IncomeExpense Form 20201 pdf through the airSlate SignNow platform. Simply sign up for an account, and you can download or create the form directly within the application.

-

Is there a cost associated with using the IncomeExpense Form 20201 pdf on airSlate SignNow?

airSlate SignNow offers a cost-effective solution for using the IncomeExpense Form 20201 pdf. Pricing plans vary based on features and usage, but they are designed to be affordable for businesses of all sizes.

-

What features does airSlate SignNow offer for the IncomeExpense Form 20201 pdf?

airSlate SignNow provides features such as eSigning, document sharing, and secure storage for the IncomeExpense Form 20201 pdf. These features enhance the efficiency of managing your financial documents and ensure compliance with legal standards.

-

Can I integrate the IncomeExpense Form 20201 pdf with other software?

Yes, airSlate SignNow allows for seamless integration with various software applications, making it easy to use the IncomeExpense Form 20201 pdf alongside your existing tools. This integration helps streamline your workflow and improves productivity.

-

What are the benefits of using the IncomeExpense Form 20201 pdf with airSlate SignNow?

Using the IncomeExpense Form 20201 pdf with airSlate SignNow offers numerous benefits, including time savings, improved accuracy, and enhanced security. The platform's user-friendly interface makes it easy to manage your financial documents efficiently.

-

Is the IncomeExpense Form 20201 pdf customizable?

Absolutely! The IncomeExpense Form 20201 pdf can be customized to meet your specific needs within the airSlate SignNow platform. You can add your branding, modify fields, and tailor the document to suit your business requirements.

Get more for IncomeExpense Form 20201 pdf

- Notice of dishonored check civil keywords bad check bounced check wisconsin form

- Mutual wills containing last will and testaments for man and woman living together not married with no children wisconsin form

- Mutual wills package of last wills and testaments for man and woman living together not married with adult children wisconsin form

- Mutual wills or last will and testaments for man and woman living together not married with minor children wisconsin form

- Wisconsin cohabitation form

- Paternity law and procedure handbook wisconsin form

- Bill of sale in connection with sale of business by individual or corporate seller wisconsin form

- Office lease agreement wisconsin form

Find out other IncomeExpense Form 20201 pdf

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe