Claiming the Adoption Expenses Tax Credit 2023-2026

Understanding the Adoption Expenses Tax Credit

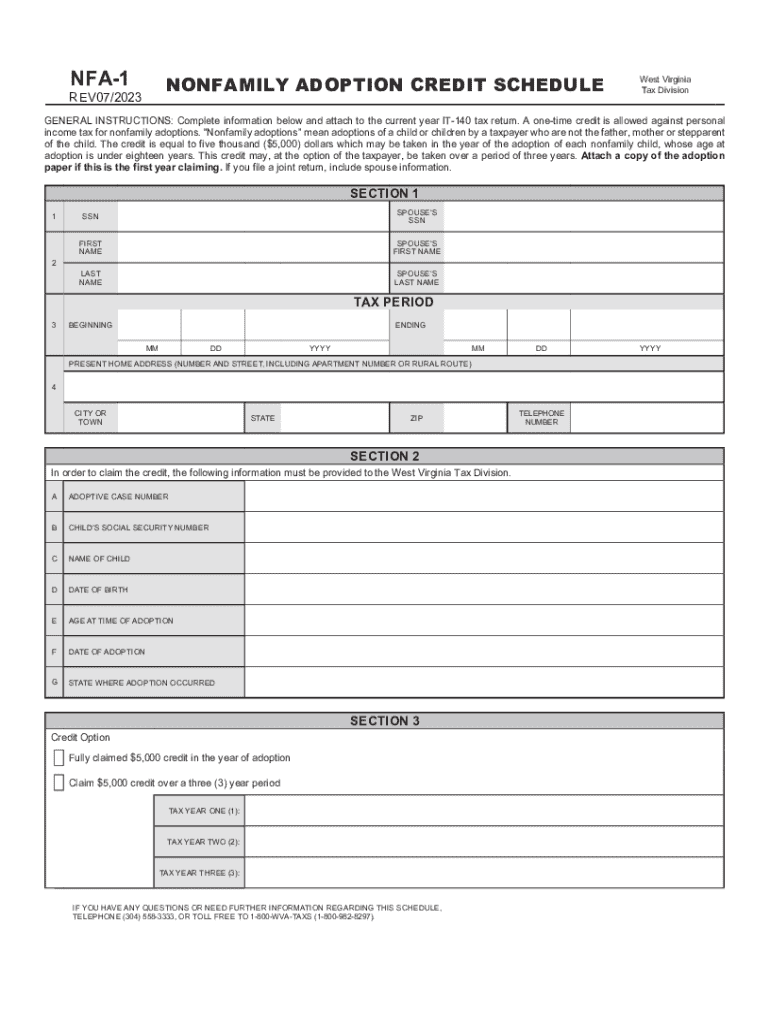

The Adoption Expenses Tax Credit is a valuable financial benefit for families who adopt children. This credit helps offset the costs associated with adoption, including legal fees, agency fees, and other related expenses. The credit is designed to support both family and non-family adoptions, making it accessible to a wide range of adoptive parents. In West Virginia, the wv nfa 1 form is specifically used to claim this credit, ensuring that families can receive the financial assistance they need during the adoption process.

Eligibility Criteria for the Adoption Expenses Tax Credit

To qualify for the Adoption Expenses Tax Credit, applicants must meet specific criteria. Generally, the credit is available to individuals or couples who have incurred qualified adoption expenses. These expenses can include fees paid to adoption agencies, legal costs, and travel expenses related to the adoption process. Additionally, the adoption must be finalized, and the child must be under the age of eighteen at the time of the adoption. Understanding these eligibility requirements is crucial for successfully claiming the credit on the wv nfa 1 form.

Steps to Complete the wv nfa 1 Form

Filling out the wv nfa 1 form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documentation, including receipts for adoption-related expenses. Next, accurately complete the form, providing detailed information about the adoption and the associated costs. It is essential to double-check all entries for correctness before submission. Finally, submit the completed form to the appropriate tax authority, either electronically or by mail, depending on your preference.

Required Documents for Claiming the Credit

When applying for the Adoption Expenses Tax Credit using the wv nfa 1 form, certain documents are required to substantiate your claim. These documents typically include:

- Receipts for all qualified adoption expenses.

- Legal documentation confirming the finalization of the adoption.

- Proof of the child's age and relationship to the adoptive parents.

Having these documents organized and ready will streamline the process and help ensure a successful claim.

Filing Deadlines for the Adoption Expenses Tax Credit

It is important to be aware of the filing deadlines associated with the Adoption Expenses Tax Credit. Typically, the wv nfa 1 form must be submitted by the tax filing deadline for the year in which the adoption was finalized. For most taxpayers, this deadline falls on April fifteenth. However, if additional time is needed, taxpayers may file for an extension, which can provide extra time to gather necessary documentation and complete the form.

IRS Guidelines for Adoption Tax Credits

The IRS provides specific guidelines regarding the Adoption Expenses Tax Credit, including the maximum credit amount and eligible expenses. It is crucial to review these guidelines to ensure compliance and maximize the financial benefit. The IRS updates its regulations periodically, so staying informed about any changes can help prevent issues during the filing process. Consulting the IRS website or a tax professional can provide clarity on the latest requirements and benefits available.

Create this form in 5 minutes or less

Find and fill out the correct claiming the adoption expenses tax credit

Create this form in 5 minutes!

How to create an eSignature for the claiming the adoption expenses tax credit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is wv nfa 1 and how does it relate to airSlate SignNow?

The wv nfa 1 is a specific document type that can be easily managed using airSlate SignNow. This platform allows users to send, sign, and store wv nfa 1 documents securely, streamlining the entire process for businesses.

-

How much does airSlate SignNow cost for managing wv nfa 1 documents?

airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. The cost for managing wv nfa 1 documents is included in these plans, providing a cost-effective solution for document management and eSigning.

-

What features does airSlate SignNow offer for wv nfa 1 document handling?

airSlate SignNow provides a range of features for wv nfa 1 document handling, including customizable templates, automated workflows, and secure cloud storage. These features enhance efficiency and ensure compliance with legal standards.

-

Can I integrate airSlate SignNow with other tools for wv nfa 1 processing?

Yes, airSlate SignNow offers seamless integrations with various tools and platforms, making it easy to manage wv nfa 1 documents alongside your existing software. This flexibility helps streamline your workflow and improve productivity.

-

What are the benefits of using airSlate SignNow for wv nfa 1 documents?

Using airSlate SignNow for wv nfa 1 documents provides numerous benefits, including faster turnaround times, reduced paper usage, and enhanced security. These advantages help businesses operate more efficiently and sustainably.

-

Is airSlate SignNow user-friendly for managing wv nfa 1 documents?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to manage wv nfa 1 documents without extensive training. Its intuitive interface allows users to navigate the platform effortlessly.

-

How secure is airSlate SignNow for wv nfa 1 document storage?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect wv nfa 1 documents. Users can trust that their sensitive information is safe and secure within the platform.

Get more for Claiming The Adoption Expenses Tax Credit

Find out other Claiming The Adoption Expenses Tax Credit

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now