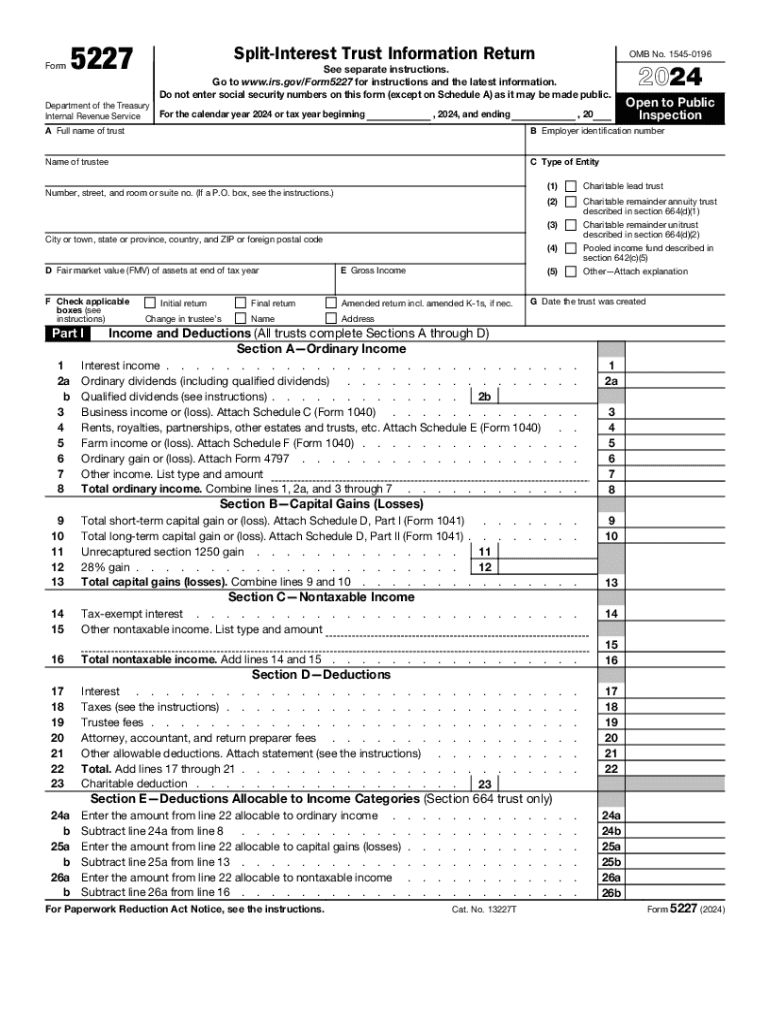

Form 5227, the Split Interest Trust Information 2024

What is the Form 5227?

The Form 5227, officially known as the Split Interest Trust Information, is a document used to report information about split-interest trusts. These trusts are designed to benefit both charitable organizations and non-charitable beneficiaries. The form provides the Internal Revenue Service (IRS) with essential details regarding the trust’s assets, income, and distributions. It is crucial for ensuring compliance with federal tax regulations and for the proper administration of the trust.

How to use the Form 5227

Using the Form 5227 involves accurately filling out the required sections to report the trust’s financial activities. This includes detailing income generated by the trust, distributions made to beneficiaries, and any contributions to the trust. The form must be submitted annually, typically alongside the trust's tax return. It is important to ensure that all information is complete and accurate to avoid potential penalties.

Steps to complete the Form 5227

Completing the Form 5227 requires several key steps:

- Gather necessary information: Collect details about the trust, including its name, tax identification number, and financial statements.

- Fill out the form: Input the required information in the appropriate sections, such as income, deductions, and distributions.

- Review for accuracy: Double-check all entries to ensure there are no errors or omissions.

- Submit the form: File the completed Form 5227 with the IRS by the deadline.

Key elements of the Form 5227

The Form 5227 includes several critical components that need to be addressed:

- Trust information: Basic details about the trust, including its type and purpose.

- Financial data: Income, expenses, and distributions made during the tax year.

- Beneficiary information: Details about both charitable and non-charitable beneficiaries receiving benefits from the trust.

- Compliance statements: Affirmations regarding adherence to IRS regulations and reporting requirements.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the Form 5227. Generally, the form must be submitted by the fifteenth day of the fourth month following the end of the trust's tax year. For trusts operating on a calendar year basis, this typically means the deadline is April 15. However, if the deadline falls on a weekend or holiday, it is extended to the next business day. Keeping track of these dates helps avoid late filing penalties.

Legal use of the Form 5227

The legal use of the Form 5227 is fundamental for maintaining compliance with IRS regulations. Trusts that fail to file this form may face penalties, including fines and potential disqualification of tax-exempt status. Properly completing and submitting the form ensures that the trust operates within the legal framework established by the IRS, safeguarding both the trust and its beneficiaries.

Create this form in 5 minutes or less

Find and fill out the correct form 5227 the split interest trust information

Create this form in 5 minutes!

How to create an eSignature for the form 5227 the split interest trust information

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 5227 and how can airSlate SignNow help?

Form 5227 is a tax form used for reporting certain financial information. airSlate SignNow simplifies the process of completing and eSigning form 5227, ensuring that your documents are securely managed and easily accessible.

-

What features does airSlate SignNow offer for managing form 5227?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking specifically for form 5227. These tools help streamline the completion and submission process, making it more efficient for users.

-

Is there a cost associated with using airSlate SignNow for form 5227?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan includes features that support the management of form 5227, ensuring you get the best value for your investment.

-

Can I integrate airSlate SignNow with other software for form 5227?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to manage form 5227 alongside your existing tools. This integration enhances productivity and ensures a smooth workflow.

-

What are the benefits of using airSlate SignNow for form 5227?

Using airSlate SignNow for form 5227 offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform's user-friendly interface makes it easy for anyone to complete and eSign documents quickly.

-

How secure is airSlate SignNow when handling form 5227?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your form 5227 and other documents. You can trust that your sensitive information is safe and secure throughout the signing process.

-

Can I access my form 5227 documents from anywhere?

Yes, airSlate SignNow allows you to access your form 5227 documents from any device with internet connectivity. This flexibility ensures that you can manage your documents on the go, making it convenient for busy professionals.

Get more for Form 5227, The Split Interest Trust Information

- Secondary dissemination form

- Application format for change of home town

- Fsa 2344 fillable form

- Greystar rental requirements form

- Prince william county building permit application form

- Valvoline rebate form

- Kipp houston public schools athletics preparation physical form

- Family code chapter 162 adoption texasoklahoma child adoption laws and statutes family code chapter 162 adoption texasoklahoma form

Find out other Form 5227, The Split Interest Trust Information

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free