Federal Form 5227 Split Interest Trust Information Return 2023

What is the Federal Form 5227 Split Interest Trust Information Return

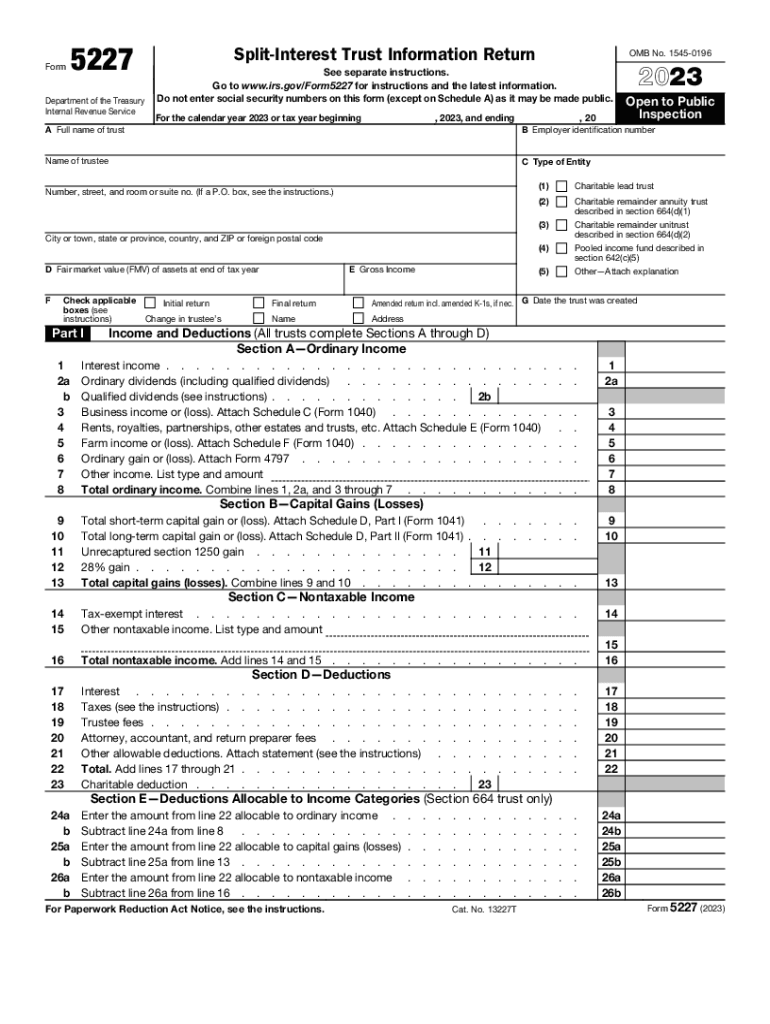

The Federal Form 5227, also known as the Split Interest Trust Information Return, is a tax form used by split-interest trusts to report their financial activities to the Internal Revenue Service (IRS). This form is essential for trusts that have both charitable and non-charitable beneficiaries. It provides detailed information about the trust's income, deductions, and distributions, ensuring compliance with federal tax regulations. The form helps the IRS monitor the activities of these trusts and ensures that they adhere to the legal requirements associated with their tax-exempt status.

How to use the Federal Form 5227 Split Interest Trust Information Return

Using the Federal Form 5227 involves several steps to ensure accurate reporting. First, gather all necessary financial documents related to the trust, including income statements, expense records, and information about distributions to beneficiaries. Next, complete the form by filling in the required sections, which include details about the trust's income, expenses, and distributions. It is crucial to provide accurate information, as errors can lead to penalties or delays in processing. After completing the form, review it for accuracy before submitting it to the IRS by the designated deadline.

Steps to complete the Federal Form 5227 Split Interest Trust Information Return

Completing the Federal Form 5227 requires careful attention to detail. Follow these steps for a successful submission:

- Gather all relevant financial documents, including income and expense records.

- Begin filling out the form with the trust's identifying information, including the name and taxpayer identification number.

- Detail the trust's income sources, such as interest, dividends, and capital gains.

- List all allowable deductions, including administrative expenses and charitable contributions.

- Document distributions made to beneficiaries, ensuring accurate reporting of amounts and dates.

- Review the completed form for accuracy and completeness.

- Submit the form to the IRS by the specified deadline, either electronically or via mail.

Filing Deadlines / Important Dates

The filing deadline for the Federal Form 5227 typically aligns with the annual tax return deadlines. Trusts must file Form 5227 by the fifteenth day of the fourth month after the end of their tax year. For trusts operating on a calendar year, this means the form is due by April 15. It is essential to be aware of these deadlines to avoid penalties and ensure timely compliance. If the deadline falls on a weekend or holiday, the due date may be extended to the next business day.

Key elements of the Federal Form 5227 Split Interest Trust Information Return

Several key elements are critical when completing the Federal Form 5227. These include:

- Trust Information: Basic details about the trust, including its name, address, and taxpayer identification number.

- Income Reporting: A comprehensive account of all income sources, including interest, dividends, and capital gains.

- Deductions: A section for reporting allowable deductions, such as administrative expenses and charitable contributions.

- Distributions: Detailed reporting of distributions made to both charitable and non-charitable beneficiaries.

- Signature: The form must be signed by the trustee or authorized representative, affirming the accuracy of the information provided.

Legal use of the Federal Form 5227 Split Interest Trust Information Return

The legal use of the Federal Form 5227 is primarily for compliance with federal tax laws governing split-interest trusts. Trusts must file this form to maintain their tax-exempt status and to ensure that they are fulfilling their reporting obligations to the IRS. Failure to file the form or inaccuracies in reporting can result in penalties, including fines or the loss of tax-exempt status. It is advisable for trustees to consult with a tax professional to navigate the complexities of trust taxation and ensure adherence to all legal requirements.

Quick guide on how to complete federal form 5227 split interest trust information return

Complete Federal Form 5227 Split Interest Trust Information Return effortlessly on any device

Digital document management has become increasingly popular with businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, edit, and eSign your documents quickly and without delays. Manage Federal Form 5227 Split Interest Trust Information Return on any platform using airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to edit and eSign Federal Form 5227 Split Interest Trust Information Return without any hassle

- Find Federal Form 5227 Split Interest Trust Information Return and click Get Form to begin.

- Make use of the tools we provide to complete your form.

- Mark important sections of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the frustration of lost or misplaced files, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Modify and eSign Federal Form 5227 Split Interest Trust Information Return and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct federal form 5227 split interest trust information return

Create this form in 5 minutes!

How to create an eSignature for the federal form 5227 split interest trust information return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IRS Form 5227?

IRS Form 5227 is a tax form used to report the information required for certain tax-exempt organizations. It helps in tracking trust and annuity distributions, ensuring compliance with IRS regulations. Understanding IRS Form 5227 is essential for maintaining your organization’s tax-exempt status.

-

How can airSlate SignNow help with IRS Form 5227?

airSlate SignNow provides an efficient platform for electronically signing and managing IRS Form 5227 documents. Our solution streamlines the process, making it easier for organizations to report the necessary information accurately. Plus, the secure eSigning feature ensures that all submitted forms are legally binding.

-

Is there a cost associated with using airSlate SignNow for IRS Form 5227?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan provides access to features that enhance the management of IRS Form 5227, including eSignature capabilities, document templates, and secure storage. You can choose a plan that best fits your organization's budget and requirements.

-

What features does airSlate SignNow offer for handling IRS Form 5227?

airSlate SignNow includes essential features like customizable templates for IRS Form 5227, multilingual support, and automated reminders for signatures. Additionally, our user-friendly interface simplifies the document workflow. With robust security measures in place, your sensitive tax documents are kept safe.

-

Can I integrate airSlate SignNow with other software for filing IRS Form 5227?

Absolutely! airSlate SignNow offers integrations with popular platforms like Google Drive, Dropbox, and various CRM systems. This enables you to easily access and manage your IRS Form 5227 alongside other important documents. Seamless integration enhances your workflow efficiency and keeps everything organized.

-

What benefits does eSigning provide for IRS Form 5227?

eSigning with airSlate SignNow accelerates the approval process for IRS Form 5227, saving you time and reducing paper usage. It offers convenience, allowing signers to complete the form from anywhere. Moreover, your documents are stored securely and can be accessed or retrieved at any time, adding to overall efficiency.

-

Is airSlate SignNow user-friendly for those unfamiliar with IRS Form 5227?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it accessible even for those unfamiliar with IRS Form 5227. Our intuitive platform guides users through the entire process, from preparing documents to securing signatures. Additionally, we provide customer support to assist with any questions.

Get more for Federal Form 5227 Split Interest Trust Information Return

Find out other Federal Form 5227 Split Interest Trust Information Return

- Electronic signature New Jersey Lease Renewal Free

- Electronic signature Texas Lease Renewal Fast

- How Can I Electronic signature Colorado Notice of Intent to Vacate

- eSignature Delaware Employee Compliance Survey Later

- eSignature Kansas Employee Compliance Survey Myself

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage

- Electronic signature West Virginia Sales Receipt Template Free

- Electronic signature Colorado Sales Invoice Template Computer

- Electronic signature New Hampshire Sales Invoice Template Computer

- Electronic signature Tennessee Introduction Letter Free

- How To eSignature Michigan Disclosure Notice

- How To Electronic signature Ohio Product Defect Notice