Www Irs Govpubirs Pdf2021 Form 5227 IRS Tax Forms 2021

What is Form 5227?

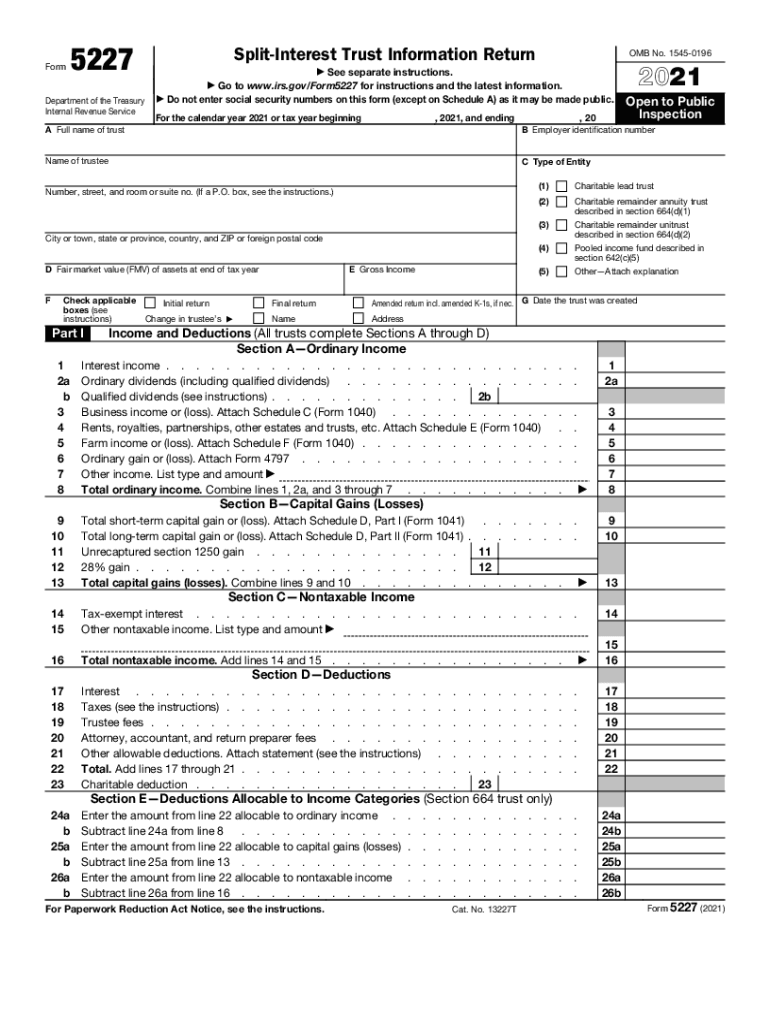

The form 5227, officially known as the "Split-Interest Trust Information Return," is utilized by split-interest trusts to report their income, deductions, and other pertinent information to the Internal Revenue Service (IRS). This form is essential for trusts that distribute income to both charitable and non-charitable beneficiaries, ensuring compliance with federal tax regulations. By accurately completing the form 5227, trustees can provide the IRS with a comprehensive overview of the trust's financial activities, which is crucial for maintaining transparency and fulfilling tax obligations.

Steps to Complete Form 5227

Completing the form 5227 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents related to the trust, including income statements, deduction records, and details about beneficiaries. Next, begin filling out the form by providing basic information about the trust, such as its name, address, and tax identification number. Follow the instructions carefully to report income, deductions, and distributions accurately. Finally, review the completed form for any errors before submitting it to the IRS.

Legal Use of Form 5227

Form 5227 serves a vital legal purpose in the realm of tax compliance for split-interest trusts. The IRS requires this form to ensure that trusts adhere to tax laws and regulations. When filled out correctly, the form helps establish the legitimacy of the trust's operations and its adherence to federal tax obligations. Additionally, electronic signatures on the form are legally valid, provided that the signing process meets the requirements set forth by the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA).

IRS Guidelines for Form 5227

The IRS provides specific guidelines for completing and submitting form 5227. These guidelines outline the necessary information that must be reported, including the trust's income, deductions, and distributions to beneficiaries. It is essential to follow these guidelines closely to avoid potential penalties for non-compliance. The IRS also emphasizes the importance of timely filing, ensuring that the form is submitted by the designated deadlines to maintain good standing with tax authorities.

Filing Deadlines for Form 5227

Timely filing of form 5227 is crucial for compliance. The form is typically due on the 15th day of the fourth month following the end of the trust's tax year. For trusts operating on a calendar year, this means the form must be submitted by April 15. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. Trustees should be aware of these deadlines to avoid late filing penalties and ensure compliance with IRS regulations.

Form Submission Methods

Form 5227 can be submitted to the IRS through various methods, including electronic filing and traditional mail. Electronic filing is encouraged as it may expedite processing times and reduce the risk of errors. If filing by mail, ensure that the form is sent to the correct IRS address based on the trust's location and the nature of the trust. Proper submission methods are essential for ensuring that the form is received and processed in a timely manner.

Quick guide on how to complete wwwirsgovpubirs pdf2021 form 5227 irs tax forms

Prepare Www irs govpubirs pdf2021 Form 5227 IRS Tax Forms effortlessly on any gadget

Digital document management has gained signNow traction among businesses and individuals. It offers an ideal environmentally friendly substitute to conventional printed and signed documentation, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without unnecessary hold-ups. Handle Www irs govpubirs pdf2021 Form 5227 IRS Tax Forms on any gadget using airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to adjust and eSign Www irs govpubirs pdf2021 Form 5227 IRS Tax Forms effortlessly

- Obtain Www irs govpubirs pdf2021 Form 5227 IRS Tax Forms and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive details with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal significance as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, and errors that require printing new document copies. airSlate SignNow manages all your document administration needs in just a few clicks from a device of your choice. Modify and eSign Www irs govpubirs pdf2021 Form 5227 IRS Tax Forms and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wwwirsgovpubirs pdf2021 form 5227 irs tax forms

Create this form in 5 minutes!

How to create an eSignature for the wwwirsgovpubirs pdf2021 form 5227 irs tax forms

The best way to make an e-signature for a PDF online

The best way to make an e-signature for a PDF in Google Chrome

The way to create an e-signature for signing PDFs in Gmail

How to generate an e-signature straight from your smartphone

How to make an e-signature for a PDF on iOS

How to generate an e-signature for a PDF document on Android

People also ask

-

What is form 5227 and how can airSlate SignNow help with it?

Form 5227 is a tax form used for reporting various tax-related information. With airSlate SignNow, you can easily create and eSign this form, ensuring compliance and accuracy while streamlining your document workflow.

-

Is there a cost associated with using airSlate SignNow for form 5227?

Yes, airSlate SignNow offers competitive pricing plans tailored to different business needs. When using it for form 5227, you can choose a plan that fits your budget while benefiting from efficient document management and electronic signatures.

-

Can I integrate airSlate SignNow with other software to manage form 5227?

Absolutely! airSlate SignNow integrates seamlessly with numerous applications, allowing you to manage form 5227 alongside your existing tools. This enhances collaboration and ensures that your document management process is efficient and streamlined.

-

What are the key features of airSlate SignNow for handling form 5227?

Key features include customizable templates, automated workflows, and powerful eSigning capabilities. These features make it easy to prepare, send, and track form 5227, saving you time and improving your overall productivity.

-

How secure is airSlate SignNow when using it for sensitive documents like form 5227?

Security is a top priority for airSlate SignNow. When handling sensitive documents like form 5227, the platform offers advanced encryption and compliance with industry standards, ensuring that your information is protected throughout the entire signing process.

-

Can I access airSlate SignNow on mobile devices while managing form 5227?

Yes, airSlate SignNow is fully optimized for mobile devices, allowing you to access and manage form 5227 anytime, anywhere. With the mobile app, you can easily eSign and send documents on the go.

-

What benefits does airSlate SignNow provide when using it for form 5227?

Using airSlate SignNow for form 5227 offers numerous benefits, including increased efficiency, reduced turnaround time, and improved accuracy. The ease of eSigning and document sharing enhances collaboration and ensures quicker completion of essential tasks.

Get more for Www irs govpubirs pdf2021 Form 5227 IRS Tax Forms

Find out other Www irs govpubirs pdf2021 Form 5227 IRS Tax Forms

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure