Form 5227 2018

What is the Form 5227

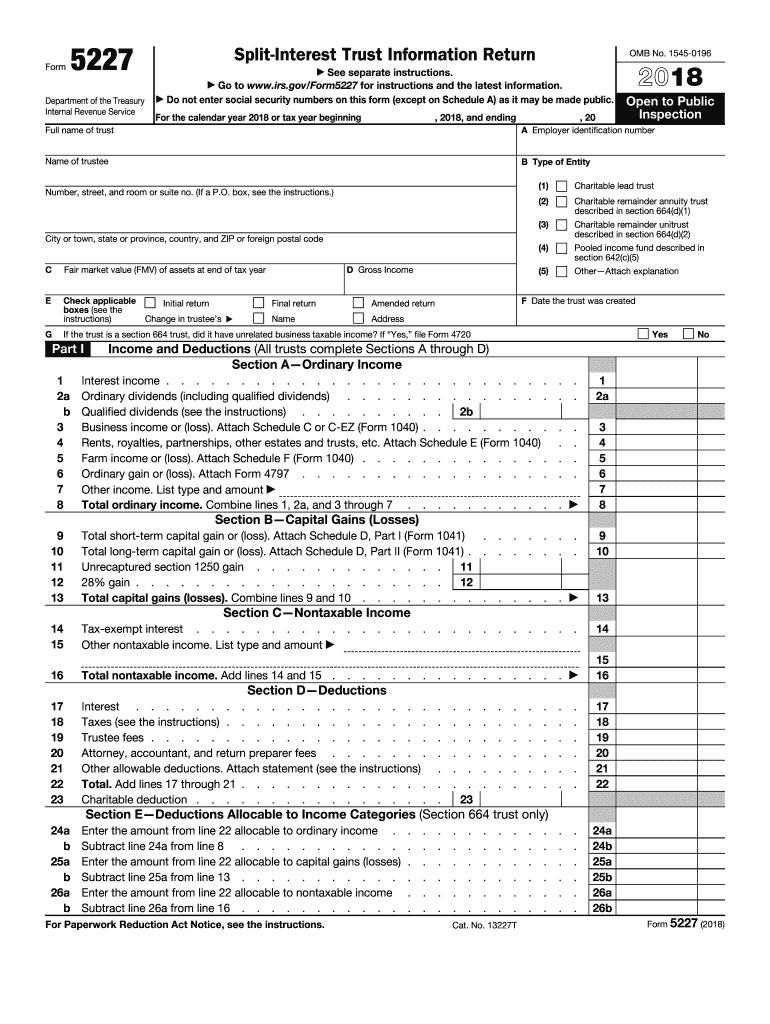

The Form 5227, officially known as the Department of the Treasury Form 5227, is a federal tax form used to report and manage the financial activities of certain tax-exempt organizations. This form is particularly relevant for organizations that are required to disclose their financial information to the IRS. It helps ensure transparency and compliance with federal tax regulations, making it a crucial document for maintaining tax-exempt status.

How to use the Form 5227

Using the Form 5227 involves several key steps. First, organizations must gather relevant financial data, including income, expenses, and other financial activities. Next, they should accurately fill out the form, ensuring that all required fields are completed. It's important to review the form for accuracy before submission, as errors can lead to compliance issues. Once completed, the form can be submitted electronically or via mail, depending on the organization's preference and compliance requirements.

Steps to complete the Form 5227

Completing the Form 5227 requires careful attention to detail. Here are the essential steps:

- Gather Information: Collect all necessary financial records, including income statements and expense reports.

- Fill Out the Form: Enter the required information in the designated fields, ensuring accuracy.

- Review: Double-check all entries for correctness and completeness.

- Submit: Choose your submission method, either electronically or by mailing the form to the appropriate IRS address.

Legal use of the Form 5227

The legal use of the Form 5227 is governed by IRS regulations, which stipulate that tax-exempt organizations must file this form to maintain compliance. It is essential that organizations understand the legal implications of their disclosures. Proper completion and timely submission of the form help avoid penalties and ensure that the organization retains its tax-exempt status. Additionally, organizations must adhere to specific guidelines set forth by the IRS to ensure their filings are legally valid.

Filing Deadlines / Important Dates

Filing deadlines for the Form 5227 can vary based on the organization's fiscal year. Generally, the form must be submitted by the 15th day of the fifth month after the end of the organization's tax year. Organizations should keep track of these deadlines to avoid late filing penalties. It is advisable to consult the IRS guidelines or a tax professional for specific dates relevant to your organization.

Required Documents

To complete the Form 5227, organizations need to prepare several documents, including:

- Financial statements detailing income and expenses.

- Records of contributions and grants received.

- Documentation supporting any deductions claimed.

- Previous tax returns, if applicable.

Having these documents ready will facilitate a smoother completion process and help ensure compliance with IRS requirements.

Quick guide on how to complete 2018 form 5227

Complete Form 5227 effortlessly on any device

Web-based document management has become increasingly favored by both organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the necessary form and securely save it online. airSlate SignNow equips you with all the tools you need to create, modify, and electronically sign your documents quickly without delays. Manage Form 5227 on any platform with airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to modify and electronically sign Form 5227 with ease

- Locate Form 5227 and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to share your form, via email, SMS, or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Form 5227 and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2018 form 5227

Create this form in 5 minutes!

How to create an eSignature for the 2018 form 5227

How to make an eSignature for the 2018 Form 5227 online

How to make an electronic signature for the 2018 Form 5227 in Google Chrome

How to generate an electronic signature for signing the 2018 Form 5227 in Gmail

How to make an eSignature for the 2018 Form 5227 straight from your smart phone

How to create an electronic signature for the 2018 Form 5227 on iOS

How to generate an electronic signature for the 2018 Form 5227 on Android devices

People also ask

-

What is Form 5227 and how does it relate to airSlate SignNow?

Form 5227 is a tax form used to report information about certain trusts. Using airSlate SignNow, businesses can easily send and eSign Form 5227, ensuring that all necessary signatures are collected efficiently and securely.

-

What features does airSlate SignNow offer for managing Form 5227?

airSlate SignNow offers a range of features for managing Form 5227, including document templates, automated workflows, and secure eSignature capabilities. These features streamline the process of completing and submitting Form 5227, making it easier for businesses to stay compliant.

-

Can I customize Form 5227 templates in airSlate SignNow?

Yes, airSlate SignNow allows users to customize Form 5227 templates to suit their specific needs. You can easily add fields, adjust formatting, and include company branding to ensure that your Form 5227 reflects your business's identity.

-

Is there a cost associated with using airSlate SignNow for Form 5227?

airSlate SignNow offers flexible pricing plans, allowing businesses to choose a solution that fits their budget. Whether you need to send a few Form 5227 documents or process them in bulk, you can find a plan that meets your requirements.

-

How does airSlate SignNow ensure the security of my Form 5227 documents?

airSlate SignNow prioritizes security with advanced encryption and compliance with industry standards. Your Form 5227 documents are protected throughout the signing process, ensuring that sensitive information remains confidential.

-

Can I integrate airSlate SignNow with other tools for managing Form 5227?

Absolutely! airSlate SignNow offers integrations with various third-party applications, such as CRM systems and cloud storage services. This allows you to streamline your workflow and manage Form 5227 alongside other essential business processes.

-

What benefits does airSlate SignNow provide for businesses handling Form 5227?

Using airSlate SignNow for Form 5227 enhances efficiency and reduces turnaround times. The platform's user-friendly interface and automation features simplify the eSigning process, allowing businesses to focus on their core activities without delays.

Get more for Form 5227

- Scale asperger syndrome pdf form

- Sheet family court 2013 2019 form

- 02 family law non custodial parent motion in title iv d 6 2012 form

- Usda rd form rd 2006 38 12 94 civil rights impact

- 2010 underpayment of estimated maryland income tax by individuals form 502up attach this form to form 502 503 or

- Te puawaitanga scholarship form

- Usfk form 207

- Dd form 1172 2 2014 2019

Find out other Form 5227

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney