Form 5227 2020

What is the Form 5227

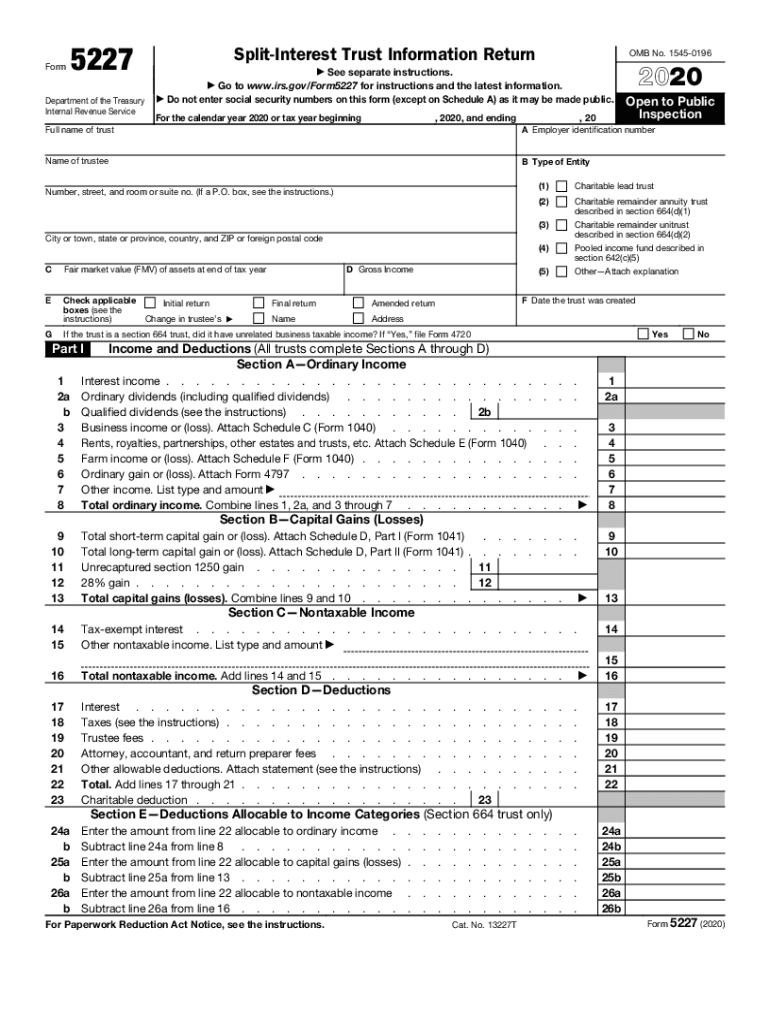

The Form 5227, officially known as the Department of the Treasury Form 5227, is a federal tax form used by individuals to report the information related to certain trusts. This form is primarily utilized for reporting the income, deductions, and credits associated with a trust that is required to file an annual return. It is essential for maintaining compliance with IRS regulations and ensuring accurate reporting of trust activities.

How to use the Form 5227

Using the Form 5227 involves several steps to ensure accurate completion. First, gather all necessary information regarding the trust, including its income, expenses, and any distributions made during the tax year. Next, fill out each section of the form carefully, ensuring that all figures are accurate and correspond to the supporting documentation. After completing the form, review it for any errors before submission. This will help avoid potential issues with the IRS.

Steps to complete the Form 5227

Completing the Form 5227 requires attention to detail. Follow these steps for successful completion:

- Gather all relevant financial documents related to the trust.

- Begin with the identification section, providing the trust's name, address, and taxpayer identification number.

- Fill in the income section, detailing all sources of income received by the trust.

- Document any deductions applicable to the trust, ensuring they are supported by receipts or records.

- Include any distributions made to beneficiaries and provide the necessary details.

- Review the completed form for accuracy before submission.

Legal use of the Form 5227

The legal use of the Form 5227 is governed by IRS regulations. To ensure that the form is considered valid, it must be filled out accurately and submitted on time. Compliance with the IRS guidelines is crucial, as failure to do so may result in penalties or legal repercussions. Additionally, the form must be signed by the appropriate parties, affirming that the information provided is truthful and complete.

Filing Deadlines / Important Dates

Filing deadlines for the Form 5227 are critical for compliance. Typically, the form must be submitted by the fifteenth day of the fourth month following the end of the trust's tax year. For trusts operating on a calendar year, this means the form is due by April 15. It is essential to be aware of these deadlines to avoid late filing penalties and ensure the trust remains in good standing with the IRS.

Required Documents

When filling out the Form 5227, certain documents are necessary to support the information reported. These may include:

- Trust agreement or declaration.

- Financial statements detailing income and expenses.

- Records of distributions made to beneficiaries.

- Any relevant tax documents, such as previous year returns.

Having these documents on hand will facilitate the accurate completion of the form and ensure compliance with IRS requirements.

Quick guide on how to complete form 5227

Effortlessly Prepare Form 5227 on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, alter, and eSign your documents promptly without delays. Handle Form 5227 on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to Alter and eSign Form 5227 with Ease

- Locate Form 5227 and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, the hassle of seeking forms, or mistakes that necessitate reprinting new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from a device of your preference. Revise and eSign Form 5227 to ensure outstanding communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 5227

Create this form in 5 minutes!

How to create an eSignature for the form 5227

How to create an electronic signature for your PDF in the online mode

How to create an electronic signature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

How to create an eSignature straight from your smart phone

How to create an electronic signature for a PDF on iOS devices

How to create an eSignature for a PDF document on Android OS

People also ask

-

What is a form 5227 fillable and how can I create one?

A form 5227 fillable is a customizable document designed to be easily filled out online. With airSlate SignNow, you can create your own form 5227 fillable by uploading a PDF and adding fillable fields. This streamlines data collection and ensures that the form is compliant with needed regulations.

-

How much does it cost to use airSlate SignNow for form 5227 fillable?

airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. The cost to use the platform for a form 5227 fillable varies depending on the chosen plan, with options for individual users and teams alike. You can check our website for detailed pricing and any promotional discounts currently available.

-

What features does airSlate SignNow offer for form 5227 fillable?

airSlate SignNow provides numerous features for managing form 5227 fillable, including eSignature capabilities, real-time collaboration, and document tracking. You can also customize templates, set reminders, and integrate with various applications, making it a comprehensive solution for your document management needs.

-

Can I integrate airSlate SignNow with other software for form 5227 fillable?

Yes, airSlate SignNow easily integrates with a variety of third-party applications, enhancing the functionality of your form 5227 fillable. Whether you use CRM systems, cloud storage, or project management tools, you can streamline your workflow and enhance productivity. Check our integrations page for a complete list of compatible applications.

-

What are the benefits of using airSlate SignNow for form 5227 fillable?

Using airSlate SignNow for your form 5227 fillable grants you efficiency and convenience. It allows for quick eSigning, reduces paperwork, and minimizes errors associated with manual data entry. Additionally, it helps you maintain compliance and security of your documents.

-

Is it easy to customize a form 5227 fillable in airSlate SignNow?

Absolutely! airSlate SignNow offers a user-friendly interface that allows you to easily customize your form 5227 fillable. You can add text fields, checkboxes, dropdowns, and more using drag-and-drop functionality, making it simple even for users with no technical expertise.

-

How secure is my data when using airSlate SignNow for form 5227 fillable?

Data security is a top priority for airSlate SignNow. When you use the platform for your form 5227 fillable, your data is protected with robust encryption and secure data storage protocols. Compliance with industry standards ensures that your sensitive information remains confidential.

Get more for Form 5227

- Pdf texas medical center cancer center referral form

- Counselling contract template form

- Bicycle accident report not involving a moving motor vehicle form

- Fda form 2301

- Military high value inventory form

- Nailah k byrd form

- Wwwcityofwarrenorgwarrentownecenterwarren towne center building for the future city of warren form

- Sexual history questionnaire form

Find out other Form 5227

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document

- Can I eSign Hawaii High Tech Word

- How Can I eSign Hawaii High Tech Form

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation