Form 656 Sp Rev 4 Offer in Compromise Spanish Version

What is the Form 656 sp Rev 4 Offer In Compromise Spanish Version

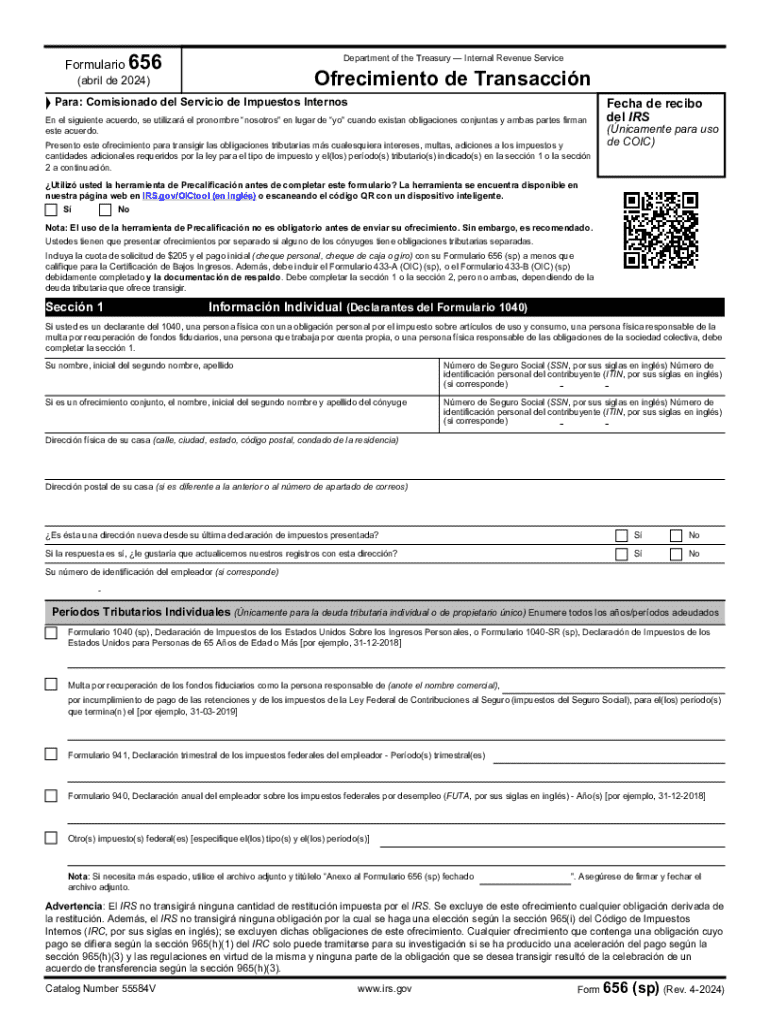

The Form 656 sp Rev 4 Offer In Compromise Spanish Version is a legal document used by taxpayers in the United States to propose a settlement with the Internal Revenue Service (IRS) regarding their tax liabilities. This form allows individuals who are unable to pay their full tax debt to negotiate a reduced amount that they can afford to pay. The Spanish version ensures that Spanish-speaking taxpayers have access to this important process, making it more inclusive and accessible.

How to use the Form 656 sp Rev 4 Offer In Compromise Spanish Version

To use the Form 656 sp Rev 4 Offer In Compromise Spanish Version, taxpayers must first determine their eligibility for an offer in compromise. This involves assessing their financial situation, including income, expenses, and asset values. Once eligibility is confirmed, the taxpayer should complete the form accurately, providing all required information about their tax liabilities and financial circumstances. After filling out the form, it must be submitted to the IRS along with the necessary fees and supporting documentation.

Steps to complete the Form 656 sp Rev 4 Offer In Compromise Spanish Version

Completing the Form 656 sp Rev 4 Offer In Compromise Spanish Version involves several key steps:

- Gather financial documents, including income statements, expense reports, and asset valuations.

- Fill out the form with accurate information, ensuring all sections are completed.

- Calculate the offer amount based on your ability to pay and the IRS guidelines.

- Attach any required documentation that supports your offer.

- Submit the form along with the application fee to the appropriate IRS address.

Eligibility Criteria

To qualify for submitting the Form 656 sp Rev 4 Offer In Compromise Spanish Version, taxpayers must meet specific criteria set by the IRS. These criteria typically include demonstrating an inability to pay the full tax liability, proving that the offer is in the best interest of both the taxpayer and the IRS, and providing accurate financial information. Taxpayers should review the IRS guidelines to ensure they meet all necessary conditions before submitting their offer.

Required Documents

When submitting the Form 656 sp Rev 4 Offer In Compromise Spanish Version, certain documents are required to support the application. These may include:

- Proof of income, such as pay stubs or tax returns.

- Documentation of monthly expenses, including bills and receipts.

- Asset information, detailing the value of properties, vehicles, and other possessions.

- A signed Form 433-A (OIC) or Form 433-B (OIC), which provides a comprehensive overview of financial status.

Form Submission Methods

The Form 656 sp Rev 4 Offer In Compromise Spanish Version can be submitted to the IRS through various methods. Taxpayers may choose to mail the completed form and supporting documents to the designated IRS address. Alternatively, some individuals may opt to submit their forms electronically, depending on the IRS's current capabilities and guidelines. It is essential to verify the submission method that best fits your situation and to ensure all documents are complete before submission.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 656 sp rev 4 offer in compromise spanish version 771158918

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 656 sp Rev 4 Offer In Compromise Spanish Version?

The Form 656 sp Rev 4 Offer In Compromise Spanish Version is a document used by individuals to propose a settlement with the IRS for tax debts. This form allows Spanish-speaking taxpayers to communicate their financial situation and negotiate a reduced tax liability. Using this form can help alleviate financial burdens and provide a clear path to resolving tax issues.

-

How can airSlate SignNow help with the Form 656 sp Rev 4 Offer In Compromise Spanish Version?

airSlate SignNow simplifies the process of completing and submitting the Form 656 sp Rev 4 Offer In Compromise Spanish Version. Our platform allows users to fill out the form electronically, ensuring accuracy and efficiency. Additionally, you can eSign the document securely, making the submission process seamless.

-

Is there a cost associated with using airSlate SignNow for the Form 656 sp Rev 4 Offer In Compromise Spanish Version?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs. Our plans are designed to be cost-effective, providing excellent value for businesses and individuals needing to manage documents like the Form 656 sp Rev 4 Offer In Compromise Spanish Version. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for the Form 656 sp Rev 4 Offer In Compromise Spanish Version?

airSlate SignNow provides a range of features for the Form 656 sp Rev 4 Offer In Compromise Spanish Version, including customizable templates, secure eSigning, and document tracking. These features enhance the user experience, making it easier to manage and submit important tax documents. Our platform also supports collaboration, allowing multiple parties to review and sign the form.

-

Can I integrate airSlate SignNow with other applications for the Form 656 sp Rev 4 Offer In Compromise Spanish Version?

Absolutely! airSlate SignNow offers integrations with various applications, enhancing your workflow when dealing with the Form 656 sp Rev 4 Offer In Compromise Spanish Version. You can connect with popular tools like Google Drive, Dropbox, and CRM systems to streamline document management and storage.

-

What are the benefits of using airSlate SignNow for the Form 656 sp Rev 4 Offer In Compromise Spanish Version?

Using airSlate SignNow for the Form 656 sp Rev 4 Offer In Compromise Spanish Version provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are stored safely and can be accessed anytime. Additionally, the ease of eSigning accelerates the submission process, helping you resolve tax issues faster.

-

Is airSlate SignNow user-friendly for completing the Form 656 sp Rev 4 Offer In Compromise Spanish Version?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it easy for anyone to complete the Form 656 sp Rev 4 Offer In Compromise Spanish Version. Our intuitive interface guides users through the process, ensuring that even those with minimal technical skills can navigate the platform effectively. You'll find the tools you need to complete your forms quickly and accurately.

Get more for Form 656 sp Rev 4 Offer In Compromise Spanish Version

- Emcare online application 2022 form

- Sickness notification form 330130823

- Intso previous papers form

- Mmabatho high school matric upgrade form

- Lettre de consentement recommande pour un enfant voyageant ltranger form

- Esy regression recoupment form

- Grade 6 four point fluency scale form

- Transcript request form warwick valley central school district

Find out other Form 656 sp Rev 4 Offer In Compromise Spanish Version

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe