Schedule a Form 940 IRS Tax FormsAbout Schedule a Form 940, Multi State Employer and FUTA Credit ReductionInternal Revenue Servi 2021

Understanding the Schedule A Form 940

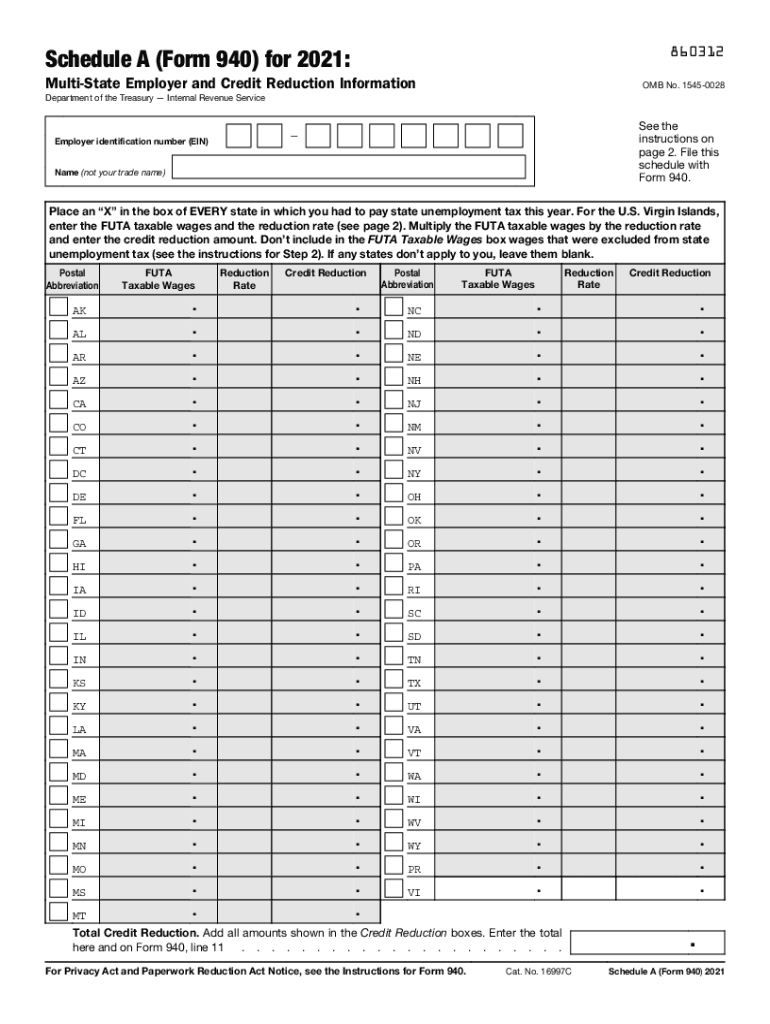

The Schedule A Form 940 is an essential document for employers in the United States who are required to report their Federal Unemployment Tax Act (FUTA) liabilities. This form is specifically designed for employers who operate in multiple states and need to account for any FUTA credit reductions due to state unemployment tax issues. Completing this form accurately is crucial for compliance with IRS regulations and to ensure that employers can claim the appropriate credits.

Steps to Complete the Schedule A Form 940

Filling out the Schedule A Form 940 involves several key steps to ensure that all necessary information is provided accurately. First, gather all relevant payroll records and state unemployment tax details. Next, identify the states where you have paid unemployment taxes and determine if any credits are applicable. Then, fill in the required fields on the form, including the total FUTA tax liability and any state-specific adjustments. Finally, review the completed form for accuracy before submission.

IRS Guidelines for the Schedule A Form 940

The IRS provides specific guidelines for completing the Schedule A Form 940, which include instructions on how to report state unemployment tax payments and any reductions in FUTA credits. Employers must adhere to these guidelines to avoid penalties and ensure compliance. It is important to stay updated with any changes in IRS regulations that may affect the completion and submission of this form.

Filing Deadlines for the Schedule A Form 940

Employers must be aware of the filing deadlines associated with the Schedule A Form 940. Typically, the form is due on January 31 of the year following the tax year being reported. If the employer has deposited all FUTA tax owed on time, they may have an extended deadline until February 10. Meeting these deadlines is crucial to avoid late fees and maintain compliance with IRS requirements.

Penalties for Non-Compliance with the Schedule A Form 940

Failure to comply with the requirements of the Schedule A Form 940 can result in significant penalties. The IRS may impose fines for late filing, inaccuracies, or failure to report FUTA tax liabilities correctly. Understanding these penalties can motivate employers to ensure that they complete and submit the form accurately and on time.

Legal Use of the Schedule A Form 940

The Schedule A Form 940 is legally binding when completed and submitted according to IRS regulations. Employers must ensure that the information provided is truthful and accurate, as discrepancies can lead to audits or legal repercussions. Utilizing a reliable electronic signature solution can also enhance the legal validity of the submitted form.

Quick guide on how to complete 2020 schedule a form 940 irs tax formsabout schedule a form 940 multi state employer and futa credit reductioninternal revenue

Effortlessly Prepare Schedule A Form 940 IRS Tax FormsAbout Schedule A Form 940, Multi State Employer And FUTA Credit ReductionInternal Revenue Servi on Any Device

Digital document management has gained popularity among organizations and individuals alike. It serves as an excellent sustainable alternative to traditional printed and signed documents, enabling you to locate the necessary form and securely keep it online. airSlate SignNow provides all the tools required to create, edit, and electronically sign your documents promptly and efficiently. Manage Schedule A Form 940 IRS Tax FormsAbout Schedule A Form 940, Multi State Employer And FUTA Credit ReductionInternal Revenue Servi on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The Easiest Way to Edit and Electronically Sign Schedule A Form 940 IRS Tax FormsAbout Schedule A Form 940, Multi State Employer And FUTA Credit ReductionInternal Revenue Servi

- Locate Schedule A Form 940 IRS Tax FormsAbout Schedule A Form 940, Multi State Employer And FUTA Credit ReductionInternal Revenue Servi and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information using tools that airSlate SignNow specifically offers for this purpose.

- Generate your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet signature.

- Review the information and click on the Done button to save your changes.

- Choose how you'd like to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Schedule A Form 940 IRS Tax FormsAbout Schedule A Form 940, Multi State Employer And FUTA Credit ReductionInternal Revenue Servi while ensuring effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 schedule a form 940 irs tax formsabout schedule a form 940 multi state employer and futa credit reductioninternal revenue

Create this form in 5 minutes!

How to create an eSignature for the 2020 schedule a form 940 irs tax formsabout schedule a form 940 multi state employer and futa credit reductioninternal revenue

The way to make an electronic signature for a PDF file online

The way to make an electronic signature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The way to generate an electronic signature from your mobile device

The way to generate an e-signature for a PDF file on iOS

The way to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is IRS 940, and why is it important for businesses?

IRS 940 is a form used by employers to report annual federal unemployment taxes. Understanding the IRS 940 is crucial for businesses in order to stay compliant with federal tax regulations, avoid penalties, and ensure proper payroll management. Utilizing airSlate SignNow can simplify the process of eSigning and submitting your IRS 940 documents efficiently.

-

How can airSlate SignNow help with filing IRS 940?

airSlate SignNow offers a streamlined platform to digitally sign and manage your IRS 940 documents. Our intuitive interface allows users to easily prepare, send, and store essential tax forms securely. With airSlate SignNow, you can complete your IRS 940 filings swiftly and with confidence.

-

What features does airSlate SignNow provide for IRS 940 documentation?

airSlate SignNow provides key features such as document templates, real-time collaboration, and secure cloud storage, which are essential for managing IRS 940 filings. You can automate your document workflows, ensuring that your IRS 940 is completed accurately and submitted on time. Our solution enhances organizational efficiency and compliance.

-

Are there any pricing plans for using airSlate SignNow for IRS 940?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, starting with affordable options that provide essential features for managing your IRS 940 forms. Each plan is designed to deliver value, with additional features for enhanced functionality as you scale. Contact us for a detailed breakdown of our pricing specifically for IRS 940 services.

-

Is airSlate SignNow compliant with IRS regulations for IRS 940?

Absolutely, airSlate SignNow is designed with compliance in mind, ensuring that all eSignatures and document processes adhere to IRS regulations for IRS 940. We prioritize security and legality, providing businesses with peace of mind when handling sensitive tax documents. Trust our platform to help you stay compliant.

-

Can I integrate airSlate SignNow with my existing accounting software for IRS 940?

Yes, airSlate SignNow integrates seamlessly with many popular accounting and payroll platforms, making it easy to manage your IRS 940 filings alongside your other financial operations. This integration simplifies data transfer and document management, reducing errors and saving time. Enhancing your workflow for IRS 940 has never been easier.

-

What are the benefits of using airSlate SignNow for eSigning IRS 940 forms?

Using airSlate SignNow to eSign IRS 940 forms provides numerous benefits, including faster turnaround times and reduced paperwork. The electronic signature process is not only secure but also eliminates the need for mailing physical documents, which can cause delays. Enjoy a more efficient way to handle your IRS 940 filings with our solution.

Get more for Schedule A Form 940 IRS Tax FormsAbout Schedule A Form 940, Multi State Employer And FUTA Credit ReductionInternal Revenue Servi

Find out other Schedule A Form 940 IRS Tax FormsAbout Schedule A Form 940, Multi State Employer And FUTA Credit ReductionInternal Revenue Servi

- How To eSignature New York Job Applicant Rejection Letter

- How Do I eSignature Kentucky Executive Summary Template

- eSignature Hawaii CV Form Template Mobile

- eSignature Nevada CV Form Template Online

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online