Fillable Online Rental Form Northeast Passage Fax Email 2021

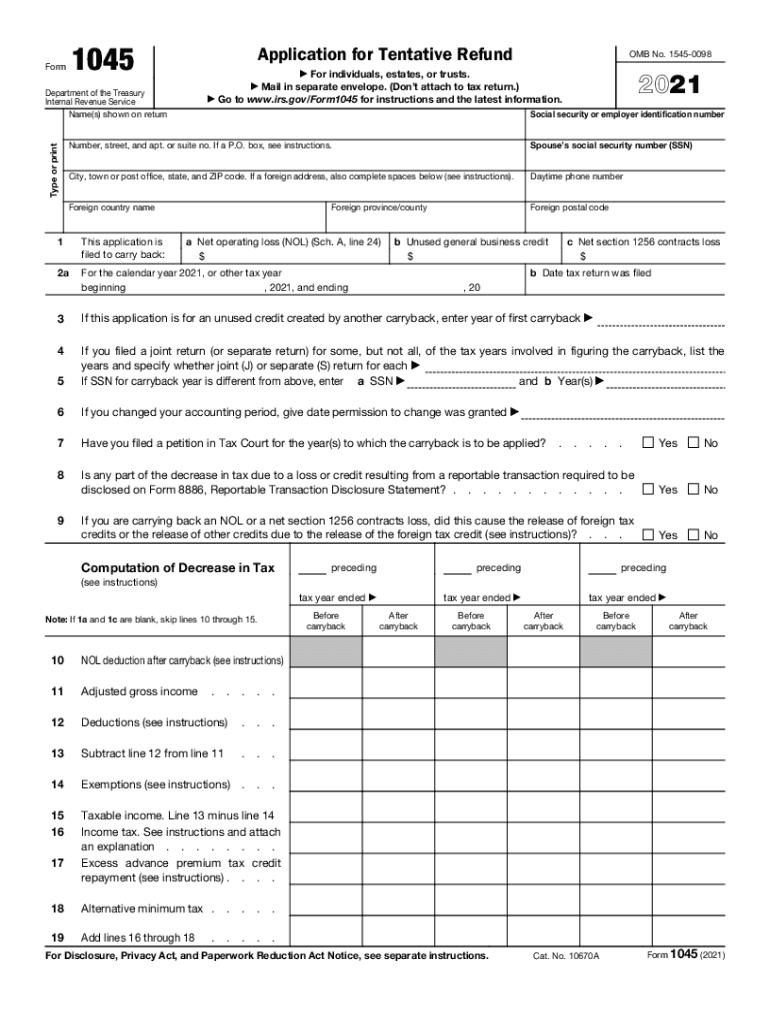

What is IRS Form 1045?

IRS Form 1045 is a tax form used by individuals and businesses to apply for a carryback of net operating losses (NOL). This form allows taxpayers to amend their previous tax returns and claim refunds for taxes paid in prior years. The 1045 form is particularly beneficial for those who have experienced a significant loss in a given tax year, as it enables them to offset taxable income from earlier years, potentially resulting in a tax refund.

Eligibility Criteria for Using Form 1045

To qualify for filing IRS Form 1045, taxpayers must meet specific criteria. Primarily, they must have incurred a net operating loss in the current tax year. Additionally, the loss must be carried back to one or more of the previous two tax years. Taxpayers should also ensure they have filed their tax returns for those years. Understanding these eligibility requirements is crucial for effectively utilizing the 1045 form.

Steps to Complete IRS Form 1045

Filling out IRS Form 1045 involves several steps to ensure accuracy and compliance. Here’s a simplified process:

- Gather necessary documentation, including prior year tax returns and records of the net operating loss.

- Complete the form by providing personal information, including your name, address, and Social Security number.

- Detail the amount of the net operating loss and the years to which you wish to carry it back.

- Calculate the refund amount based on the losses and previous tax liabilities.

- Sign and date the form before submission.

Filing Deadlines for Form 1045

Timely submission of IRS Form 1045 is essential to ensure you receive any potential tax refunds. The form must be filed within twelve months of the end of the year in which the net operating loss occurred. For example, if the loss occurred in 2022, the form must be submitted by December 31, 2023. Understanding these deadlines can help taxpayers avoid missing out on valuable refunds.

Form Submission Methods

IRS Form 1045 can be submitted through various methods, providing flexibility for taxpayers. The form can be filed electronically using approved tax software, which often streamlines the process. Alternatively, taxpayers may choose to mail the completed form to the appropriate IRS address. It is important to verify the correct mailing address based on your location and the specifics of your tax situation.

IRS Guidelines for Form 1045

The IRS provides specific guidelines regarding the use of Form 1045. Taxpayers are encouraged to review these guidelines to ensure compliance with all requirements. Key points include understanding the definitions of net operating losses, the types of income that can be offset, and the necessary documentation to support the claim. Adhering to these guidelines is crucial for a successful application.

Quick guide on how to complete fillable online rental form northeast passage fax email

Complete Fillable Online Rental Form Northeast Passage Fax Email effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, as you can find the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents swiftly without interruptions. Handle Fillable Online Rental Form Northeast Passage Fax Email on any device using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

The easiest method to edit and eSign Fillable Online Rental Form Northeast Passage Fax Email without any hassle

- Find Fillable Online Rental Form Northeast Passage Fax Email and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or conceal sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Verify the details and click on the Done button to store your changes.

- Choose how you wish to share your form, through email, SMS, or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Fillable Online Rental Form Northeast Passage Fax Email and maintain exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fillable online rental form northeast passage fax email

Create this form in 5 minutes!

How to create an eSignature for the fillable online rental form northeast passage fax email

The way to make an electronic signature for a PDF document online

The way to make an electronic signature for a PDF document in Google Chrome

The best way to generate an e-signature for signing PDFs in Gmail

The way to generate an electronic signature straight from your smart phone

The way to generate an e-signature for a PDF document on iOS

The way to generate an electronic signature for a PDF document on Android OS

People also ask

-

What is form 1045 and how does it relate to airSlate SignNow?

Form 1045 is a tax form used to apply for a quick refund of overpaid taxes. With airSlate SignNow, you can easily fill out and eSign form 1045, streamlining your tax filing process and ensuring that your documents are securely sent.

-

How does airSlate SignNow enhance the eSigning process for form 1045?

AirSlate SignNow simplifies the eSigning process for form 1045 by offering an intuitive interface that allows you to quickly complete your document. You can send it for signatures instantly, track its status, and ensure compliance all in real-time.

-

What are the pricing options for using airSlate SignNow to manage form 1045?

AirSlate SignNow offers various pricing plans to suit different business needs, starting with a free trial for new users. Once you're ready to process form 1045 and other documents, you can choose a plan that fits your budget while providing powerful features.

-

Can I integrate airSlate SignNow with other applications for processing form 1045?

Yes, airSlate SignNow integrates seamlessly with various applications such as Google Drive, Salesforce, and Dropbox. These integrations allow you to easily manage and access your form 1045 and related documents within your existing workflows.

-

What features do airSlate SignNow offer for completing form 1045?

AirSlate SignNow provides features like customizable templates, the ability to add comments, and secure cloud storage for all your eSigned documents. These tools make it easier to manage form 1045, ensuring you capture all necessary information accurately.

-

Is airSlate SignNow compliant with legal regulations for form 1045?

Absolutely, airSlate SignNow is designed with compliance in mind, adhering to eSignature laws such as ESIGN and UETA. This means any eSigned form 1045 processed through our platform is considered legally binding.

-

How secure is my information when using airSlate SignNow for form 1045?

Security is a top priority for airSlate SignNow. Your information related to form 1045 is encrypted both in transit and at rest, ensuring that your sensitive data remains secure and protected from unauthorized access.

Get more for Fillable Online Rental Form Northeast Passage Fax Email

- Employment or job termination package georgia form

- Newly widowed individuals package georgia form

- Employment interview package georgia form

- Employment employee form

- Assignment of mortgage package georgia form

- Assignment of lease package georgia form

- Georgia purchase form

- Satisfaction cancellation or release of mortgage package georgia form

Find out other Fillable Online Rental Form Northeast Passage Fax Email

- How To Sign Arizona Non-Profit Cease And Desist Letter

- Can I Sign Arkansas Non-Profit LLC Operating Agreement

- Sign Arkansas Non-Profit LLC Operating Agreement Free

- Sign California Non-Profit Living Will Easy

- Sign California Non-Profit IOU Myself

- Sign California Non-Profit Lease Agreement Template Free

- Sign Maryland Life Sciences Residential Lease Agreement Later

- Sign Delaware Non-Profit Warranty Deed Fast

- Sign Florida Non-Profit LLC Operating Agreement Free

- Sign Florida Non-Profit Cease And Desist Letter Simple

- Sign Florida Non-Profit Affidavit Of Heirship Online

- Sign Hawaii Non-Profit Limited Power Of Attorney Myself

- Sign Hawaii Non-Profit Limited Power Of Attorney Free

- Sign Idaho Non-Profit Lease Agreement Template Safe

- Help Me With Sign Illinois Non-Profit Business Plan Template

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free