Fw2 Attention You May File Forms W 2 and W 3 Electronically 2021

Understanding Form 499R 2 W 2PR

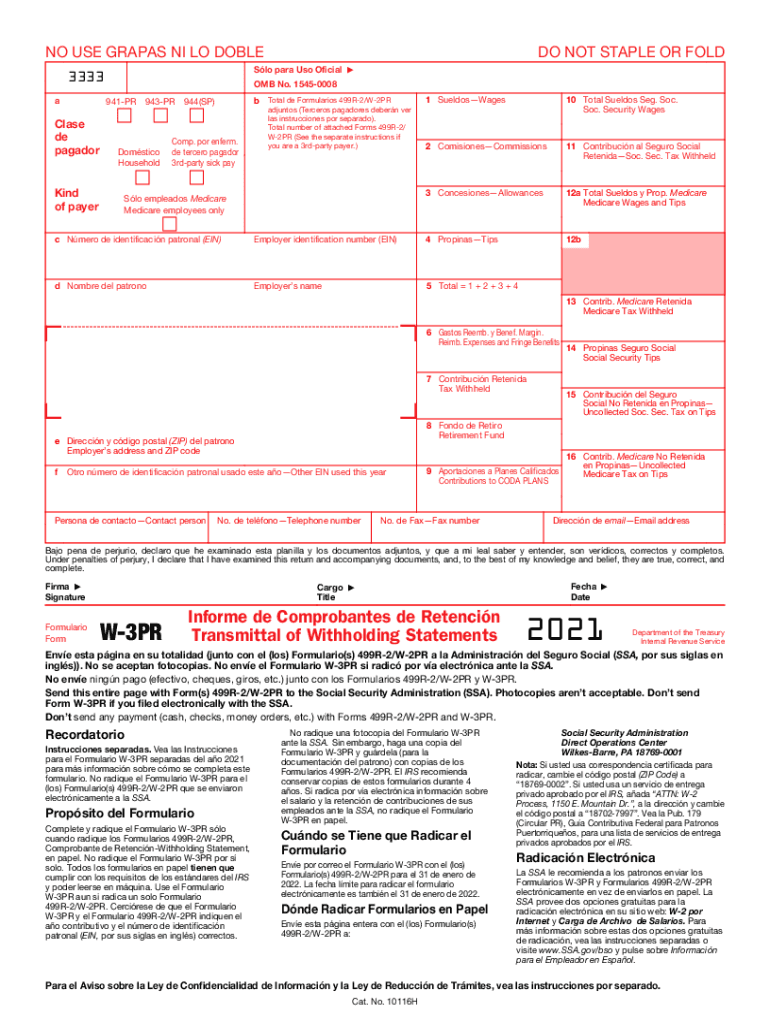

Form 499R 2 W 2PR is a tax document used primarily in Puerto Rico for reporting wages and taxes withheld for employees. This form serves a similar purpose to the federal W-2 form but is tailored to meet the specific requirements of Puerto Rican tax law. Employers must accurately complete this form to ensure proper tax reporting and compliance with local regulations.

Steps to Complete Form 499R 2 W 2PR

Completing Form 499R 2 W 2PR involves several key steps:

- Gather all necessary employee information, including names, addresses, and Social Security numbers.

- Calculate total wages paid to each employee during the tax year.

- Determine the amount of taxes withheld from each employee's wages.

- Fill out the form accurately, ensuring all fields are completed as required.

- Review the completed form for any errors before submission.

Filing Deadlines for Form 499R 2 W 2PR

It is crucial to adhere to filing deadlines for Form 499R 2 W 2PR to avoid penalties. Generally, employers must submit this form to the Puerto Rico Department of the Treasury by the end of January following the tax year. However, specific deadlines may vary, so it is advisable to check for any updates or changes in regulations each year.

Legal Use of Form 499R 2 W 2PR

Form 499R 2 W 2PR is legally binding and must be completed in accordance with Puerto Rican tax laws. Employers are responsible for ensuring that the information provided is accurate and submitted on time. Failure to comply with these legal requirements may result in fines or other penalties from tax authorities.

Required Documents for Filing Form 499R 2 W 2PR

Before filing Form 499R 2 W 2PR, employers should prepare the following documents:

- Employee payroll records for the tax year.

- Documentation of taxes withheld from employee wages.

- Any prior year forms for reference, if applicable.

Form Submission Methods for 499R 2 W 2PR

Employers can submit Form 499R 2 W 2PR through various methods:

- Electronically via the Puerto Rico Department of the Treasury's online portal.

- By mail, ensuring that the form is sent to the correct address.

- In-person at designated tax offices, if preferred.

Quick guide on how to complete fw2 attention you may file forms w 2 and w 3 electronically

Complete Fw2 Attention You May File Forms W 2 And W 3 Electronically effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can locate the necessary form and securely keep it online. airSlate SignNow provides you with all the resources you require to create, edit, and eSign your documents promptly without any delays. Manage Fw2 Attention You May File Forms W 2 And W 3 Electronically on any platform with airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Fw2 Attention You May File Forms W 2 And W 3 Electronically seamlessly

- Locate Fw2 Attention You May File Forms W 2 And W 3 Electronically and click Get Form to begin.

- Utilize the features we offer to complete your document.

- Highlight essential parts of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign feature, which takes seconds and bears the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tiresome form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Modify and eSign Fw2 Attention You May File Forms W 2 And W 3 Electronically and ensure excellent communication at any stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fw2 attention you may file forms w 2 and w 3 electronically

Create this form in 5 minutes!

How to create an eSignature for the fw2 attention you may file forms w 2 and w 3 electronically

The way to generate an e-signature for your PDF document online

The way to generate an e-signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The way to generate an electronic signature right from your smart phone

The way to create an electronic signature for a PDF document on iOS

The way to generate an electronic signature for a PDF on Android OS

People also ask

-

What is the 499r 2 w 2pr and how does it work?

The 499r 2 w 2pr is a powerful feature within the airSlate SignNow platform that streamlines the eSignature process. It allows users to send, sign, and manage documents efficiently in a cost-effective manner. With its user-friendly interface, businesses can enhance their workflow and reduce turnaround time on important documents.

-

What are the pricing options for airSlate SignNow featuring 499r 2 w 2pr?

Pricing for airSlate SignNow's 499r 2 w 2pr solutions is designed to be budget-friendly and adaptable to various business sizes. Users can choose from several subscription plans that fit their specific needs, ensuring they only pay for the features they require. Additionally, a free trial is often available to help users explore its benefits before committing.

-

What features does the 499r 2 w 2pr offer?

The 499r 2 w 2pr includes essential features like customizable templates, multi-party signing, and real-time notifications. This allows teams to collaborate seamlessly on document management and maintain an organized signing process. Enhanced security measures are also in place to protect sensitive data throughout the signing journey.

-

How does the 499r 2 w 2pr benefit businesses?

By using the 499r 2 w 2pr feature, businesses can signNowly increase their operational efficiency and reduce paper waste. It allows for quicker turnaround times, which enhances customer satisfaction and frees up resources. Additionally, the eSigning process ensures compliance and security, giving businesses peace of mind.

-

Can the 499r 2 w 2pr integrate with other applications?

Yes, the 499r 2 w 2pr can easily integrate with various third-party applications, including CRM and project management tools. This seamless connectivity helps businesses to manage their documents and workflows more effectively. Integrations also allow users to maximize the functionality of airSlate SignNow across their tech stack.

-

Is the 499r 2 w 2pr user-friendly for non-technical users?

Absolutely! The 499r 2 w 2pr feature is designed to be intuitive and user-friendly, making it accessible to users of all technical abilities. With clear prompts and a straightforward interface, anyone can quickly learn how to send and eSign documents without extensive training.

-

What industries can benefit from using the 499r 2 w 2pr feature?

Many industries, including real estate, legal, healthcare, and finance, can benefit from the 499r 2 w 2pr feature in airSlate SignNow. This versatility allows different sectors to streamline their document processes, ensuring conformity with industry-specific requirements. As a result, any company that relies on signed documents can enhance its operations signNowly.

Get more for Fw2 Attention You May File Forms W 2 And W 3 Electronically

Find out other Fw2 Attention You May File Forms W 2 And W 3 Electronically

- Help Me With eSign Kentucky Government Job Offer

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast

- eSign Kentucky Healthcare / Medical Last Will And Testament Free

- eSign Maine Healthcare / Medical LLC Operating Agreement Now

- eSign Louisiana High Tech LLC Operating Agreement Safe

- eSign Massachusetts Government Quitclaim Deed Fast

- How Do I eSign Massachusetts Government Arbitration Agreement

- eSign Maryland High Tech Claim Fast

- eSign Maine High Tech Affidavit Of Heirship Now

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile