Form 5498 IRA Contribution Information 2021

What is the Form 5498 IRA Contribution Information

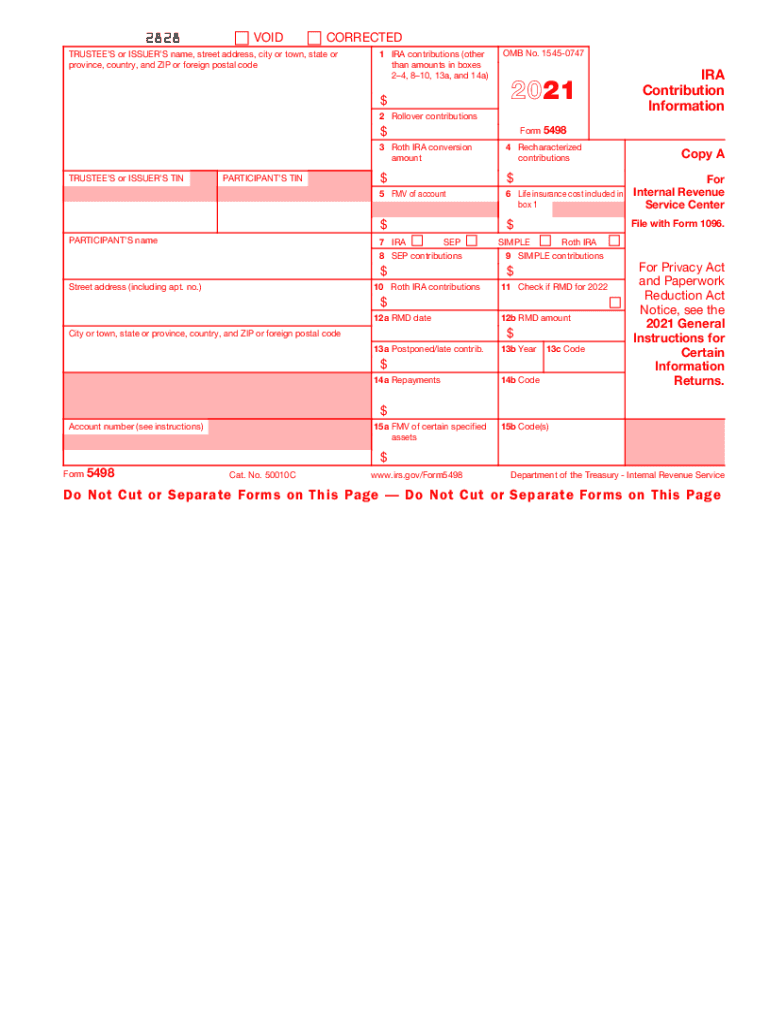

The Form 5498 is an important document used to report contributions to individual retirement accounts (IRAs) for a given tax year. Specifically for the 2018 tax year, this form provides the IRS with details regarding contributions made to traditional IRAs, Roth IRAs, and other types of retirement accounts. The information on the form includes the total contributions made, the fair market value of the account at year-end, and any rollovers or conversions that occurred during the year. Understanding this form is essential for taxpayers to ensure compliance with IRS regulations regarding retirement savings.

How to obtain the Form 5498 IRA Contribution Information

To obtain the Form 5498 for the 2018 tax year, individuals can access it through several methods. First, financial institutions that manage IRAs are required to provide this form to account holders by May 31 of the year following the tax year. Taxpayers can also download a copy of the form directly from the IRS website. Additionally, many tax preparation software programs and services include the form as part of their offerings, making it easier for users to complete their tax filings accurately.

Steps to complete the Form 5498 IRA Contribution Information

Completing the Form 5498 involves several key steps. First, gather all relevant information regarding your IRA contributions for the 2018 tax year. This includes details on contributions made, rollovers, and the fair market value of the account at the end of the year. Next, fill out the form by entering the total contributions in the appropriate sections, ensuring accuracy to avoid potential issues with the IRS. Finally, submit the completed form to the IRS, either electronically or via mail, depending on your filing method. It is important to keep a copy of the form for your records.

Legal use of the Form 5498 IRA Contribution Information

The Form 5498 is legally binding and must be filled out accurately to reflect true contributions and account values. It serves as a crucial document for both taxpayers and the IRS, ensuring that contributions to IRAs are reported correctly for tax purposes. Compliance with IRS regulations regarding the completion and submission of this form is essential, as inaccuracies can lead to penalties or issues with tax filings. Utilizing trusted electronic solutions for signing and submitting the form can enhance security and ensure compliance with legal standards.

IRS Guidelines

The IRS provides specific guidelines regarding the Form 5498, including filing deadlines and requirements for reporting contributions. For the 2018 tax year, the form must be submitted by May 31 of the following year. Taxpayers should ensure that all contributions are accurately reported, including any rollovers or conversions. The IRS also emphasizes the importance of keeping records related to IRA contributions, as this information may be necessary for future tax filings or audits. Familiarizing oneself with these guidelines can help ensure compliance and avoid potential penalties.

Filing Deadlines / Important Dates

For the 2018 tax year, the filing deadline for Form 5498 is May 31, 2019. This deadline applies to financial institutions that must report contributions made to IRAs. Taxpayers should be aware that while the form is typically not required to be submitted with their tax return, it must be provided to the IRS by the financial institution. Keeping track of this deadline is crucial for ensuring that all contributions are reported accurately and timely, helping to maintain compliance with IRS regulations.

Key elements of the Form 5498 IRA Contribution Information

Key elements of the Form 5498 include various sections that capture essential information about IRA contributions. These sections typically cover the total contributions made during the year, the fair market value of the account, and any rollovers or conversions. Additionally, the form may include information on required minimum distributions (RMDs) if applicable. Understanding these elements is vital for both taxpayers and financial institutions to ensure accurate reporting and compliance with IRS regulations regarding retirement accounts.

Quick guide on how to complete 2021 form 5498 ira contribution information

Effortlessly Prepare Form 5498 IRA Contribution Information on Any Device

Digital document management has gained popularity among businesses and individuals alike. It serves as a perfect environmentally friendly alternative to traditional printed and signed papers, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Form 5498 IRA Contribution Information on any device using airSlate SignNow’s Android or iOS applications and enhance any document-driven process today.

The Easiest Way to Modify and eSign Form 5498 IRA Contribution Information with Ease

- Find Form 5498 IRA Contribution Information and click Get Form to initiate the process.

- Make use of the tools we provide to fill out your form.

- Emphasize critical sections of the documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which only takes a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose your preferred method to submit your form, whether by email, text message (SMS), invite link, or downloading it to your computer.

Bid farewell to lost or misfiled documents, tedious form hunts, or errors requiring new document printouts. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 5498 IRA Contribution Information and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 form 5498 ira contribution information

Create this form in 5 minutes!

How to create an eSignature for the 2021 form 5498 ira contribution information

The way to make an electronic signature for a PDF online

The way to make an electronic signature for a PDF in Google Chrome

The best way to create an e-signature for signing PDFs in Gmail

The way to generate an electronic signature from your smartphone

The way to generate an e-signature for a PDF on iOS

The way to generate an electronic signature for a PDF file on Android

People also ask

-

What is the 5498 tax form 2018, and why is it important?

The 5498 tax form 2018 is an IRS form used to report various types of contributions to retirement accounts, such as IRAs. Understanding this form is crucial for ensuring compliance with tax regulations and for keeping accurate financial records. It helps individuals and businesses track contributions and determine deductions properly.

-

How can airSlate SignNow assist with the 5498 tax form 2018?

airSlate SignNow offers a streamlined solution for signing and sending the 5498 tax form 2018 electronically. With our intuitive platform, you can easily create and manage documents, ensuring that your tax-related paperwork is processed quickly and securely. Save time and reduce hassle with our eSigning capabilities.

-

Is there a fee for using airSlate SignNow to send the 5498 tax form 2018?

Yes, airSlate SignNow provides various pricing plans to suit different business needs. Our plans are designed to be cost-effective, providing excellent value for the features offered, including sending vital documents like the 5498 tax form 2018. Explore our pricing options to select the plan that best fits your requirements.

-

What features does airSlate SignNow offer for handling documents like the 5498 tax form 2018?

Our platform includes features such as customizable templates, secure eSigning, and document tracking, all of which make managing forms like the 5498 tax form 2018 easier. Users can also integrate with other applications for seamless workflow management. These tools ensure that you have everything you need to process these important documents efficiently.

-

Can I integrate airSlate SignNow with my existing software for managing the 5498 tax form 2018?

Absolutely! airSlate SignNow offers integrations with various accounting and document management software, allowing you to work efficiently with the 5498 tax form 2018. This connectivity streamlines your processes, making it easier to manage your tax forms alongside other financial documents.

-

How secure is airSlate SignNow for handling the 5498 tax form 2018?

Security is a top priority at airSlate SignNow. Our platform utilizes industry-standard encryption and secure cloud storage to ensure that your documents, including the 5498 tax form 2018, are protected. You can rest assured that your sensitive information remains confidential and secure during transmission and storage.

-

What is the turnaround time for eSigning the 5498 tax form 2018 with airSlate SignNow?

The turnaround time for eSigning the 5498 tax form 2018 using airSlate SignNow is typically very fast. Most users can complete the signing process in a matter of minutes, which signNowly reduces the time spent on document handling. This efficiency helps ensure that your tax forms are submitted on time.

Get more for Form 5498 IRA Contribution Information

- Living trust for individual as single divorced or widow or widower with no children arkansas form

- Trust single form

- Living trust for husband and wife with one child arkansas form

- Living trust for husband and wife with minor and or adult children arkansas form

- Amendment to living trust arkansas form

- Living trust property record arkansas form

- Financial account transfer to living trust arkansas form

- Assignment to living trust arkansas form

Find out other Form 5498 IRA Contribution Information

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form