Form 2210 Underpayment of Estimated Tax by Individuals, Estates, and Trusts Irs 2024

What is the Form 2210 Underpayment Of Estimated Tax By Individuals, Estates, And Trusts Irs

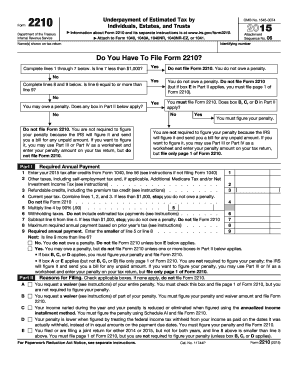

The Form 2210 is a tax form used by individuals, estates, and trusts to calculate any underpayment of estimated tax owed to the IRS. This form is essential for taxpayers who may not have paid enough tax throughout the year, either through withholding or estimated payments. It helps determine if a penalty applies and, if so, the amount of that penalty. Understanding this form is crucial for compliance with federal tax obligations and to avoid unnecessary penalties.

How to use the Form 2210 Underpayment Of Estimated Tax By Individuals, Estates, And Trusts Irs

To use Form 2210, taxpayers must first gather their income information and tax payments made throughout the year. The form provides a structured way to calculate the required estimated tax payments and compare them to what has been paid. If the total payments are less than the required amount, the form will guide the taxpayer through the process of calculating any penalties. It is advisable to consult the IRS instructions for Form 2210 to ensure accurate completion.

Steps to complete the Form 2210 Underpayment Of Estimated Tax By Individuals, Estates, And Trusts Irs

Completing Form 2210 involves several key steps:

- Gather income and tax payment records for the year.

- Determine the total tax liability for the year.

- Calculate the required estimated tax payments based on income.

- Compare actual payments made to the required payments.

- Fill out the form, providing necessary calculations and information.

- Submit the completed form with your tax return or as a standalone document if required.

Filing Deadlines / Important Dates

Filing deadlines for Form 2210 align with the general tax return deadlines. Typically, the form must be filed by the tax return due date, which is usually April 15 for most individuals. If you file for an extension, the deadline may shift to October 15. It is important to keep these dates in mind to avoid late penalties and ensure compliance with IRS regulations.

Penalties for Non-Compliance

Failure to file Form 2210 when required can result in significant penalties. The IRS may impose a penalty for underpayment of estimated tax, which is calculated based on the amount of underpayment and the period it remained unpaid. Understanding the potential penalties can motivate timely and accurate filing, helping to avoid unnecessary financial burdens.

Digital vs. Paper Version

Form 2210 can be completed and submitted in both digital and paper formats. The digital version allows for easier calculations and may streamline the submission process. However, some taxpayers may prefer the paper version for record-keeping purposes. Regardless of the method chosen, it is essential to ensure that the form is accurately completed and submitted by the appropriate deadlines.

Create this form in 5 minutes or less

Find and fill out the correct form 2210 underpayment of estimated tax by individuals estates and trusts irs

Create this form in 5 minutes!

How to create an eSignature for the form 2210 underpayment of estimated tax by individuals estates and trusts irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 2210 Underpayment Of Estimated Tax By Individuals, Estates, And Trusts Irs?

Form 2210 Underpayment Of Estimated Tax By Individuals, Estates, And Trusts Irs is a tax form used to determine if you owe a penalty for underpaying your estimated taxes. It helps individuals, estates, and trusts calculate the amount of tax owed and avoid penalties. Understanding this form is crucial for compliance with IRS regulations.

-

How can airSlate SignNow help with Form 2210 Underpayment Of Estimated Tax By Individuals, Estates, And Trusts Irs?

airSlate SignNow provides a seamless platform for eSigning and sending documents, including Form 2210 Underpayment Of Estimated Tax By Individuals, Estates, And Trusts Irs. Our solution simplifies the process, ensuring that your tax forms are completed and submitted efficiently. This can save you time and reduce the risk of errors.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs, starting from a basic plan to more advanced options. Each plan includes features that support the completion and eSigning of documents like Form 2210 Underpayment Of Estimated Tax By Individuals, Estates, And Trusts Irs. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, which are essential for managing tax documents like Form 2210 Underpayment Of Estimated Tax By Individuals, Estates, And Trusts Irs. These features enhance efficiency and ensure that your documents are handled securely and professionally.

-

Is airSlate SignNow compliant with IRS regulations?

Yes, airSlate SignNow is designed to comply with IRS regulations, ensuring that your use of Form 2210 Underpayment Of Estimated Tax By Individuals, Estates, And Trusts Irs meets all necessary legal requirements. Our platform prioritizes security and compliance, giving you peace of mind when handling sensitive tax documents.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow offers integrations with various tax preparation software, making it easy to manage Form 2210 Underpayment Of Estimated Tax By Individuals, Estates, And Trusts Irs alongside your other financial documents. This integration streamlines your workflow and enhances productivity.

-

What are the benefits of using airSlate SignNow for tax forms?

Using airSlate SignNow for tax forms like Form 2210 Underpayment Of Estimated Tax By Individuals, Estates, And Trusts Irs provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to eSign documents quickly and track their status, ensuring a smooth filing process.

Get more for Form 2210 Underpayment Of Estimated Tax By Individuals, Estates, And Trusts Irs

- Esdc letter form

- Adult care home fl2 form

- P garf recording and scoring form onlinevents co uk onlinevents co

- Www sanantonio gov sapd alarmpermits form

- D2049 injury or disease details sheet d2049 injury or disease details sheet 314sqn aafc org form

- Groupmember sbi life co n form

- Synthes distal fibula inventory 42741165 form

- Exclusive service agreement template form

Find out other Form 2210 Underpayment Of Estimated Tax By Individuals, Estates, And Trusts Irs

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document