Payee Certification 2020

What is the Payee Certification

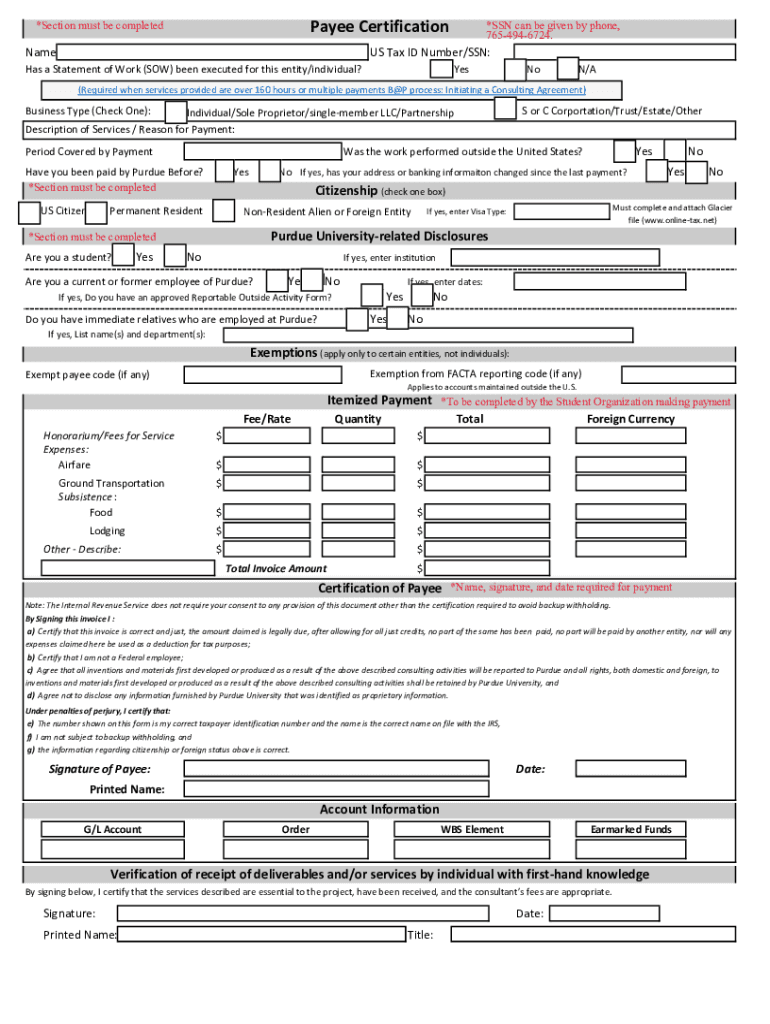

The Payee Certification is a crucial document used primarily for tax purposes in the United States. It certifies that the payee, or the individual receiving payment, is accurately reporting their taxpayer identification information to the payer. This form is essential for ensuring compliance with IRS regulations and helps avoid backup withholding on payments made to the payee. The certification typically includes the payee's name, address, and taxpayer identification number (TIN), which can be a Social Security Number (SSN) or Employer Identification Number (EIN).

How to use the Payee Certification

Using the Payee Certification involves several steps to ensure it is completed correctly. First, the payee must fill out the form with accurate personal and tax information. This includes providing their TIN and confirming their tax status. Once completed, the payee should sign and date the form to validate the information provided. The payer will then use this certification to determine the correct tax treatment of payments made to the payee. It is essential to keep a copy of the certification for personal records and to provide it to the payer as required.

Steps to complete the Payee Certification

Completing the Payee Certification requires careful attention to detail. Follow these steps:

- Gather necessary information, including your name, address, and TIN.

- Access the Payee Certification form, either online or in printed format.

- Fill out the form accurately, ensuring all information is correct.

- Review the completed form for any errors or omissions.

- Sign and date the form to authenticate it.

- Submit the form to the payer as instructed.

Legal use of the Payee Certification

The Payee Certification serves a legal purpose in the realm of tax compliance. By submitting this form, the payee affirms that the information provided is true and accurate, which protects both the payee and payer from potential penalties related to incorrect tax reporting. It is important for payees to understand that providing false information on this certification can lead to serious legal consequences, including fines and penalties imposed by the IRS.

Key elements of the Payee Certification

Several key elements are essential to the Payee Certification. These include:

- Name: The full legal name of the payee.

- Address: The current mailing address of the payee.

- Taxpayer Identification Number (TIN): This can be an SSN or EIN.

- Certification statement: A declaration affirming the accuracy of the provided information.

- Signature and date: The payee's signature and the date of signing.

Required Documents

To complete the Payee Certification, certain documents may be required. The payee should have the following on hand:

- Proof of identity, such as a driver's license or passport.

- Tax documents that confirm the TIN, such as a Social Security card or EIN confirmation letter.

- Any previous tax forms that may relate to the payee's tax status.

Create this form in 5 minutes or less

Find and fill out the correct payee certification

Create this form in 5 minutes!

How to create an eSignature for the payee certification

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Payee Certification in airSlate SignNow?

Payee Certification in airSlate SignNow is a process that ensures the authenticity and verification of payees before transactions are processed. This feature helps businesses maintain compliance and reduce fraud risks by confirming the identity of payees through secure electronic signatures.

-

How does airSlate SignNow facilitate Payee Certification?

airSlate SignNow facilitates Payee Certification by providing a user-friendly platform that allows businesses to send documents for eSignature quickly. The platform includes features such as customizable templates and automated workflows, making the certification process efficient and straightforward.

-

What are the benefits of using Payee Certification with airSlate SignNow?

Using Payee Certification with airSlate SignNow offers several benefits, including enhanced security, improved compliance, and faster transaction processing. By ensuring that payees are verified, businesses can minimize the risk of fraud and streamline their payment processes.

-

Is there a cost associated with Payee Certification in airSlate SignNow?

Yes, there is a cost associated with using Payee Certification in airSlate SignNow, which varies based on the subscription plan chosen. However, the investment is often justified by the increased security and efficiency it brings to your business operations.

-

Can I integrate Payee Certification with other tools?

Absolutely! airSlate SignNow offers integrations with various third-party applications, allowing you to incorporate Payee Certification into your existing workflows seamlessly. This flexibility ensures that you can enhance your document management processes without disrupting your current systems.

-

How secure is the Payee Certification process in airSlate SignNow?

The Payee Certification process in airSlate SignNow is highly secure, utilizing advanced encryption and authentication methods to protect sensitive information. This ensures that all transactions and signatures are safe, giving businesses peace of mind when managing payee verifications.

-

What types of documents can I use for Payee Certification?

You can use a variety of documents for Payee Certification in airSlate SignNow, including contracts, invoices, and payment authorizations. The platform allows you to customize documents to meet your specific needs while ensuring that all necessary information for certification is included.

Get more for Payee Certification

Find out other Payee Certification

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors