Schedule N Form 990 or 990 EZ Liquidation, Termination, Dissolution, or Significant Disposition of Assests 2023

Understanding the Schedule N Form 990 or 990 EZ

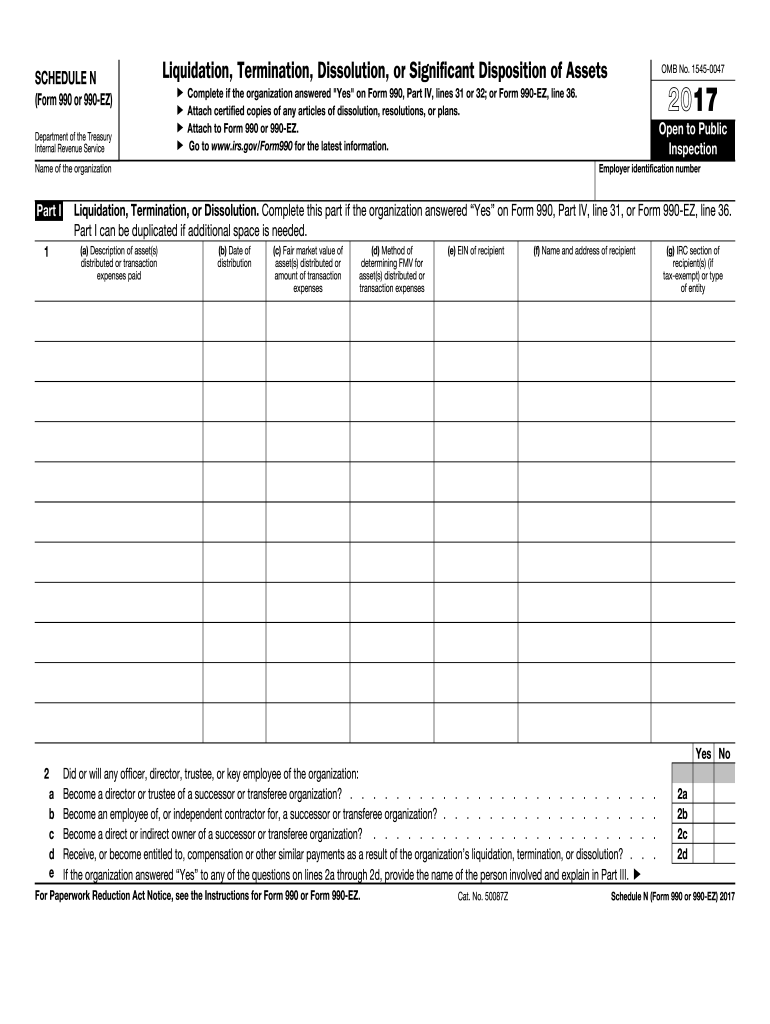

The Schedule N Form 990 or 990 EZ is a crucial document for nonprofit organizations that are undergoing liquidation, termination, dissolution, or a significant disposition of assets. This form is required by the Internal Revenue Service (IRS) to report the details of these actions. It ensures that organizations comply with federal regulations while providing transparency about their financial activities. Completing this form accurately is essential for maintaining compliance and avoiding potential penalties.

Steps to Complete the Schedule N Form 990 or 990 EZ

Filling out the Schedule N Form 990 or 990 EZ involves several key steps. First, gather all necessary financial records, including asset valuations and details about the organization’s operations. Next, provide information about the organization, including its name, address, and Employer Identification Number (EIN). Then, detail the specific actions being taken, such as the type of liquidation or disposition of assets. It is important to ensure that all information is accurate and complete before submission. Finally, review the form for any errors or omissions, as these can lead to delays or compliance issues.

Legal Use of the Schedule N Form 990 or 990 EZ

The Schedule N Form 990 or 990 EZ serves a legal purpose by documenting the dissolution or significant asset disposition of a nonprofit organization. This form must be filed in accordance with IRS regulations to ensure that the organization meets its legal obligations. Failure to file this form can result in penalties, including the loss of tax-exempt status. Organizations should consult with legal professionals to understand the implications of their actions and ensure compliance with all relevant laws.

Filing Deadlines for the Schedule N Form 990 or 990 EZ

Timely filing of the Schedule N Form 990 or 990 EZ is essential for compliance. The form is typically due on the fifteenth day of the fifth month after the end of the organization’s tax year. For organizations operating on a calendar year, this means the form is due on May fifteenth. Extensions may be available, but organizations must file for them prior to the original deadline. It is advisable to mark these dates on a calendar to avoid missing important deadlines.

Required Documents for the Schedule N Form 990 or 990 EZ

To complete the Schedule N Form 990 or 990 EZ, organizations must compile several key documents. These include financial statements, asset valuations, and any relevant legal documents related to the dissolution or liquidation process. Additionally, records of prior tax filings and correspondence with the IRS may be necessary to provide a complete picture of the organization’s financial status. Ensuring that all required documents are gathered beforehand can streamline the filing process.

IRS Guidelines for the Schedule N Form 990 or 990 EZ

The IRS provides specific guidelines for completing the Schedule N Form 990 or 990 EZ. These guidelines outline the information that must be included, how to report different types of asset dispositions, and any additional disclosures that may be required. Organizations should refer to the IRS instructions for the Schedule N to ensure they are following the most current regulations and requirements. Staying informed about these guidelines helps organizations maintain compliance and avoid issues with the IRS.

Create this form in 5 minutes or less

Find and fill out the correct schedule n form 990 or 990 ez liquidation termination dissolution or significant disposition of assests

Create this form in 5 minutes!

How to create an eSignature for the schedule n form 990 or 990 ez liquidation termination dissolution or significant disposition of assests

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Schedule N Form 990 Or 990 EZ for Liquidation, Termination, Dissolution, Or signNow Disposition Of Assets?

The Schedule N Form 990 Or 990 EZ is a tax form used by organizations to report the liquidation, termination, dissolution, or signNow disposition of assets. This form helps ensure compliance with IRS regulations and provides transparency regarding the organization's financial activities during these processes.

-

How can airSlate SignNow assist with completing the Schedule N Form 990 Or 990 EZ?

airSlate SignNow offers an intuitive platform that simplifies the process of completing the Schedule N Form 990 Or 990 EZ. With our easy-to-use tools, you can fill out, sign, and send the form securely, ensuring that all necessary information is accurately captured and submitted on time.

-

What are the pricing options for using airSlate SignNow for Schedule N Form 990 Or 990 EZ?

airSlate SignNow provides flexible pricing plans tailored to meet the needs of various organizations. Whether you are a small nonprofit or a large corporation, our cost-effective solutions ensure that you can efficiently manage the Schedule N Form 990 Or 990 EZ without breaking your budget.

-

What features does airSlate SignNow offer for managing the Schedule N Form 990 Or 990 EZ?

Our platform includes features such as document templates, eSignature capabilities, and secure cloud storage, all designed to streamline the management of the Schedule N Form 990 Or 990 EZ. These tools enhance collaboration and ensure that your documents are always accessible and compliant with IRS requirements.

-

Can I integrate airSlate SignNow with other software for managing the Schedule N Form 990 Or 990 EZ?

Yes, airSlate SignNow offers seamless integrations with various software applications, allowing you to manage the Schedule N Form 990 Or 990 EZ alongside your existing tools. This integration capability enhances your workflow and ensures that all relevant data is synchronized across platforms.

-

What are the benefits of using airSlate SignNow for the Schedule N Form 990 Or 990 EZ?

Using airSlate SignNow for the Schedule N Form 990 Or 990 EZ provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform empowers organizations to focus on their core missions while ensuring compliance with IRS regulations.

-

Is airSlate SignNow secure for handling sensitive information related to the Schedule N Form 990 Or 990 EZ?

Absolutely! airSlate SignNow prioritizes security and employs advanced encryption protocols to protect sensitive information related to the Schedule N Form 990 Or 990 EZ. You can trust that your documents and data are safe while using our platform.

Get more for Schedule N Form 990 Or 990 EZ Liquidation, Termination, Dissolution, Or Significant Disposition Of Assests

- Pta certificate of recognition form

- Cpd 44112 summary report chicago police department form

- Driver license renewal options nevada dmv form

- Picnic and special event permit application form

- Date of report day mo form

- Draw sheet for 32 entries form

- Lost book form minooka high school handbook mchs

- Ihsaa waiver form

Find out other Schedule N Form 990 Or 990 EZ Liquidation, Termination, Dissolution, Or Significant Disposition Of Assests

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement