Contact Us by MailDepartment of Revenue Taxation 2019

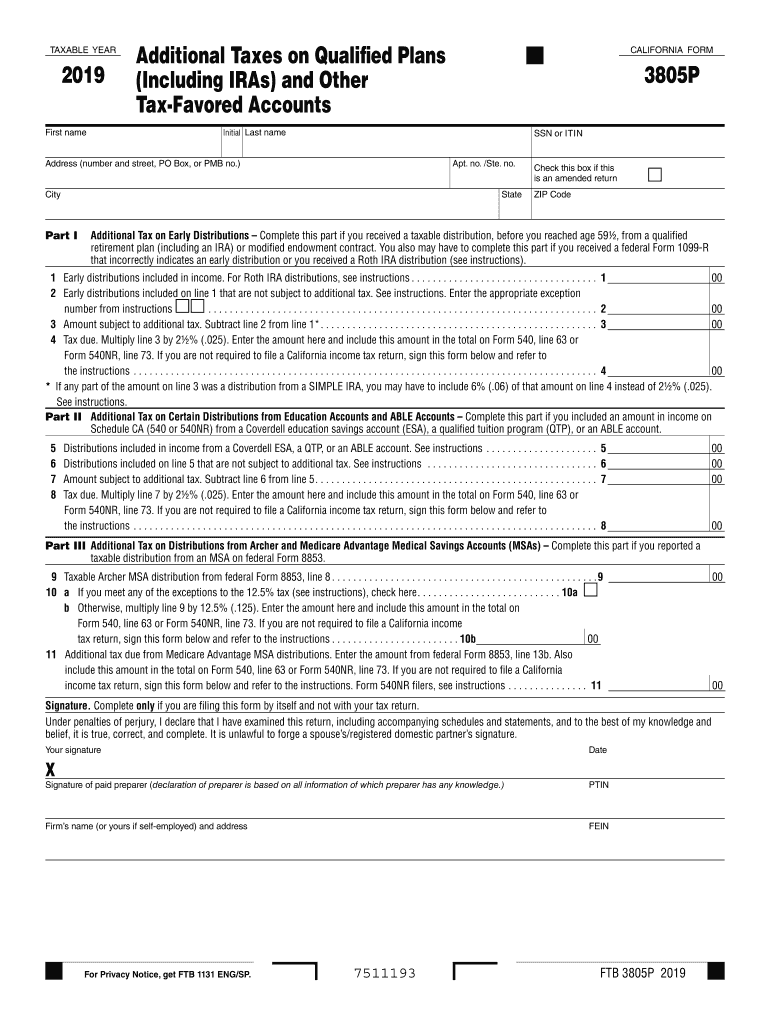

What is the ftb 3805p?

The ftb 3805p is a California tax form used for individuals who wish to opt out of the California IRA tax program. This form is essential for taxpayers who want to ensure they are not automatically enrolled in the state’s retirement savings program. By completing the ftb 3805p, individuals can formally declare their decision to opt out, maintaining control over their retirement savings choices.

Steps to complete the ftb 3805p

Completing the ftb 3805p involves several straightforward steps:

- Obtain the latest version of the ftb 3805p form from the California Franchise Tax Board.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate your intention to opt out of the California IRA tax program by following the instructions provided on the form.

- Review the completed form for accuracy to ensure all information is correct.

- Sign and date the form to validate your request.

- Submit the form according to the specified submission methods.

Form Submission Methods

The ftb 3805p can be submitted through various methods to ensure convenience for taxpayers:

- Online Submission: If available, you may submit the form through the California Franchise Tax Board's online portal.

- Mail: Print the completed form and send it to the designated address provided on the form. Ensure you use the correct postage.

- In-Person: You may also deliver the form in person at a local Franchise Tax Board office.

Key elements of the ftb 3805p

The ftb 3805p contains several key elements that are crucial for proper completion:

- Personal Information: This includes your name, address, and Social Security number.

- Opt-Out Declaration: A clear statement indicating your desire to opt out of the California IRA tax program.

- Signature: Your signature is required to authenticate the form and confirm your request.

Legal use of the ftb 3805p

Using the ftb 3805p legally requires adherence to specific guidelines. The completed form must be submitted by the deadline set by the California Franchise Tax Board to ensure it is processed correctly. Failure to submit the form on time may result in automatic enrollment in the California IRA tax program, which could affect your tax obligations and retirement savings.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the ftb 3805p. Typically, the form must be submitted by a specific date each year to avoid automatic enrollment. Check the California Franchise Tax Board's official website for the most current deadlines to ensure compliance.

Quick guide on how to complete contact us by maildepartment of revenue taxation

Effortlessly Prepare Contact Us By MailDepartment Of Revenue Taxation on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect environmentally friendly substitute for conventional printed and signed paperwork, enabling you to acquire the right form and securely store it online. airSlate SignNow provides all the resources you require to create, modify, and eSign your documents quickly and without delays. Manage Contact Us By MailDepartment Of Revenue Taxation on any device using the airSlate SignNow Android or iOS applications, and simplify any document-related process today.

The simplest way to alter and eSign Contact Us By MailDepartment Of Revenue Taxation without hassle

- Find Contact Us By MailDepartment Of Revenue Taxation and click on Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which only takes seconds and carries the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign Contact Us By MailDepartment Of Revenue Taxation while ensuring excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct contact us by maildepartment of revenue taxation

Create this form in 5 minutes!

How to create an eSignature for the contact us by maildepartment of revenue taxation

The way to generate an eSignature for your PDF document in the online mode

The way to generate an eSignature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

The best way to generate an electronic signature right from your mobile device

The way to create an electronic signature for a PDF document on iOS devices

The best way to generate an electronic signature for a PDF on Android devices

People also ask

-

What is the FTB 3805P form and how is it used?

The FTB 3805P form is a California tax form used for claiming a credit for taxes paid to other states. By understanding the purpose of the FTB 3805P, businesses can effectively manage their state tax obligations and maximize potential refunds.

-

How can airSlate SignNow simplify the process of filling out the FTB 3805P?

AirSlate SignNow provides an intuitive platform that allows users to fill out the FTB 3805P form electronically. With features like data validation and eSignature, you can ensure that your form is accurate and submitted on time.

-

Is there a cost associated with using airSlate SignNow for the FTB 3805P?

Yes, airSlate SignNow offers competitive pricing plans that cater to various business needs. This cost-effective solution enables businesses to manage their document workflows, including the FTB 3805P, without breaking the bank.

-

What are the key features of airSlate SignNow for eSigning the FTB 3805P?

Key features include the ability to electronically sign the FTB 3805P, track document status, and securely store all forms. These functions streamline the signature process, allowing users to focus on their business operations.

-

Can I integrate airSlate SignNow with other software for processing the FTB 3805P?

Absolutely! AirSlate SignNow offers easy integrations with popular business applications. This allows you to automate workflows related to the FTB 3805P and enhance your productivity.

-

What are the benefits of using airSlate SignNow for the FTB 3805P?

Using airSlate SignNow to handle the FTB 3805P benefits businesses by increasing efficiency, reducing paperwork errors, and accelerating the submission process. This ensures a smoother experience during tax season.

-

How secure is airSlate SignNow when dealing with the FTB 3805P?

AirSlate SignNow takes security seriously, ensuring that all documents, including the FTB 3805P, are protected through advanced encryption protocols. You can trust that your sensitive information remains confidential.

Get more for Contact Us By MailDepartment Of Revenue Taxation

Find out other Contact Us By MailDepartment Of Revenue Taxation

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document