CORP Form

What is Form G-1003?

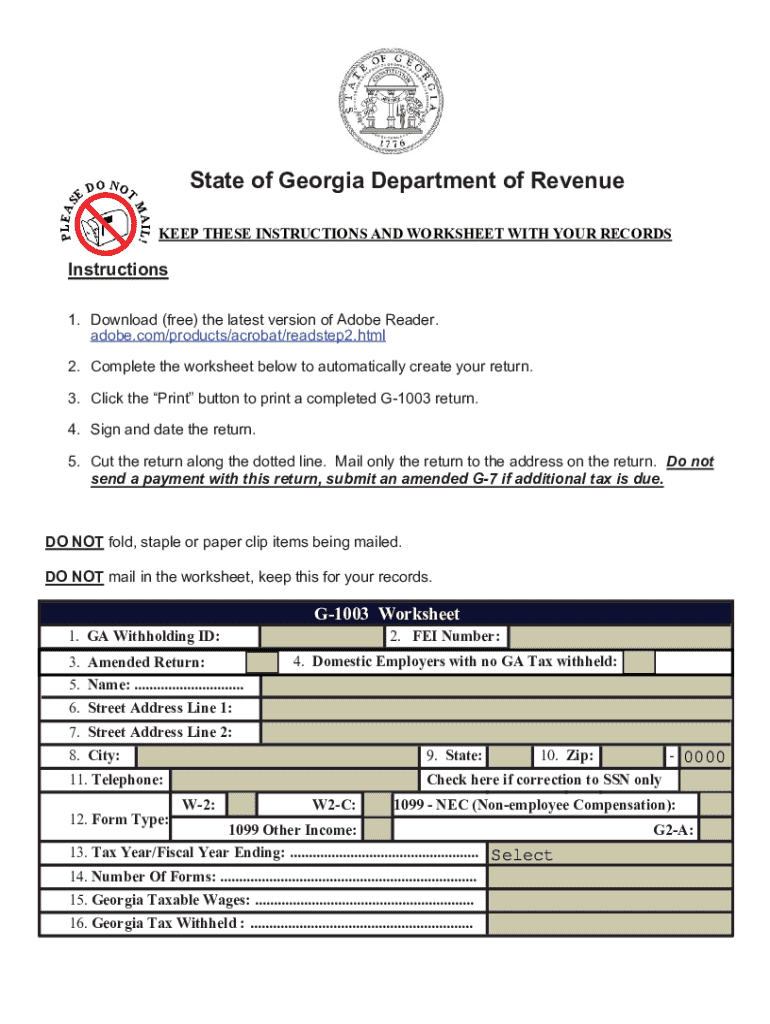

The G-1003 form, also known as the Georgia G-1003 Statement, is a tax document used by businesses in Georgia to report certain tax information to the Georgia Department of Revenue. This form is essential for ensuring compliance with state tax regulations and accurately reporting financial data. The G-1003 is particularly relevant for businesses that need to document their gross receipts and other financial transactions for tax purposes.

Steps to Complete the G-1003

Completing the G-1003 form involves several key steps to ensure accuracy and compliance:

- Gather Required Information: Collect all necessary financial records, including gross receipts and any deductions that may apply.

- Fill Out the Form: Enter the required information in the appropriate fields, ensuring that all figures are accurate and complete.

- Review for Accuracy: Double-check all entries for errors or omissions before submitting the form.

- Submit the Form: Choose your preferred submission method, whether online, by mail, or in person.

Legal Use of the G-1003

The G-1003 form is legally required for businesses operating in Georgia to report their gross receipts. Failing to submit this form can lead to penalties and fines. It is important for businesses to understand the legal implications of their reporting obligations and to ensure that they are compliant with state tax laws.

Filing Deadlines / Important Dates

Businesses must be aware of the filing deadlines associated with the G-1003 form to avoid late fees and penalties. Typically, the G-1003 is due on the 20th day of the month following the end of the reporting period. For example, if reporting for the month of January, the form must be submitted by February 20th. It is advisable to check the Georgia Department of Revenue's website for any updates or changes to these deadlines.

Form Submission Methods

Businesses can submit the G-1003 form through various methods, including:

- Online Submission: Many businesses prefer to file electronically through the Georgia Department of Revenue's online portal, which offers a streamlined process.

- Mail: The form can be printed and mailed to the appropriate address provided by the Georgia Department of Revenue.

- In-Person: Some businesses may choose to deliver the form in person at their local Department of Revenue office.

Required Documents

To complete the G-1003 form, businesses must have certain documents on hand. These typically include:

- Financial statements reflecting gross receipts

- Any relevant receipts or invoices

- Documentation of deductions claimed

Having these documents ready will facilitate a smoother filing process and help ensure accuracy in reporting.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the corp

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is g1003 and how does it relate to airSlate SignNow?

The g1003 is a unique identifier for a specific feature set within airSlate SignNow. It represents our commitment to providing businesses with an efficient eSigning solution. By utilizing g1003, users can streamline their document workflows and enhance productivity.

-

How much does airSlate SignNow cost with the g1003 feature?

Pricing for airSlate SignNow with the g1003 feature varies based on the subscription plan chosen. We offer flexible pricing options to accommodate businesses of all sizes. For detailed pricing information, visit our website or contact our sales team.

-

What features are included with the g1003 plan?

The g1003 plan includes a comprehensive set of features such as document templates, advanced eSigning capabilities, and integration with popular applications. These features are designed to simplify the signing process and improve overall efficiency for users.

-

How can g1003 benefit my business?

Implementing the g1003 feature can signNowly benefit your business by reducing turnaround times for document signing. It enhances collaboration and ensures that all parties can sign documents securely and efficiently. This leads to improved customer satisfaction and streamlined operations.

-

Can I integrate g1003 with other software applications?

Yes, airSlate SignNow with the g1003 feature offers seamless integration with various software applications, including CRM and project management tools. This allows for a more cohesive workflow and ensures that your document management processes are fully optimized.

-

Is there a free trial available for the g1003 feature?

Yes, we offer a free trial for airSlate SignNow, which includes access to the g1003 feature. This allows prospective customers to explore the capabilities and benefits of our eSigning solution before committing to a subscription.

-

What types of documents can I sign using g1003?

With the g1003 feature, you can sign a wide variety of documents, including contracts, agreements, and forms. The platform supports multiple file formats, ensuring that you can manage all your signing needs in one place.

Get more for CORP

- Colorado department of revenue sales tax reporting form

- Temporary injunction for protection against domestic violencewith minor children family law forms

- Dr 0021w form

- Wwwpdffillercom568083057 cover sheet request2021 form ca request for domestic violence restraining order

- Family law 7 103 form

- Instructions for the colorado business registration form cr

- Marijuana finding of suitability application natural person form

- About schedule e form 1040 supplemental income and loss schedule e for supplemental income and loss explainedschedule e for

Find out other CORP

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself