2024AR4PT ABC PDF Form

What is the AR Withholding Affidavit?

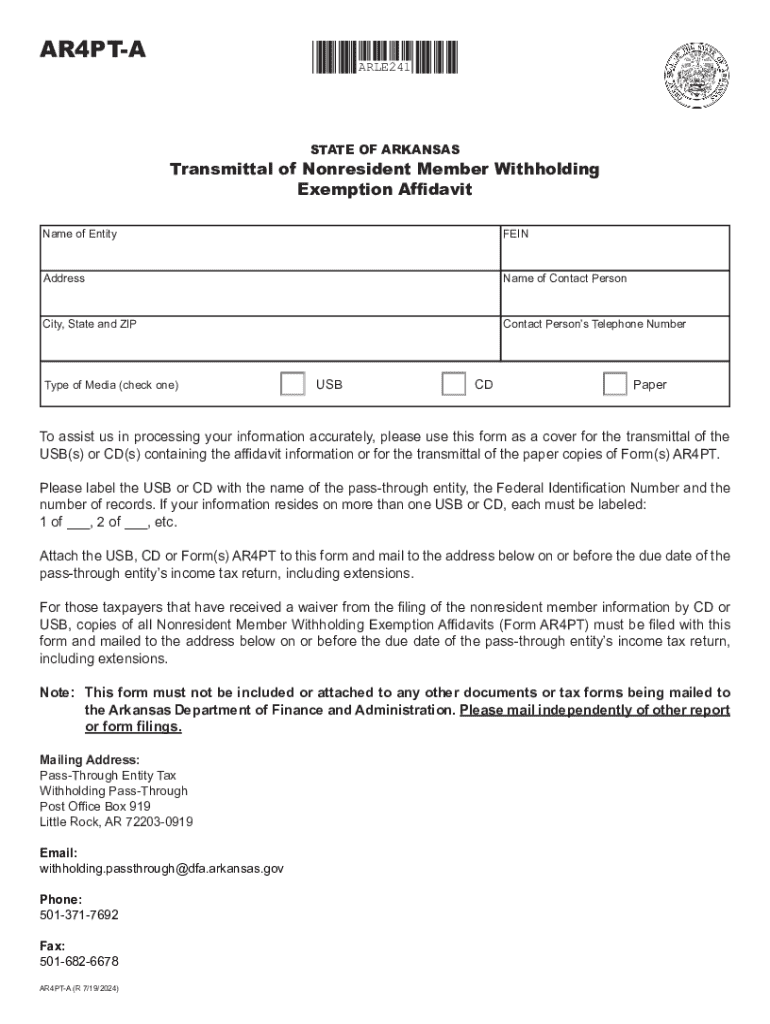

The AR withholding affidavit, also known as the AR4PT form, is a document used by individuals and businesses in Arkansas to claim withholding exemptions. This form is essential for nonresidents who earn income in Arkansas and wish to avoid unnecessary state tax withholding. By completing this affidavit, taxpayers can provide the necessary information to the Arkansas Department of Finance and Administration, ensuring that the correct amount of tax is withheld from their earnings.

Steps to Complete the AR Withholding Affidavit

To successfully fill out the AR withholding affidavit, follow these steps:

- Obtain the AR4PT form, which can be downloaded in PDF format.

- Provide your personal information, including your name, address, and Social Security number.

- Indicate your residency status, confirming whether you are a nonresident.

- Specify the type of income you are receiving and the withholding exemption you are claiming.

- Sign and date the affidavit to certify that the information provided is accurate.

Key Elements of the AR Withholding Affidavit

The AR withholding affidavit includes several key elements that are crucial for proper completion:

- Personal Information: This section requires your name, address, and Social Security number.

- Residency Status: You must clearly indicate whether you are a resident or nonresident of Arkansas.

- Income Type: Specify the nature of the income you are receiving, such as wages or contract payments.

- Exemption Claim: Detail the specific withholding exemption you are applying for, if applicable.

Legal Use of the AR Withholding Affidavit

The AR withholding affidavit serves a legal purpose by allowing nonresidents to claim exemptions from state tax withholding. It is important to use this form correctly to comply with Arkansas tax laws. Failure to accurately complete the affidavit could result in incorrect tax withholding, leading to potential penalties or issues with the state tax authority.

Filing Deadlines / Important Dates

When filing the AR withholding affidavit, it is essential to be aware of key deadlines:

- Submit the affidavit before the first payment is made to ensure proper withholding.

- Check for any annual updates or changes to filing requirements that may affect your submission.

- Keep track of any specific deadlines related to your income type or residency status.

Form Submission Methods

The AR withholding affidavit can be submitted through various methods:

- Online: Some taxpayers may have the option to submit the form electronically through the Arkansas Department of Finance and Administration's online portal.

- Mail: You can print the completed form and mail it to the appropriate state office.

- In-Person: Alternatively, you may choose to deliver the form in person to a designated state office.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2024ar4pt abc pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an AR withholding affidavit?

An AR withholding affidavit is a legal document used to signNow that a business or individual is compliant with Arkansas withholding tax requirements. This affidavit is essential for ensuring that the correct amount of taxes is withheld from payments made to employees or contractors. Understanding this document is crucial for maintaining compliance and avoiding penalties.

-

How can airSlate SignNow help with AR withholding affidavits?

airSlate SignNow provides a streamlined platform for creating, sending, and eSigning AR withholding affidavits. Our user-friendly interface allows you to easily customize your documents and ensure they meet state requirements. With airSlate SignNow, you can manage your affidavits efficiently, saving time and reducing errors.

-

What are the pricing options for using airSlate SignNow for AR withholding affidavits?

airSlate SignNow offers flexible pricing plans to accommodate businesses of all sizes. Our plans include features specifically designed for managing documents like AR withholding affidavits, ensuring you get the best value for your investment. You can choose a plan that fits your needs and budget, with options for monthly or annual billing.

-

Are there any integrations available for airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various applications and platforms, enhancing your workflow for managing AR withholding affidavits. You can connect with popular tools like Google Drive, Salesforce, and more to streamline your document processes. These integrations help you maintain efficiency and keep all your important documents in one place.

-

What are the benefits of using airSlate SignNow for AR withholding affidavits?

Using airSlate SignNow for AR withholding affidavits offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced compliance. Our platform allows for quick eSigning and document tracking, ensuring that your affidavits are processed promptly. Additionally, the secure storage of documents helps protect sensitive information.

-

Is airSlate SignNow secure for handling AR withholding affidavits?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that your AR withholding affidavits are protected. We utilize advanced encryption and secure cloud storage to safeguard your documents. You can trust that your sensitive information is safe while using our platform.

-

Can I customize my AR withholding affidavit templates in airSlate SignNow?

Yes, airSlate SignNow allows you to customize your AR withholding affidavit templates to meet your specific needs. You can easily add your branding, modify fields, and include any necessary information to ensure compliance with Arkansas regulations. This flexibility helps you create professional documents that reflect your business.

Get more for 2024AR4PT ABC pdf

- Water lien letter real estate transfer tax stamps form

- Wwwstatenjustreasurytaxationnj division of taxation sales and use tax forms

- Commercial motor vehicle guidebook form

- Arizona 46 0106 form

- Sc angel investor credit form

- South carolina w2 form

- Cobb county georgia homestead exemption form

- Httpsapi14ilovepdfcomv1download form

Find out other 2024AR4PT ABC pdf

- How To eSign Illinois Rental application

- How To eSignature Maryland Affidavit of Identity

- eSignature New York Affidavit of Service Easy

- How To eSignature Idaho Affidavit of Title

- eSign Wisconsin Real estate forms Secure

- How To eSign California Real estate investment proposal template

- eSignature Oregon Affidavit of Title Free

- eSign Colorado Real estate investment proposal template Simple

- eSign Louisiana Real estate investment proposal template Fast

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now