MC 366 and MC 366A Nevada IFTA Tax Return, Instructions and Form

What is the MC 366 and MC 366A Nevada IFTA Tax Return?

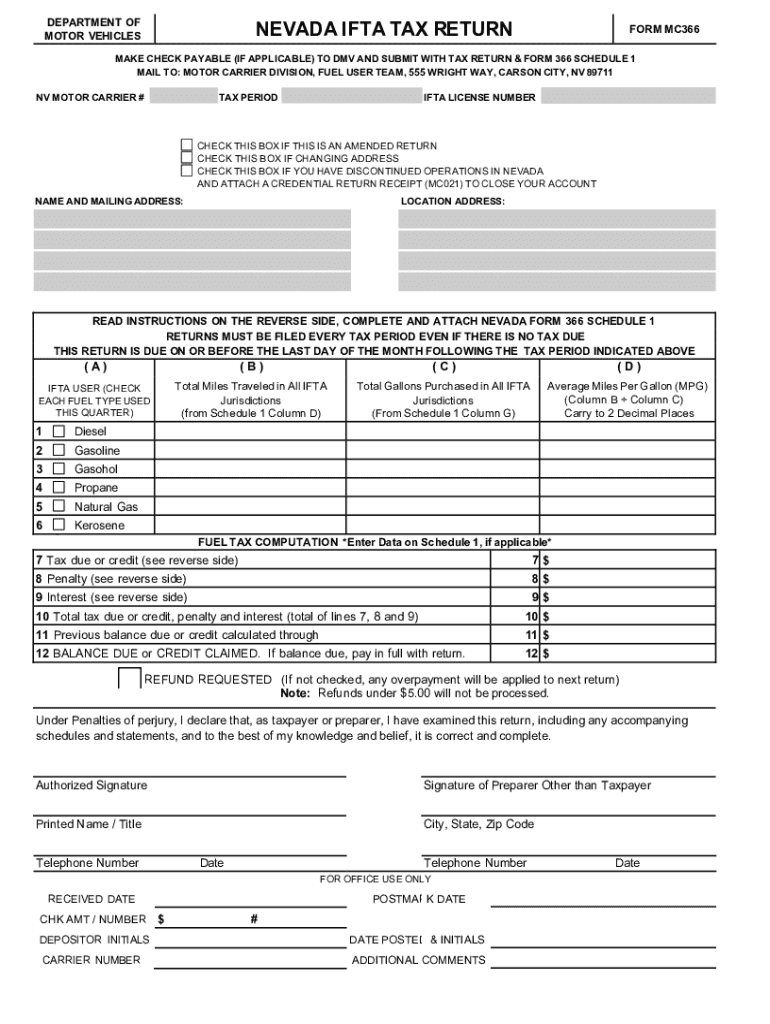

The MC 366 and MC 366A forms are essential documents for businesses operating in Nevada that are subject to the International Fuel Tax Agreement (IFTA). These forms are used to report fuel use by motor carriers that operate in multiple jurisdictions. The MC 366 serves as the primary tax return, detailing the fuel consumed in each state, while the MC 366A is an accompanying schedule that provides additional information on fuel purchases and usage. Together, these forms ensure compliance with state and federal fuel tax regulations.

Steps to Complete the MC 366 and MC 366A Nevada IFTA Tax Return

Completing the MC 366 and MC 366A forms involves several key steps. First, gather all relevant data regarding fuel purchases and mileage driven in each jurisdiction. Next, fill out the MC 366 by entering total miles traveled and fuel consumed in each state. For the MC 366A, provide detailed records of fuel purchases, including dates, quantities, and costs. After completing both forms, review them for accuracy before submission. Be mindful of the filing deadlines to avoid penalties.

Filing Deadlines for the MC 366 and MC 366A Forms

It is crucial to adhere to the filing deadlines for the MC 366 and MC 366A forms to maintain compliance with Nevada tax regulations. Typically, these forms are due quarterly, with specific deadlines falling on the last day of the month following the end of each quarter. For example, the due date for the first quarter (January to March) is April 30. Late submissions may incur penalties and interest, making timely filing essential for all motor carriers.

Required Documents for the MC 366 and MC 366A Filing

When preparing to file the MC 366 and MC 366A forms, certain documents are necessary to ensure accurate reporting. These include detailed records of fuel purchases, mileage logs, and any previous IFTA returns. Additionally, businesses should maintain receipts and invoices for fuel transactions, as these documents may be required for verification purposes. Having all necessary documentation organized can streamline the filing process and reduce the risk of errors.

Form Submission Methods for the MC 366 and MC 366A

The MC 366 and MC 366A forms can be submitted through various methods, offering flexibility for businesses. Motor carriers can file these forms online through the Nevada DMV website, ensuring a quick and efficient process. Alternatively, businesses can choose to mail their completed forms to the appropriate tax authority or submit them in person at a DMV office. Each method has its own advantages, and businesses should select the one that best suits their operational needs.

Penalties for Non-Compliance with IFTA Regulations

Failure to comply with IFTA regulations, including the timely filing of the MC 366 and MC 366A forms, can result in significant penalties. These may include fines, interest on unpaid taxes, and potential audits by tax authorities. In severe cases, repeated non-compliance can lead to the suspension of IFTA credentials, impacting a business's ability to operate across state lines. It is essential for motor carriers to understand these consequences and prioritize compliance to avoid financial repercussions.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mc 366 and mc 366a nevada ifta tax return instructions and

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Nevada IFTA sign feature in airSlate SignNow?

The Nevada IFTA sign feature in airSlate SignNow allows businesses to easily eSign and manage their International Fuel Tax Agreement documents. This feature streamlines the process, ensuring compliance with Nevada regulations while saving time and reducing paperwork.

-

How does airSlate SignNow ensure the security of my Nevada IFTA sign documents?

airSlate SignNow prioritizes the security of your Nevada IFTA sign documents by employing advanced encryption and secure cloud storage. This ensures that your sensitive information remains protected and accessible only to authorized users.

-

What are the pricing options for using the Nevada IFTA sign feature?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including options for the Nevada IFTA sign feature. You can choose a plan that fits your budget while enjoying the benefits of efficient document management and eSigning.

-

Can I integrate airSlate SignNow with other software for my Nevada IFTA sign needs?

Yes, airSlate SignNow provides seamless integrations with various software applications, enhancing your workflow for Nevada IFTA sign documents. This allows you to connect with tools you already use, making the eSigning process even more efficient.

-

What are the benefits of using airSlate SignNow for Nevada IFTA sign documents?

Using airSlate SignNow for your Nevada IFTA sign documents offers numerous benefits, including increased efficiency, reduced turnaround time, and improved compliance. The user-friendly interface makes it easy for anyone to eSign documents quickly and securely.

-

Is there a mobile app for managing Nevada IFTA sign documents?

Yes, airSlate SignNow offers a mobile app that allows you to manage your Nevada IFTA sign documents on the go. This feature ensures that you can eSign and send documents anytime, anywhere, enhancing your productivity.

-

How can I track the status of my Nevada IFTA sign documents?

airSlate SignNow provides real-time tracking for your Nevada IFTA sign documents, allowing you to monitor their status easily. You will receive notifications when documents are viewed, signed, or completed, ensuring you stay informed throughout the process.

Get more for MC 366 And MC 366A Nevada IFTA Tax Return, Instructions And

- Missouri deed formsquit claim warranty and special

- Missouri warranty deed us legal forms

- Control number mo 014 77 form

- Control number mo 014 78 form

- Control number mo 015 77 form

- Husband and wife to husband and form

- Control number mo 017 78 form

- Accordance with the applicable laws of the state of missouri form

Find out other MC 366 And MC 366A Nevada IFTA Tax Return, Instructions And

- Electronic signature Delaware Non-Profit Stock Certificate Free

- Electronic signature Iowa Legal LLC Operating Agreement Fast

- Electronic signature Legal PDF Kansas Online

- Electronic signature Legal Document Kansas Online

- Can I Electronic signature Kansas Legal Warranty Deed

- Can I Electronic signature Kansas Legal Last Will And Testament

- Electronic signature Kentucky Non-Profit Stock Certificate Online

- Electronic signature Legal PDF Louisiana Online

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online