Form 720 2025-2026

What is the Form 720

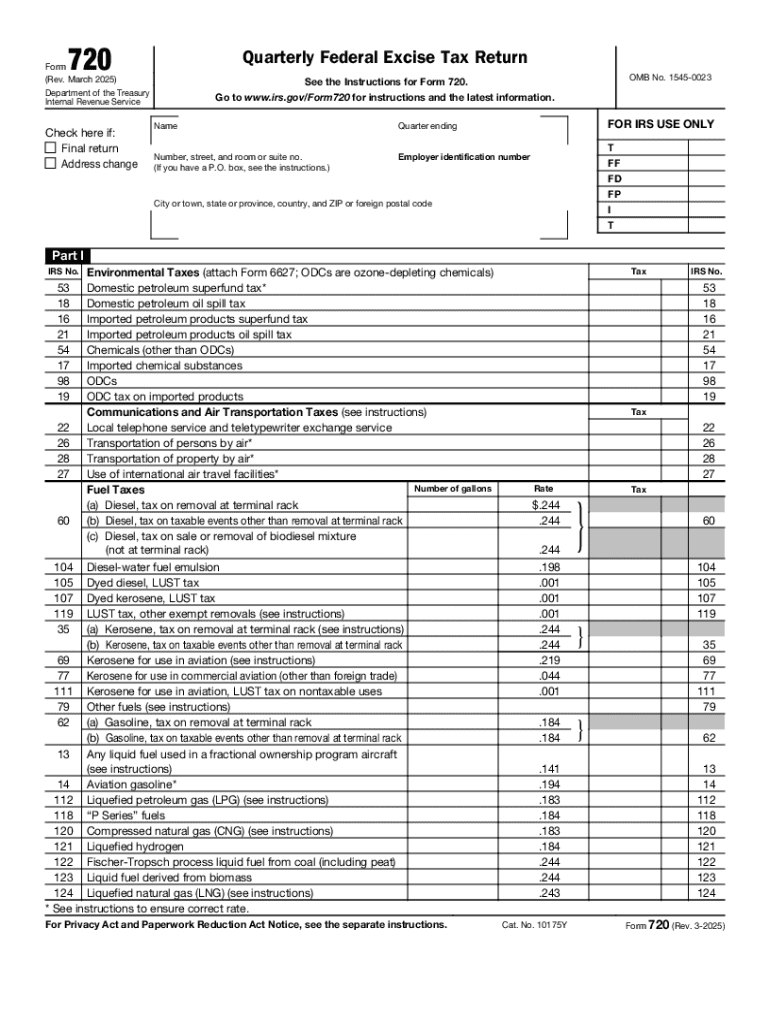

The IRS Form 720 is a tax form used to report and pay federal excise taxes. This form is essential for businesses and individuals who are liable for specific taxes imposed on certain goods, services, and activities. The form covers a range of excise taxes, including those related to environmental taxes, communication services, and fuel taxes. Understanding the purpose and requirements of Form 720 is crucial for compliance with federal tax laws.

How to use the Form 720

Using Form 720 involves several steps to ensure accurate reporting of excise taxes. Taxpayers must first determine if they are subject to any excise taxes based on their business activities. Once this is established, they can complete the form by providing necessary details such as the type of tax being reported and the amounts owed. It is important to follow the instructions carefully to avoid errors that could lead to penalties.

Steps to complete the Form 720

Completing Form 720 requires careful attention to detail. Here are the general steps:

- Gather all relevant financial information regarding taxable activities.

- Identify the specific excise taxes applicable to your situation.

- Fill out the form by entering the required information in the designated fields.

- Calculate the total tax liability based on the information provided.

- Review the completed form for accuracy before submission.

Filing Deadlines / Important Dates

Filing deadlines for Form 720 vary depending on the specific tax period. Generally, the form is filed quarterly, with due dates falling on the last day of the month following the end of each quarter. It is crucial to be aware of these deadlines to avoid late fees and penalties. Taxpayers should also keep track of any changes to deadlines that may occur due to legislative updates or IRS announcements.

Penalties for Non-Compliance

Failure to file Form 720 or pay the associated excise taxes can result in significant penalties. The IRS imposes fines for late filing, which can accumulate over time. Additionally, interest may be charged on any unpaid taxes. Understanding these penalties emphasizes the importance of timely and accurate filing to maintain compliance and avoid unnecessary financial burdens.

IRS Guidelines

The IRS provides detailed guidelines for completing and submitting Form 720. These guidelines include instructions on the types of taxes reported, eligibility criteria, and specific requirements for various business entities. Taxpayers should refer to the IRS publications and resources to ensure they are following the most current procedures and regulations.

Handy tips for filling out Form 720 online

Quick steps to complete and e-sign Form 720 online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing documents can be. Get access to a GDPR and HIPAA compliant service for optimum simplicity. Use signNow to electronically sign and send Form 720 for collecting e-signatures.

Create this form in 5 minutes or less

Find and fill out the correct form 720 777213004

Create this form in 5 minutes!

How to create an eSignature for the form 720 777213004

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to the number 720?

airSlate SignNow is a powerful eSignature solution that enables businesses to send and sign documents efficiently. The number 720 refers to our pricing plans, which start at just $720 annually, making it a cost-effective choice for organizations looking to streamline their document workflows.

-

What features does airSlate SignNow offer for the 720 pricing plan?

The 720 pricing plan includes essential features such as unlimited eSignatures, document templates, and advanced security options. Users can also access mobile capabilities and integrations with popular applications, ensuring a seamless experience for managing documents.

-

How can airSlate SignNow benefit my business with the 720 plan?

By choosing the 720 plan, businesses can enhance their efficiency by reducing the time spent on document management. The easy-to-use interface and robust features help teams collaborate better, ultimately leading to faster decision-making and improved productivity.

-

Are there any integrations available with the 720 plan?

Yes, the 720 plan offers integrations with various applications such as Google Drive, Salesforce, and Microsoft Office. These integrations allow users to streamline their workflows and manage documents directly from their preferred platforms.

-

Is there a free trial available for the 720 pricing plan?

Yes, airSlate SignNow offers a free trial for prospective customers interested in the 720 plan. This allows users to explore the features and benefits of the platform before committing to a subscription, ensuring it meets their needs.

-

What types of documents can I sign with airSlate SignNow under the 720 plan?

With the 720 plan, you can sign a wide variety of documents, including contracts, agreements, and forms. The platform supports multiple file formats, making it easy to manage all your document signing needs in one place.

-

How secure is airSlate SignNow with the 720 plan?

Security is a top priority for airSlate SignNow. The 720 plan includes advanced security features such as encryption, secure cloud storage, and compliance with industry standards, ensuring that your documents are protected at all times.

Get more for Form 720

Find out other Form 720

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile

- Can I Sign Alabama Healthcare / Medical Quitclaim Deed

- Sign Utah Government Month To Month Lease Myself

- Can I Sign Texas Government Limited Power Of Attorney

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later

- Sign California Healthcare / Medical Arbitration Agreement Free

- Help Me With Sign California Healthcare / Medical Lease Agreement Form

- Sign Connecticut Healthcare / Medical Business Plan Template Free

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile