Form 941 2025-2026

What is the Form 941

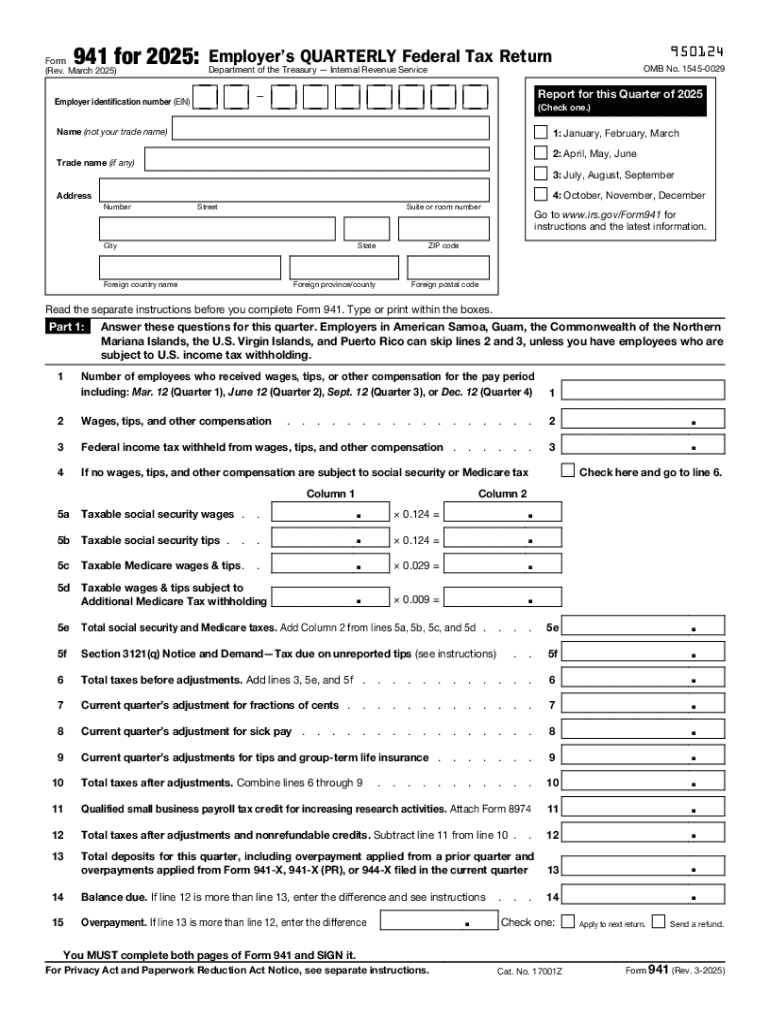

The Form 941 is the IRS quarterly federal tax return used by employers to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. This form is essential for businesses to ensure compliance with federal tax obligations. It is typically filed every quarter and provides the IRS with information about the amount of taxes withheld and the employer's share of Social Security and Medicare taxes.

How to use the Form 941

To effectively use the Form 941, employers must accurately report their payroll taxes. This involves calculating the total wages paid to employees, the amount of federal income tax withheld, and the employer's contributions to Social Security and Medicare. Employers should fill out the form with precise figures to avoid discrepancies that could lead to penalties. The form is also used to reconcile the amounts reported on previous payroll tax deposits.

Steps to complete the Form 941

Completing the Form 941 involves several key steps:

- Gather necessary payroll records, including total wages and taxes withheld.

- Enter the total number of employees and the total wages paid during the quarter.

- Calculate the federal income tax withheld and the employer's share of Social Security and Medicare taxes.

- Complete the payment section if any taxes are due.

- Review the form for accuracy before submission.

Filing Deadlines / Important Dates

Employers must adhere to specific deadlines when filing Form 941. The form is due on the last day of the month following the end of the quarter. For example, for the first quarter ending March 31, the form is due by April 30. Timely filing is crucial to avoid penalties and interest on unpaid taxes.

Form Submission Methods

Form 941 can be submitted through various methods, including:

- Online filing through the IRS e-file system.

- Mailing a paper form to the appropriate IRS address based on the employer's location.

- In-person submission at designated IRS offices.

Penalties for Non-Compliance

Failure to file Form 941 on time or accurately can result in significant penalties. The IRS imposes fines for late filings, which can increase the longer the form remains unfiled. Additionally, underreporting taxes can lead to interest charges and further penalties, emphasizing the importance of compliance and accurate reporting.

IRS Guidelines

The IRS provides detailed guidelines on how to complete and file Form 941. Employers should refer to these guidelines to ensure they understand their obligations. The instructions cover everything from how to calculate taxes owed to specific filing requirements and tips for avoiding common mistakes.

Handy tips for filling out Form 941 online

Quick steps to complete and e-sign Form 941 online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing documents can be. Get access to a GDPR and HIPAA compliant service for optimum simplicity. Use signNow to e-sign and share Form 941 for collecting e-signatures.

Create this form in 5 minutes or less

Find and fill out the correct form 941 776802390

Create this form in 5 minutes!

How to create an eSignature for the form 941 776802390

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 941 tax form for 22025 prtntablle?

The 941 tax form for 22025 prtntablle is a quarterly tax return used by employers to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. This form is essential for businesses to stay compliant with federal tax regulations. Using airSlate SignNow, you can easily fill out and eSign this form, ensuring accuracy and efficiency.

-

How can airSlate SignNow help with the 941 tax form for 22025 prtntablle?

airSlate SignNow streamlines the process of completing the 941 tax form for 22025 prtntablle by providing an intuitive platform for document management. You can fill out the form digitally, eSign it, and send it directly to the IRS, saving time and reducing the risk of errors. Our solution is designed to simplify tax compliance for businesses of all sizes.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate various business needs, including options for small businesses and larger enterprises. Each plan includes access to features that facilitate the completion of documents like the 941 tax form for 22025 prtntablle. You can choose a plan that best fits your budget and requirements.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your sensitive documents, including the 941 tax form for 22025 prtntablle, are protected. We use advanced encryption and security protocols to safeguard your data. You can trust our platform to handle your tax documents with the utmost care.

-

Can I integrate airSlate SignNow with other software?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, enhancing your workflow. Whether you use accounting software or other business tools, you can easily connect them to streamline the process of managing the 941 tax form for 22025 prtntablle and other documents.

-

What features does airSlate SignNow offer for eSigning documents?

airSlate SignNow provides a range of features for eSigning documents, including customizable templates, automated workflows, and real-time tracking. These features make it easy to manage the 941 tax form for 22025 prtntablle and ensure that all signatures are collected promptly. Our platform is designed to enhance your document signing experience.

-

How does airSlate SignNow improve efficiency in tax document management?

By using airSlate SignNow, businesses can signNowly improve efficiency in tax document management, including the 941 tax form for 22025 prtntablle. Our platform allows for quick document creation, easy eSigning, and instant sharing, reducing the time spent on paperwork. This efficiency helps businesses focus on their core operations.

Get more for Form 941

- New jersey ucc f 223 form

- Dfw zip code map printable form

- Dental health history form template

- Lic 613b 103 personal rights childrenamp39s residential dss cahwnet form

- Ljm apc jb 003 pin 1 17 form

- Girl scout interest survey form

- Bopter form

- South texas health system mcallen hospital in mcallen tx form

Find out other Form 941

- eSign Minnesota Non-Profit Confidentiality Agreement Fast

- How Do I eSign Montana Non-Profit POA

- eSign Legal Form New York Online

- Can I eSign Nevada Non-Profit LLC Operating Agreement

- eSign Legal Presentation New York Online

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement