Form ST 809 New York State and Local Sales and Use Tax Return for Part Quarterly Monthly Filers Revised 125 2025-2026

Understanding the ST 809 Form

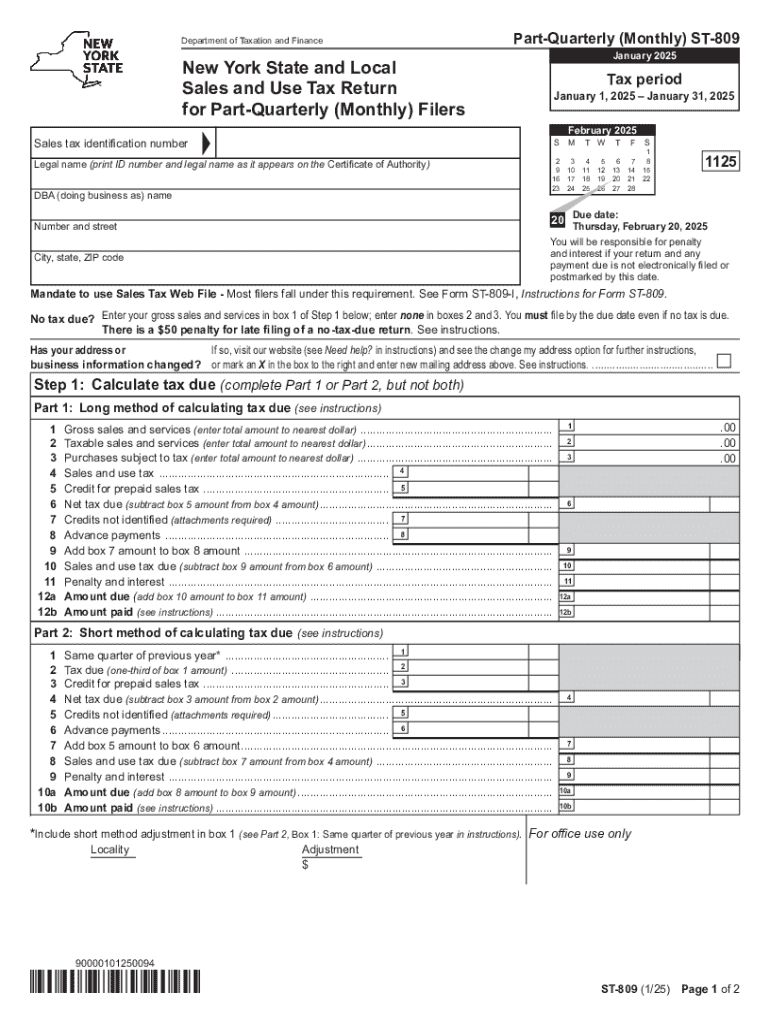

The ST 809 form, officially known as the New York State and Local Sales and Use Tax Return for Part Quarterly Monthly Filers, is a crucial document for businesses operating in New York. This form is used to report sales and use tax liabilities to the state, ensuring compliance with tax regulations. It is specifically designed for businesses that are required to file on a quarterly or monthly basis, depending on their tax obligations. Completing this form accurately is essential for maintaining good standing with the New York State Department of Taxation and Finance.

Steps to Complete the ST 809 Form

Filling out the ST 809 form involves several key steps:

- Gather Necessary Information: Collect all relevant sales data, including total sales, taxable sales, and exempt sales.

- Calculate Tax Liability: Determine the total amount of sales tax owed based on the sales figures collected.

- Complete the Form: Input the calculated figures into the appropriate sections of the ST 809 form, ensuring accuracy.

- Review for Errors: Double-check all entries for mistakes or omissions before submission.

- Submit the Form: File the completed ST 809 form by the designated deadline, either online or via mail.

Obtaining the ST 809 Form

The ST 809 form can be easily obtained through the New York State Department of Taxation and Finance website. It is available as a downloadable PDF, allowing businesses to print and fill it out manually. Additionally, businesses can access the form through various tax software solutions that support New York sales tax filings. Ensuring you have the most current version of the form is important, as tax regulations may change.

Key Elements of the ST 809 Form

The ST 809 form includes several important sections that must be completed:

- Business Information: This section requires the name, address, and identification number of the business.

- Sales and Use Tax Calculations: Businesses must report total sales, taxable sales, and calculate the sales tax owed.

- Exemptions: Any exempt sales must be documented in this section to clarify tax obligations.

- Signature and Date: The form must be signed by an authorized representative of the business, along with the date of submission.

Legal Use of the ST 809 Form

The ST 809 form is legally required for businesses that meet certain sales thresholds in New York. Failure to file this form can result in penalties and interest on unpaid taxes. It serves as an official record of a business's sales tax activity, which can be audited by state authorities. Therefore, it is important for businesses to understand their obligations and ensure timely and accurate filings.

Filing Deadlines and Important Dates

Businesses must adhere to specific deadlines for submitting the ST 809 form. Generally, monthly filers are required to submit their returns by the 20th of the following month, while quarterly filers have deadlines based on the end of their reporting periods. Keeping track of these dates is essential to avoid late fees and maintain compliance with state tax laws.

Create this form in 5 minutes or less

Find and fill out the correct form st 809 new york state and local sales and use tax return for part quarterly monthly filers revised 125

Create this form in 5 minutes!

How to create an eSignature for the form st 809 new york state and local sales and use tax return for part quarterly monthly filers revised 125

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the st 809 form and why is it important?

The st 809 form is a crucial document used for various business transactions, particularly in the context of tax and compliance. Understanding its significance can help businesses ensure they meet regulatory requirements and avoid potential penalties.

-

How can airSlate SignNow help with the st 809 form?

airSlate SignNow simplifies the process of completing and signing the st 809 form by providing an intuitive platform for electronic signatures. This ensures that your documents are signed quickly and securely, streamlining your workflow.

-

Is there a cost associated with using airSlate SignNow for the st 809 form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan provides access to features that facilitate the efficient handling of documents like the st 809 form, ensuring you get value for your investment.

-

What features does airSlate SignNow offer for managing the st 809 form?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure cloud storage, all of which enhance the management of the st 809 form. These tools help you save time and reduce errors in document handling.

-

Can I integrate airSlate SignNow with other applications for the st 809 form?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to seamlessly manage the st 809 form alongside your existing tools. This enhances productivity and ensures a smooth workflow across platforms.

-

What are the benefits of using airSlate SignNow for the st 809 form?

Using airSlate SignNow for the st 809 form provides numerous benefits, including increased efficiency, reduced turnaround times, and enhanced security. These advantages help businesses focus on their core operations while ensuring compliance.

-

Is airSlate SignNow user-friendly for completing the st 809 form?

Yes, airSlate SignNow is designed with user experience in mind, making it easy for anyone to complete the st 809 form. The platform's intuitive interface allows users to navigate effortlessly, even if they are not tech-savvy.

Get more for Form ST 809 New York State And Local Sales And Use Tax Return For Part Quarterly Monthly Filers Revised 125

- Statement of personal history washington county co washington or form

- Mcsa 5889 form

- Stock transfer form uk collective investment schemes

- Dd form 2883 credit worthiness evaluation july 2004 dtic

- Isp 3026 formpdffillercom 2015 2019

- Canada pension plan credit split sc isp 1901 e servicecanada gc form

- Where to send sc isp 1200 form

- Penndot form p 329

Find out other Form ST 809 New York State And Local Sales And Use Tax Return For Part Quarterly Monthly Filers Revised 125

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure