Form ST 809120New York State and Local Tax Ny Gov 2020

What is the NYS ST 809 Form?

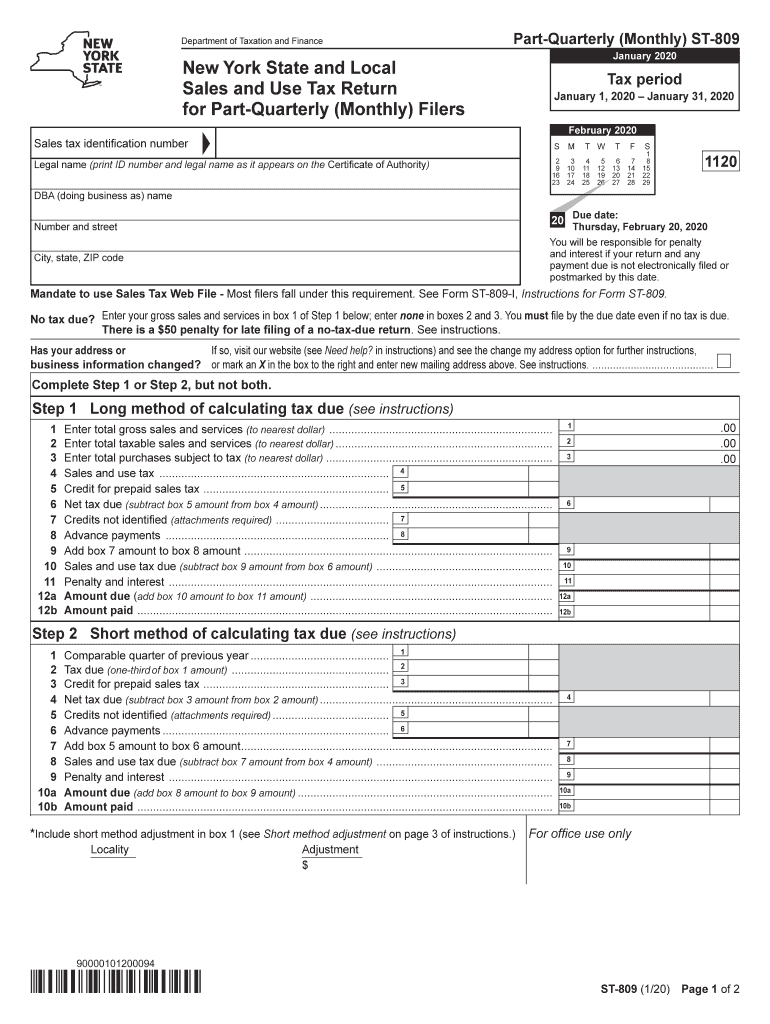

The NYS ST 809 form, also known as the New York State Sales Tax Form ST-809, is a crucial document used by businesses to report sales tax exemptions. This form is specifically designed for use in New York State and is essential for claiming sales tax exemptions on purchases made for resale or other qualifying purposes. Understanding the purpose and requirements of the ST 809 form is vital for businesses looking to maintain compliance with state tax regulations.

Steps to Complete the NYS ST 809 Form

Completing the NYS ST 809 form involves several key steps to ensure accuracy and compliance. Here is a straightforward guide to help you fill out the form:

- Begin by entering your business information, including the legal name and address.

- Provide your New York State sales tax identification number, which is necessary for processing the form.

- Clearly indicate the type of exemption you are claiming, such as resale or other specific exemptions.

- List the items or services for which you are claiming the exemption, ensuring that they meet the criteria established by New York State tax laws.

- Sign and date the form to validate your claims and ensure that all information is accurate and complete.

Legal Use of the NYS ST 809 Form

The NYS ST 809 form is legally binding when filled out correctly and submitted in accordance with New York State tax regulations. To ensure its legal use, it is important to provide truthful information and to only claim exemptions for eligible purchases. Misuse of the form can lead to penalties, including fines or other legal repercussions. Therefore, businesses should be diligent in understanding the legal implications of the exemptions they claim on this form.

Filing Deadlines / Important Dates

Timely submission of the NYS ST 809 form is critical for maintaining compliance with state tax laws. Businesses should be aware of the following important dates:

- The form should be submitted at the time of purchase to ensure that the seller can apply the exemption correctly.

- Keep track of any updates to filing requirements or deadlines announced by the New York State Department of Taxation and Finance.

Form Submission Methods

The NYS ST 809 form can be submitted through various methods to accommodate different business needs. Options include:

- Submitting the form in person at the point of sale to ensure immediate processing.

- Mailing the completed form to the seller for their records, ensuring that you keep a copy for your own documentation.

- Utilizing digital platforms that may allow for electronic submission, depending on the seller’s capabilities.

Key Elements of the NYS ST 809 Form

Understanding the key elements of the NYS ST 809 form is essential for accurate completion. The form typically includes:

- Business identification details, including name and sales tax ID number.

- Types of exemptions being claimed, clearly categorized for ease of understanding.

- A declaration section where the signer certifies the accuracy of the information provided.

Quick guide on how to complete form st 809120new york state and local taxnygov

Effortlessly prepare Form ST 809120New York State And Local Tax ny gov on any device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to locate the suitable form and securely store it online. airSlate SignNow provides you with all the tools necessary for creating, modifying, and electronically signing your documents promptly without any hold-ups. Handle Form ST 809120New York State And Local Tax ny gov on any device with the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign Form ST 809120New York State And Local Tax ny gov with ease

- Obtain Form ST 809120New York State And Local Tax ny gov and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant parts of your documents or obscure sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign feature, which takes only seconds and holds the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method for delivering your form, whether via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors requiring new copies to be printed. airSlate SignNow addresses your document management needs with just a few clicks from any device you choose. Modify and electronically sign Form ST 809120New York State And Local Tax ny gov and ensure exceptional communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form st 809120new york state and local taxnygov

Create this form in 5 minutes!

How to create an eSignature for the form st 809120new york state and local taxnygov

How to create an electronic signature for your Form St 809120new York State And Local Taxnygov in the online mode

How to create an eSignature for the Form St 809120new York State And Local Taxnygov in Google Chrome

How to create an eSignature for putting it on the Form St 809120new York State And Local Taxnygov in Gmail

How to make an electronic signature for the Form St 809120new York State And Local Taxnygov from your smart phone

How to create an eSignature for the Form St 809120new York State And Local Taxnygov on iOS

How to make an eSignature for the Form St 809120new York State And Local Taxnygov on Android OS

People also ask

-

What is the NYS ST 809 form and why is it important?

The NYS ST 809 form is a certificate used in New York State for tax-exempt purchases. Understanding its importance is crucial for businesses that wish to avoid sales tax on qualifying items. Using airSlate SignNow, you can easily eSign and manage your NYS ST 809 forms digitally, streamlining the process.

-

How can airSlate SignNow help with the NYS ST 809 form?

AirSlate SignNow allows users to electronically sign the NYS ST 809 form quickly and securely. This eliminates the hassle of physical paperwork, enabling you to process tax-exempt transactions more efficiently while maintaining compliance with legal requirements.

-

Is there a cost associated with using airSlate SignNow for the NYS ST 809 form?

AirSlate SignNow offers various pricing plans that cater to different business needs, ensuring affordability. By using our platform for the NYS ST 809 form, you not only save time but also reduce costs associated with printing and mailing documents.

-

What features does airSlate SignNow provide for processing the NYS ST 809 form?

AirSlate SignNow includes features like document templates, custom branding, and secure cloud storage, all of which enhance your experience while handling the NYS ST 809 form. These features help ensure that your forms are filled out correctly and stored securely, simplifying your workflow.

-

Can I integrate airSlate SignNow with other tools for managing the NYS ST 809 form?

Yes, airSlate SignNow offers seamless integrations with various tools like CRM systems, project management software, and cloud storage services. This makes it easy to manage your NYS ST 809 form alongside other documents and tasks, enhancing productivity and organization.

-

What benefits does eSigning the NYS ST 809 form provide?

eSigning the NYS ST 809 form with airSlate SignNow speeds up the process and reduces the chances of errors compared to paper-based signing. Additionally, it allows you to track the status of your forms in real-time, providing peace of mind and ensuring that you maintain compliance.

-

How secure is airSlate SignNow when handling the NYS ST 809 form?

AirSlate SignNow prioritizes security with advanced encryption and secure storage for all documents, including the NYS ST 809 form. Your sensitive information is safeguarded, ensuring compliance with industry regulations and protecting your business's data.

Get more for Form ST 809120New York State And Local Tax ny gov

- Westford ma pistol permit application form

- Mshsl triple a mshsl form

- Dhs 3973 disclosure statement for individual performing providers dhsforms hr state or

- Gel application form pagcor

- Emergency information form kiddie academy

- Fringe benefit statement form

- Azui unemployment application form

- Cit 0480 f formulaire pr paration du certificat de citoyennet cic gc

Find out other Form ST 809120New York State And Local Tax ny gov

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation

- How Do I eSign Hawaii Charity Presentation

- How Can I eSign Illinois Charity Word

- How To eSign Virginia Business Operations Presentation

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form