Form ST 809 New York State and Local Sales and Use Tax Return for Part Quarterly Monthly Filers Revised 1020 2020

What is the Form ST 809?

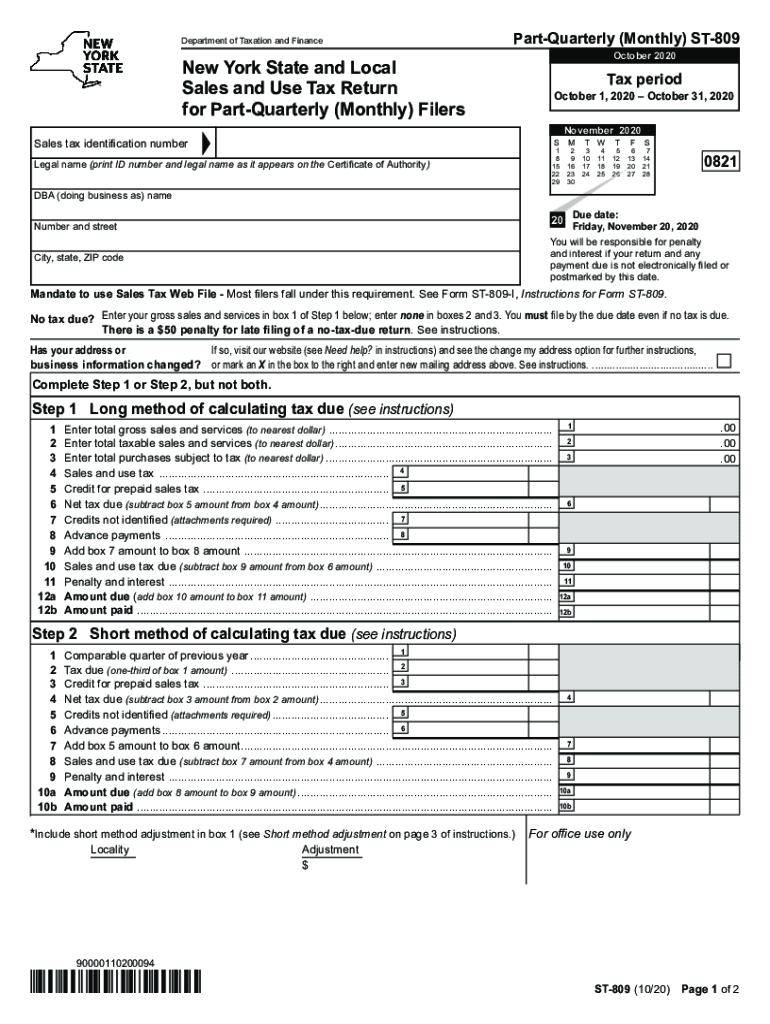

The Form ST 809 is the New York State and Local Sales and Use Tax Return designed for businesses that file on a quarterly or monthly basis. This form is essential for reporting sales tax collected from customers and for remitting the appropriate amount to the state. It provides a structured way for businesses to account for their sales and use tax obligations, ensuring compliance with New York tax laws.

Steps to Complete the Form ST 809

Completing the Form ST 809 involves several key steps to ensure accuracy and compliance:

- Gather necessary information: Collect all sales records, including taxable and exempt sales, and any purchases made that are subject to use tax.

- Complete the form: Fill out the required sections, including total sales, taxable sales, and the amount of sales tax collected.

- Calculate totals: Ensure that all calculations are accurate, including any deductions for exempt sales.

- Review for errors: Double-check all entries for completeness and accuracy before submission.

- Submit the form: Choose your preferred submission method, whether online or by mail, to ensure timely filing.

How to Obtain the Form ST 809

The Form ST 809 can be easily obtained through the New York State Department of Taxation and Finance website. It is available for download in PDF format, which allows for easy printing and completion. Additionally, businesses may request physical copies through the department's offices if needed.

Filing Deadlines and Important Dates

It is crucial for businesses to be aware of the filing deadlines associated with the Form ST 809. Typically, the form must be submitted on a quarterly or monthly basis, depending on the business's sales volume. The specific due dates can vary, so it is advisable to consult the New York State Department of Taxation and Finance website for the most current information regarding deadlines.

Key Elements of the Form ST 809

The Form ST 809 includes several key elements that are essential for accurate reporting:

- Taxpayer information: Basic details about the business, including name, address, and identification number.

- Sales data: Sections for reporting total sales, taxable sales, and any exempt sales.

- Tax calculations: Areas to calculate the total sales tax due based on reported sales.

- Signature line: A section for the authorized representative of the business to sign and date the form, certifying its accuracy.

Legal Use of the Form ST 809

The Form ST 809 is legally binding when completed accurately and submitted in accordance with New York tax regulations. It serves as an official document for reporting sales tax obligations and can be used as evidence of compliance in case of audits or inquiries from tax authorities. Understanding the legal implications of this form is essential for businesses to maintain their good standing with the state.

Quick guide on how to complete form st 809 new york state and local sales and use tax return for part quarterly monthly filers revised 1020

Complete Form ST 809 New York State And Local Sales And Use Tax Return For Part Quarterly Monthly Filers Revised 1020 effortlessly on any device

Online document management has gained traction among businesses and individuals. It serves as an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the features required to create, modify, and electronically sign your documents quickly and without issues. Manage Form ST 809 New York State And Local Sales And Use Tax Return For Part Quarterly Monthly Filers Revised 1020 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to alter and electronically sign Form ST 809 New York State And Local Sales And Use Tax Return For Part Quarterly Monthly Filers Revised 1020 with ease

- Find Form ST 809 New York State And Local Sales And Use Tax Return For Part Quarterly Monthly Filers Revised 1020 and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes requiring the printing of new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Form ST 809 New York State And Local Sales And Use Tax Return For Part Quarterly Monthly Filers Revised 1020 to ensure effective communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form st 809 new york state and local sales and use tax return for part quarterly monthly filers revised 1020

Create this form in 5 minutes!

How to create an eSignature for the form st 809 new york state and local sales and use tax return for part quarterly monthly filers revised 1020

How to create an eSignature for a PDF document in the online mode

How to create an eSignature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

The way to create an electronic signature straight from your mobile device

How to generate an eSignature for a PDF document on iOS devices

The way to create an electronic signature for a PDF document on Android devices

People also ask

-

What is ST 809 and how does it relate to airSlate SignNow?

ST 809 is a document format used for electronic signatures, and airSlate SignNow fully supports this format. With airSlate SignNow, you can easily upload, send, and eSign ST 809 documents, ensuring compliance and efficiency in your workflow.

-

How much does airSlate SignNow cost for managing ST 809 documents?

airSlate SignNow offers competitive pricing plans that cater to various business needs for handling ST 809 documents. You can choose from individual, business, or enterprise pricing tiers, each designed to provide cost-effective solutions for efficient document management.

-

What features does airSlate SignNow offer for eSigning ST 809 documents?

With airSlate SignNow, users can easily eSign ST 809 documents using features such as reusable templates, an intuitive drag-and-drop editor, and real-time tracking. The platform ensures that your documents are securely signed and stored for easy access.

-

Can airSlate SignNow integrate with other software for ST 809 document processes?

Yes, airSlate SignNow seamlessly integrates with a variety of software applications to enhance your ST 809 document workflows. This includes market-leading CRM, cloud storage, and productivity tools, making it easier to manage and sign documents collaboratively.

-

What are the benefits of using airSlate SignNow for ST 809 document management?

Using airSlate SignNow for ST 809 document management streamlines processes, reduces turnaround time, and enhances client satisfaction. Its user-friendly interface and mobile accessibility ensure that you can manage your documents anytime, anywhere.

-

Is airSlate SignNow compliant with regulations for ST 809 eSignatures?

Absolutely! airSlate SignNow complies with major eSignature regulations, including ESIGN and UETA, ensuring that your ST 809 documents are legally binding. This compliance provides peace of mind for businesses operating in regulated industries.

-

How secure is airSlate SignNow for storing ST 809 documents?

Security is a top priority at airSlate SignNow. The platform uses advanced encryption protocols and robust security measures to protect your ST 809 documents, ensuring that sensitive information remains confidential and secure.

Get more for Form ST 809 New York State And Local Sales And Use Tax Return For Part Quarterly Monthly Filers Revised 1020

Find out other Form ST 809 New York State And Local Sales And Use Tax Return For Part Quarterly Monthly Filers Revised 1020

- How Do I eSign Alabama Hold Harmless (Indemnity) Agreement

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement

- How To eSign Louisiana Hold Harmless (Indemnity) Agreement

- eSign Nevada Hold Harmless (Indemnity) Agreement Easy

- eSign Utah Hold Harmless (Indemnity) Agreement Myself

- eSign Wyoming Toll Manufacturing Agreement Later

- eSign Texas Photo Licensing Agreement Online

- How To eSign Connecticut Quitclaim Deed

- How To eSign Florida Quitclaim Deed

- Can I eSign Kentucky Quitclaim Deed

- eSign Maine Quitclaim Deed Free

- How Do I eSign New York Quitclaim Deed

- eSign New Hampshire Warranty Deed Fast

- eSign Hawaii Postnuptial Agreement Template Later

- eSign Kentucky Postnuptial Agreement Template Online

- eSign Maryland Postnuptial Agreement Template Mobile

- How Can I eSign Pennsylvania Postnuptial Agreement Template

- eSign Hawaii Prenuptial Agreement Template Secure